Solana Gets a Massive Boost From a16z

a16z’s $50 million investment in Jito marks a major step toward optimizing Solana’s MEV and staking systems. While the move may not drive immediate price growth, it could reshape Solana’s infrastructure and reward distribution in the long term.

a16z invested $50 million into Jito, a commitment that could signal huge upsides for the Solana network. The VC firm aims to upgrade infrastructure in the long term, optimizing MEV and guaranteeing efficiency.

Still, this partnership isn’t interested in immediate price growth, and we might not see lasting SOL gains for some time. Investors should keep an eye on Solana community sentiment, which could be a key indicator for success.

a16z Invests in Jito

Earlier today, Fortune reported that a16z, a prominent VC firm in the crypto space, invested $50 million into Jito, a massive Solana infrastructure project.

This investment is the largest single commitment that Jito has received from any firm, signaling a large opportunity.

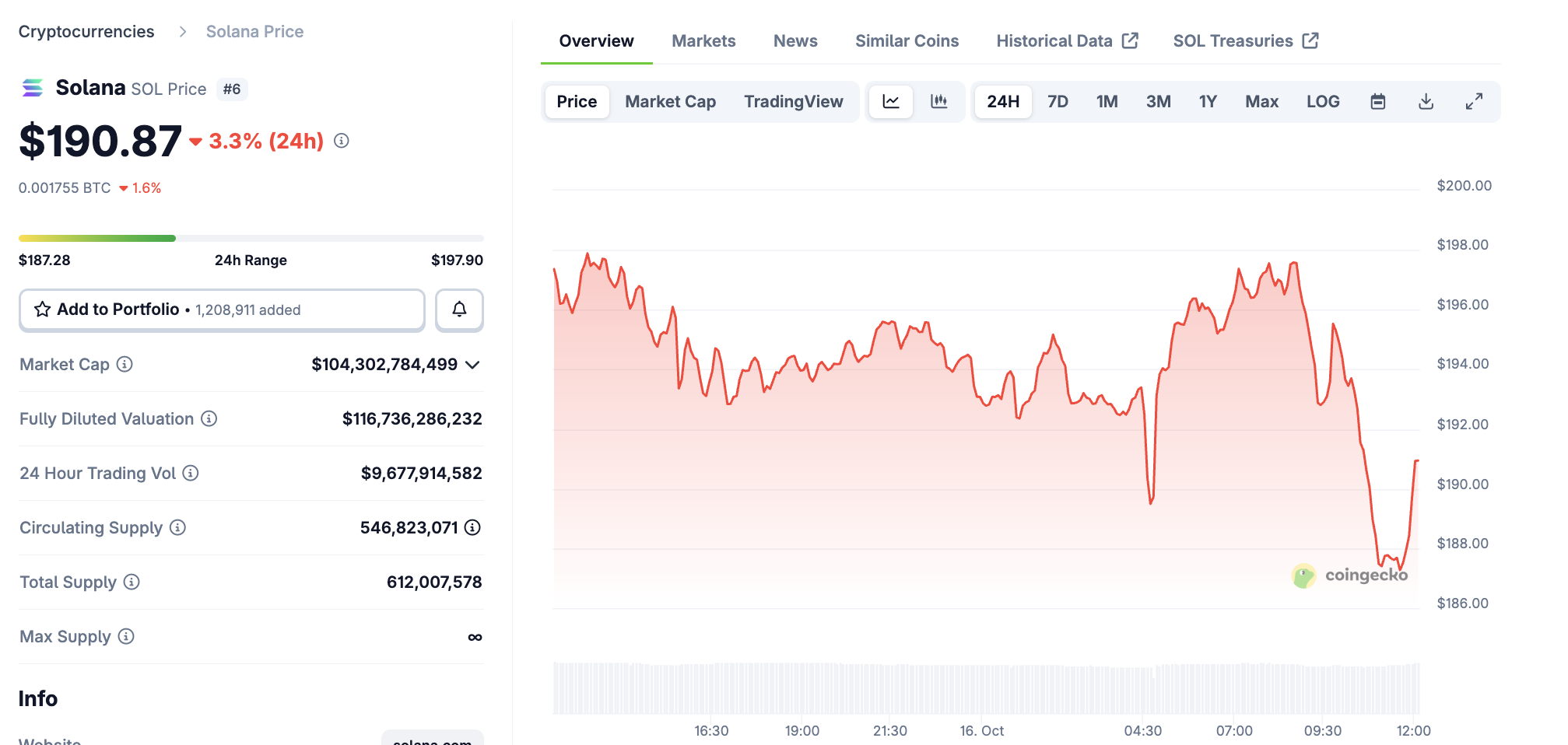

Although this could have crucial long-term implications, all we’ve seen in immediate returns is bearishness. SOL has already been on a slump this week, and it continued falling despite the announcement:

Solana Price Performance. Source:

CoinGecko

Solana Price Performance. Source:

CoinGecko

So, how can crypto traders make sense of all this? What could a16z’s investment change for Jito, and how could that lead to a real upside for Solana?

Jito is among Solana’s leading restaking and liquid staking protocols, and its stake pool receives a substantial share of SOL.

Its validator client (Jito-Solana) accounts for a large portion of stake weight (~30–40 %), making it one of the most influential entities in Solana’s validator ecosystem — rivaled chiefly by the default Solana Labs client.

Maximizing Solana Value

The key to understanding all of this is MEV, or Maximal Extractive Value. It refers to the additional revenue that can be extracted from second-order functions, such as including, excluding, or reordering transactions in a block. a16z is very interested in MEV, and Jito could potentially maximize this income.

Jito’s core functions involve optimizing block production, validator rewards, and liquid staking on Solana, and a16z could benefit from this in key ways.

By building the protocol’s capacities, the VC firm could enable speedy transaction flows and help route more MEV auction proceeds back to stakers.

Jito could both standardize MEV markets and redistribute more value across the community, encouraging SOL adoption across the board.

If Solana becomes more prominent, Jito will naturally rise in turn, and a16z is planning a long-term relationship with it. In other words, the firm isn’t trying to seize a speedy path to profit, but hoping to reap the rewards of SOL growth over time.

Such a relationship would be mutually beneficial to all parties.

Still, the Solana community has already had intense debate over Jito’s role in centralizing the blockchain. If a16z becomes a crucial component of Jito moving forward, that could also turn off DeFi proponents.

User sentiment might be the main obstacle, as the partnership seems set on improving technical capacities.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

NRG Energy rises by 0.91% even as trading volume falls by 20.05%, placing its trading activity at 65th position

Visa's 0.11% Drop and 51st-Ranked Volume Amid Stablecoin Expansion and Undervaluation Debate