PI Coin Rebounds From Record Low, Shows Early Signs of a Bullish Reversal

PI Coin is showing strong signs of recovery after its steep crash, with technical indicators pointing to a potential trend reversal. If bullish momentum holds, the token could soon test key resistance near $0.2917.

Pi Network’s native token PI has bounced back sharply after plunging to an all-time low of $0.1533 during last Friday’s market crash. Over the past three days, the altcoin has defied broader bearish sentiment, recording steady gains as traders begin to re-enter the market.

Technical indicators suggest that buying momentum is building, positioning PI to potentially break above its previous resistance levels.

PI Coin Shows Early Signs of a Bullish Reversal

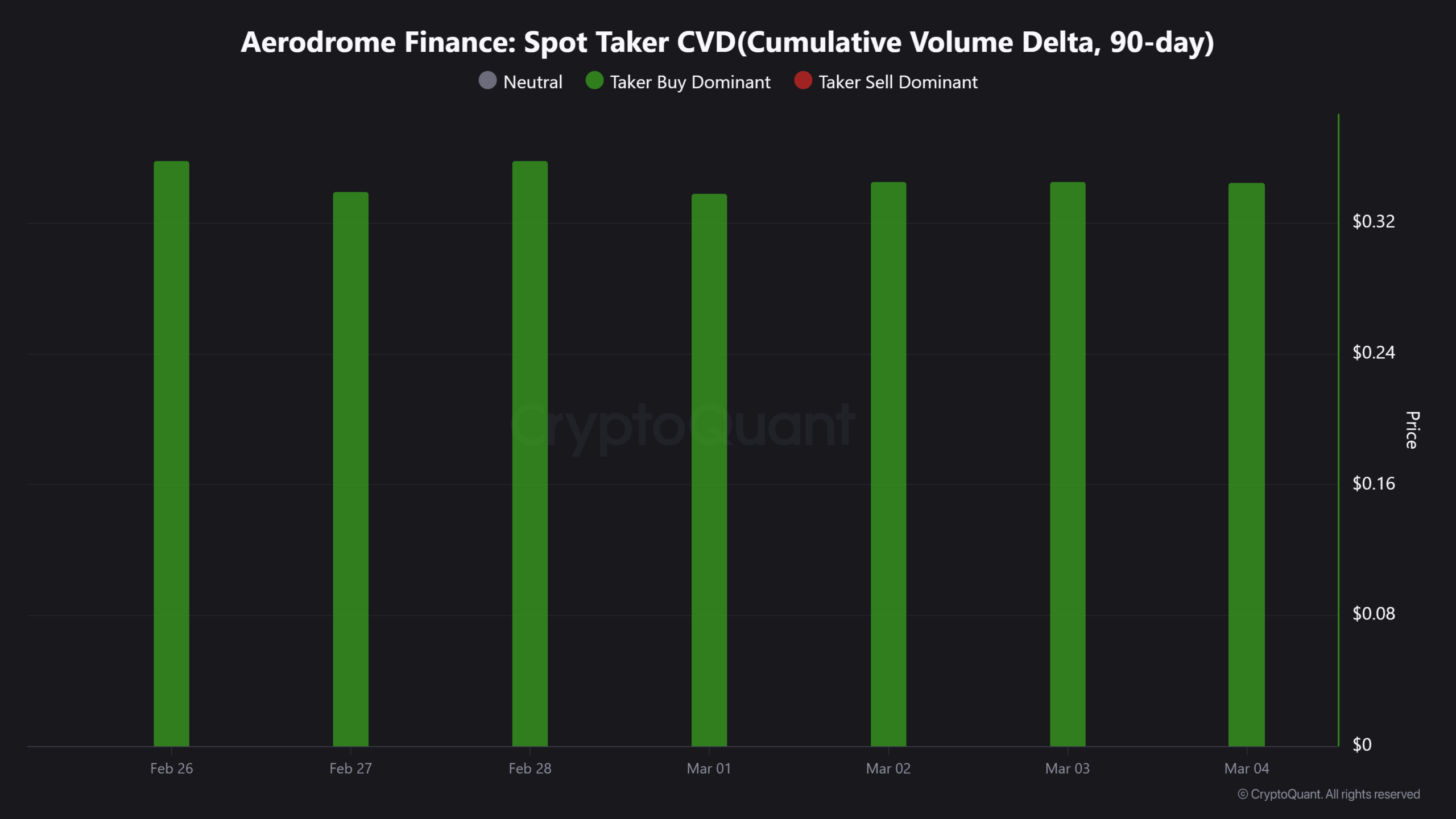

Readings from the PI/USD daily chart show that the red bars of its Elder-Ray Index have steadily shrunk over the past few sessions, signaling a gradual reduction in sell-side pressure. As of this writing, this momentum indicator is at -0.0482.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

PI Elder-Ray Index. Source:

PI Elder-Ray Index. Source:

PI Elder-Ray Index. Source:

PI Elder-Ray Index. Source:

The Elder-Ray Index measures the strength of bulls and bears in the market. When it returns red histogram bars whose sizes begin to reduce, it indicates that bearish momentum is weakening and buyers are gradually regaining control.

