RWA giant Securitize eyeing public listing via Cantor Fitzgerald SPAC at unicorn valuation: Bloomberg

Quick Take Securitize, a leading tokenization firm which powers real-world assets like BlackRock’s BUIDL fund, is in talks to go public via a merger with a company owned by Cantor Fitzgerald at a valuation of over $1 billion, according to a Bloomberg report. People familiar with the matter told Bloomberg Securitize may opt to remain private, and discussions are ongoing.

Tokenization firm Securitize is considering going public via a merger with a blank-check company sponsored by finance giant Cantor Fitzgerald, Bloomberg reported Friday.

The firm, which oversees $4.62 billion in tokenized real-world asset (RWA) value according to RWA.xyz data , would be valued at over $1 billion following the deal, Bloomberg reported , a unicorn valuation for the leading RWA firm. Bloomberg's report also states Securitize is still considering the deal, and may opt to remain private.

The blank-check company which is reportedly looking to acquire Securitize, Cantor Equity Partners II, Inc., is listed on Nasdaq as CEPT. The company was sponsored by Cantor Fitzgerald and led by Cantor chairman Brandon Lutnick, son of US secretary of commerce Howard Lutnick. CEPT raised $240 million in its IPO and deposited the full amount into its trust, alongside a $5.8 million sponsor private placement.

Shares in the firm jumped more than 12.5% following the publication of the Bloomberg report Friday, according to Yahoo Finance data . The Block could not immediately reach CEPT or Securitize for comment.

Securitize has raised money from BlackRock, Morgan Stanley Tactical Value, Blockchain Capital, Coinbase Ventures, and several other high-profile VC firms. Jump Crypto took a "strategic" stake in the company in May, but declined to outline the dollar value of the deal, The Block previously reported.

Securitize oversees BUIDL, the BlackRock USD Institutional Digital Liquidity Fund, which is the largest onchain U.S. treasuries fund by far, with over $2.8 billion in asset value tokenized, compared to runner-up Franklin OnChain U.S. Government Money Fund (BENJI), which holds $861 million in total asset value, around 30% of BUIDL's. The firm recently launched offramps for BUIDL and VanEck's VBILL tokenized funds using Ripple's RLUSD stablecoin.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Saudi and Egyptian stock exchanges tumble amid regional turmoil caused by US-Iran tensions

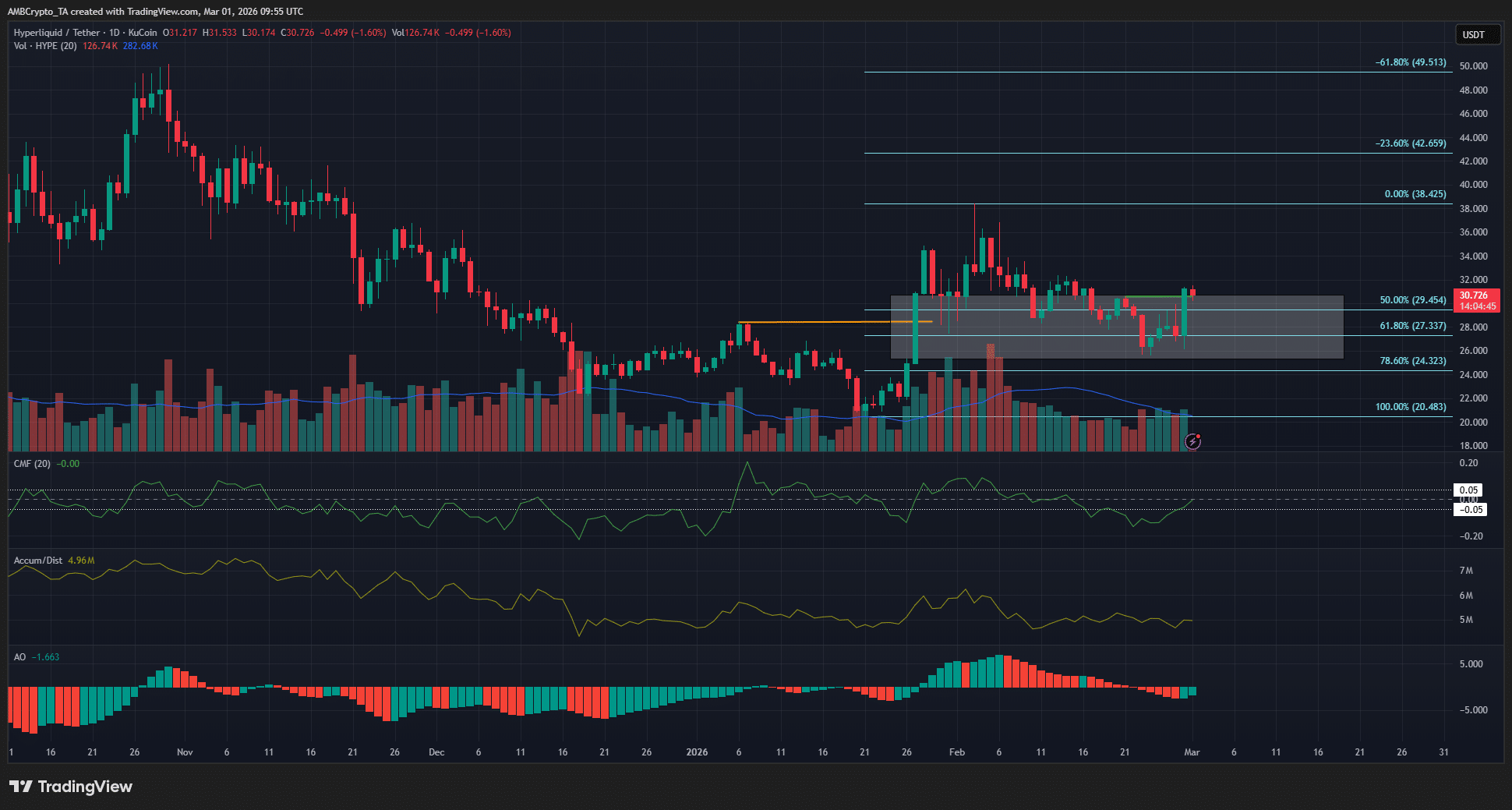

Hyperliquid price prediction – HYPE eyes $38, but watch THIS golden pocket first

If You’re Bearish on XRP, Listen to What David Schwartz Said

刚刚!央行重磅表态:降准还有一定空间