Bitcoin Passes 150 Days Trading Above $100K Mark

- Bitcoin trades above $100,000 mark for over 150 days.

- Institutional interest fuels market.

- Potential impacts on cryptocurrencies and market dynamics.

Bitcoin has traded above $100,000 since May 2025, surpassing 150 days, though no official confirmation of a 156-day daily closing streak exists. Institutional activity and macroeconomic factors contribute to its sustained valuation above this benchmark.

Bitcoin has maintained a trading value above $100,000 for over 150 days since early May 2025, according to multiple independent analytics and on-chain data sources.

Bitcoin’s sustained valuation above $100,000 highlights its growing acceptance and the positive sentiment among investors and institutions. Major flows into Bitcoin exchange-traded products confirm this continued interest.

Despite the lack of a 156-day closing streak confirmation, Bitcoin crosses $100K mark since May indicates strong market support. Key figures like PlanB and Matthew Sigel note its future outlook in the crypto space.

Institutional investments are likely influencing Bitcoin’s stability at these levels. Increased ETF and spot product flows have been documented since December 2024, pushing the digital currency past previous benchmarks.

“Bitcoin 5th month above $100k .. what’s next?!” – PlanB, Quantitative Analyst, @100trillionUSD

Community reactions indicate heightened interest through social platforms, while institutional and regulatory signals suggest a solid investor base. KOLs continue to project future growth in line with the Bitcoin halving set for 2028.

Future regulatory scrutiny may adjust market dynamics. Analysts suggest on-chain data trends could continue attracting institutional investors, impacting Bitcoin’s long-term position in global finance .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The US spot Bitcoin ETF saw a net inflow of $962.48 million yesterday.

USD/JPY Price Forecast: Holds onto gains near monthly high above 157.00

GBP/USD Price Forecast: Hovers around 1.3400 with bearish pressure intact

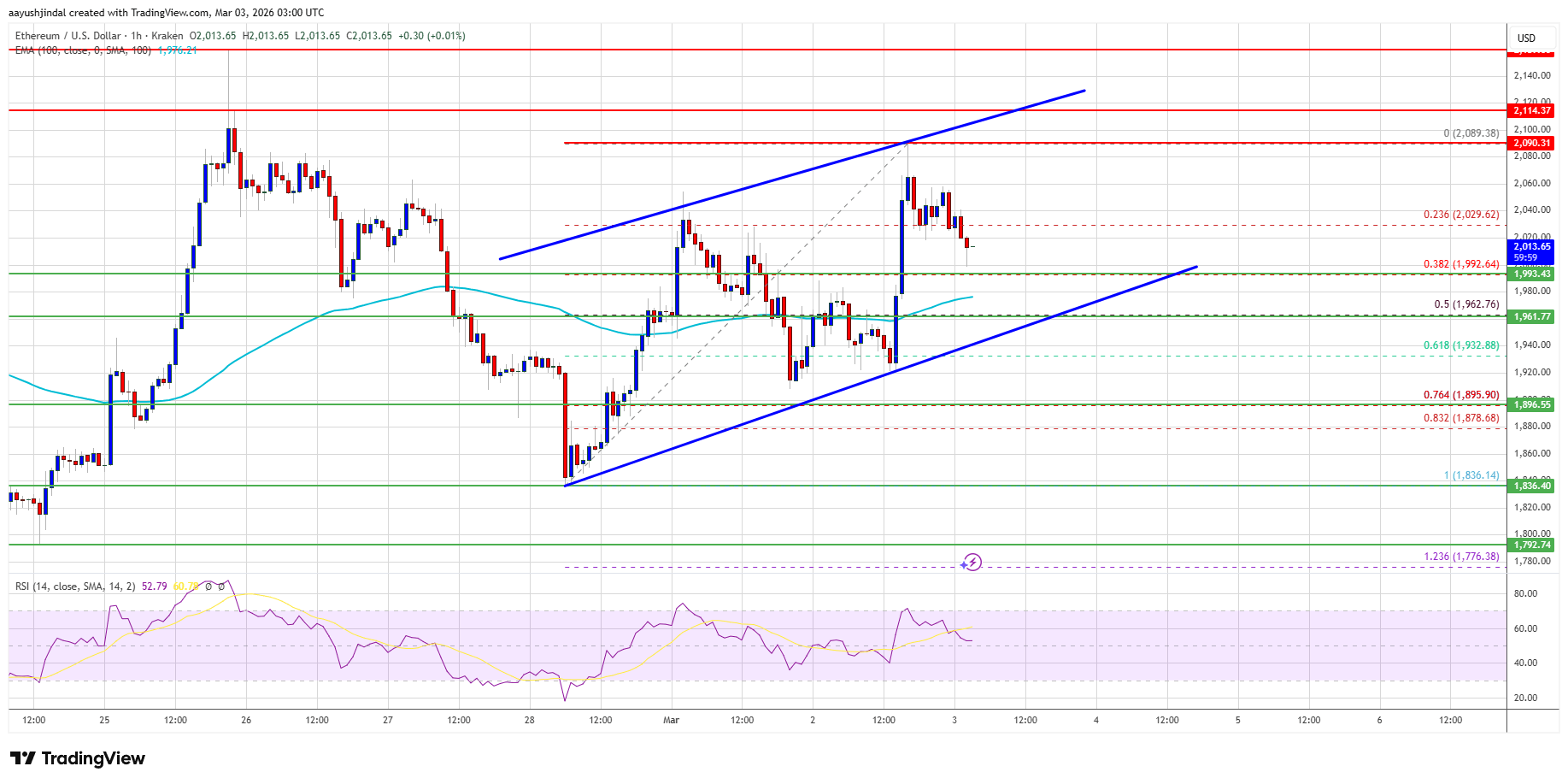

Ethereum Price Targets $2,150 Again, Bulls Seek Breakout Confirmation