Bitcoin Today: Volatility Keeps BTC Around $108

- Bitcoin fluctuates after drop driven by leverage and US-China tensions

- Cryptocurrencies today show mixed performances with losses and slight increases

- Crypto market loses $500 billion in the last week

Bitcoin's price continues to face strong volatility after a series of intense declines and recovery attempts. Since Friday, the asset has encountered resistance just above $108.000, falling back by about $1,000 shortly thereafter. This movement comes after a week marked by macroeconomic events and liquidations of leveraged positions, putting pressure on cryptocurrency investor sentiment.

BTC's recent trajectory began on October 10, when the leading cryptocurrency suffered a significant decline from over $121.000 to the $110.000 region on some exchanges, reaching levels close to $101.000 on others. The initial downward pressure was driven by statements made by current US President Donald Trump regarding China, generating uncertainty among global investors.

Despite the initial impact, Bitcoin reacted strongly over the weekend, regaining some of its lost ground and reaching $116.000 on Tuesday. However, the upward movement lost momentum, taking the asset back to the $110.000 range. Selling pressure intensified on Thursday, pushing BTC to $108.000 and then below $104.000 on Friday.

Relief came when Trump indicated that tariffs on China would not be maintained, allowing a moderate rally that propelled Bitcoin back to $106.000 and then to $108.000. Currently, the cryptocurrency's market cap is in the $2,12 trillion range, with over 57% dominance over altcoins.

Meanwhile, the weekly performance of altcoins shows significant contrasts. BNB is among the biggest losers, accumulating a loss of approximately 8% and trading below $1.100. BCH is down 12%, while LINK, XLM, AVAX, HBAR, ADA, and XRP are also retreating slightly.

On the other hand, cryptocurrencies such as ETH, SOL, TRX, and DOGE are showing small weekly gains, suggesting a possible capital rotation between market sectors. More significant positive highlights came from assets such as MNT, WLFI, TAO, and ENA, which signaled renewed interest in emerging alternatives.

The total cryptocurrency market cap has fallen to around $3,7 trillion, wiping out approximately $500 billion in just over a week, reinforcing the climate of caution among investors.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Revolut Launches Pound-Pegged Stablecoin Pilot Under UK Regulatory Oversight

大呼“买入中国”的David Tepper:减持阿里,增持拼多多、京东

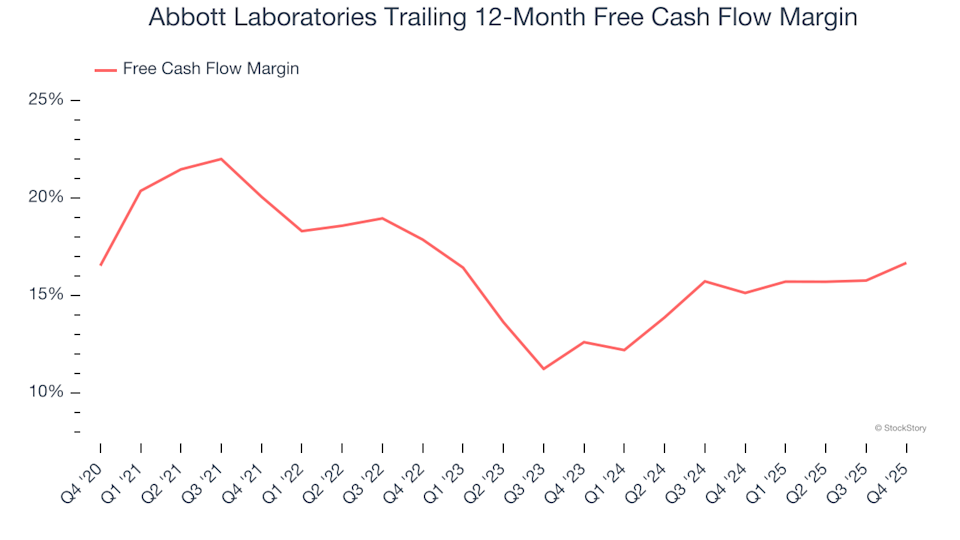

2 Reasons to Appreciate ABT and 1 Reason for Caution

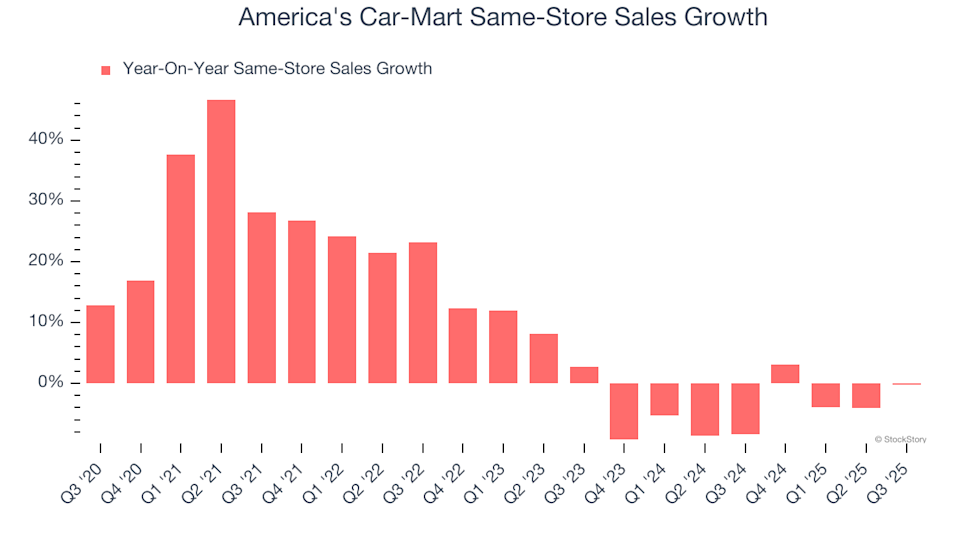

3 Reasons to Steer Clear of CRMT and One Alternative Stock Worth Buying