This pattern usually precedes a bullish trend reversal or short-term rally, especially when supported by other bullish signals.

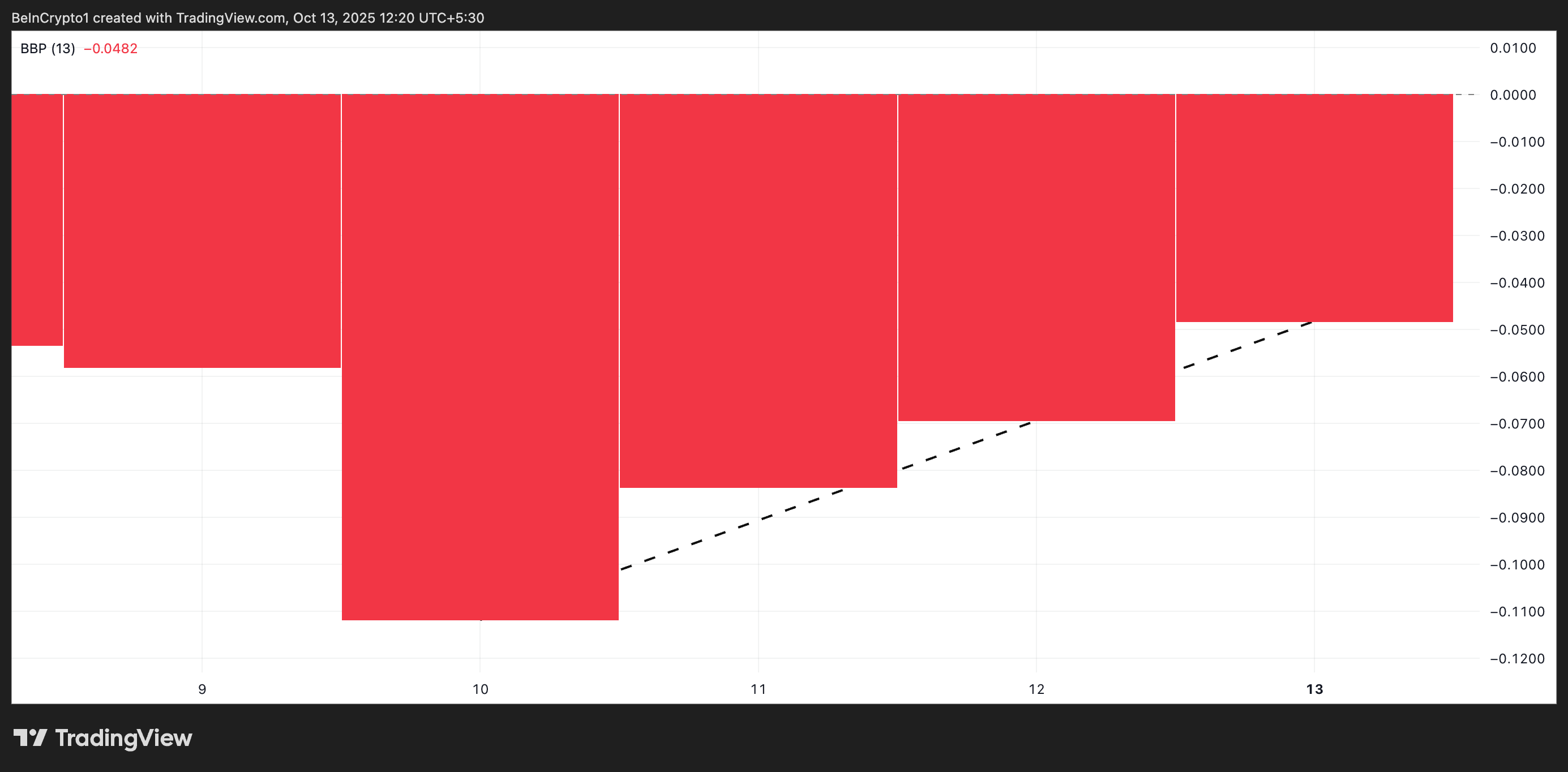

In PI’s case, its positive Balance of Power (BoP) reading supports this bullish outlook. At press time, this is at 0.59 and in an upward trend, signalling the growing buy-side conviction among traders.

PI BoP. Source:

PI BoP. Source:

PI BoP. Source:

PI BoP. Source:

The BoP indicator measures the strength of buyers versus sellers in a market. BoP readings range between -1 and +1, with values closer to +1 reflecting strong buying pressure and values near -1 indicating intense selling pressure.

PI’s current BoP value of 0.59 reflects a gradual return of bullish sentiment among token holders. The indicator’s upward trend implies that more market participants are accumulating the altcoin rather than taking profits.

PI Coin’s Reversal Takes Shape

Together, these trends show a gradual shift in market sentiment toward PI. If PI’s price maintains this trajectory, a breakout above the $0.2573 resistance could confirm the reversal and set the stage for a move toward the $0.2917 target zone.

PI Price Analysis. Source:

PI Price Analysis. Source:

PI Price Analysis. Source:

PI Price Analysis. Source:

On the other hand, if accumulation falls, it could trigger a revisit to a PI’s all-time low of $0.1533.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

NVIDIA’s Rapid S-Curve Growth: Constructing the Foundation for AI Infrastructure

How Changes in Policy and Global Geopolitical Strains Are Transforming Bitcoin Trading

Nvidia's $300 Price Target: Does Analyst Arbitrage Outweigh the Recent Stock Decline?

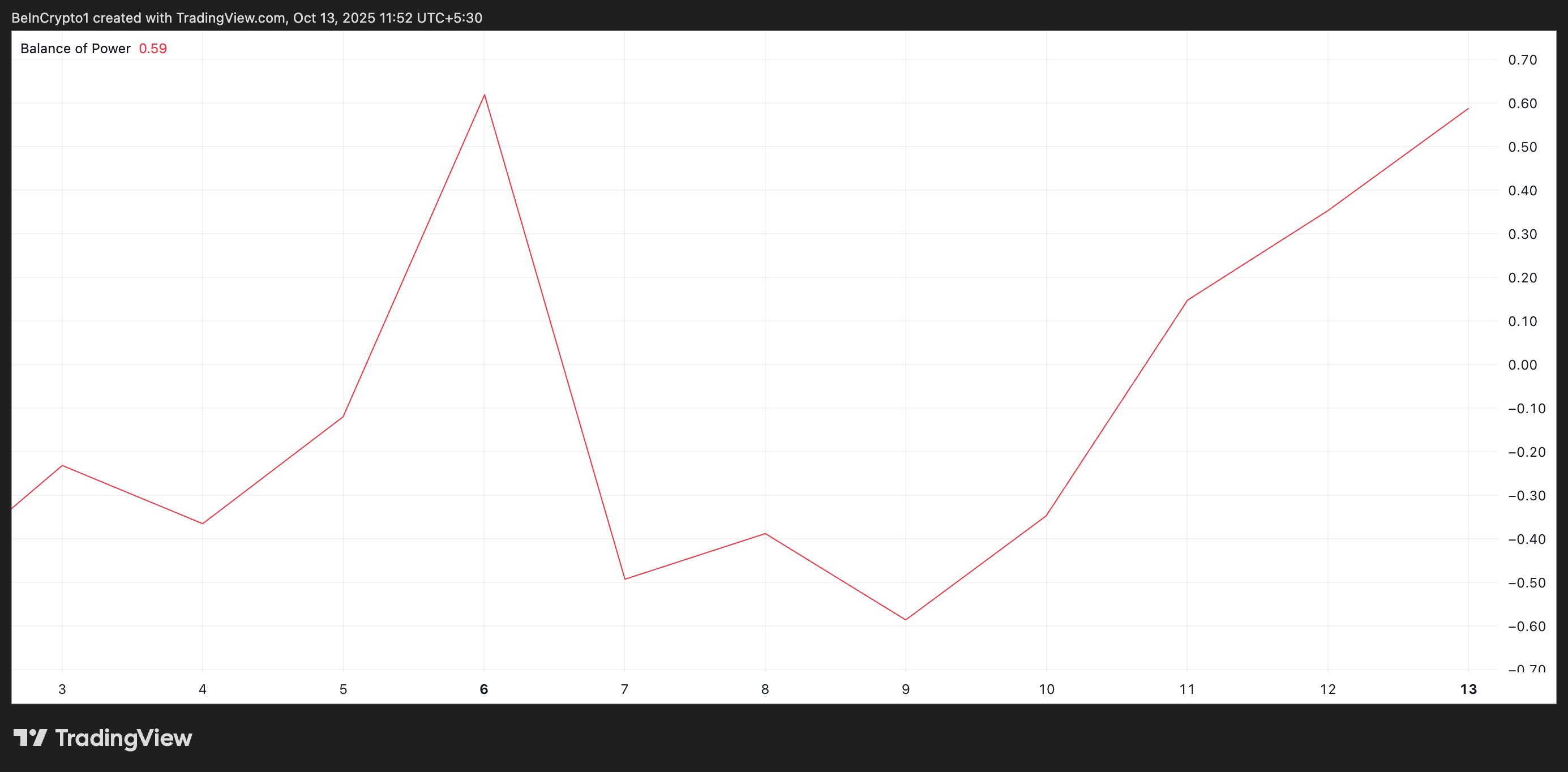

AERO rallies 12% as capital inflows surge: Is $0.40 within reach?