HBAR Price Depends On Bitcoin For A Rescue As Holders Fall Back

Hedera’s sentiment has collapsed to record lows, leaving its price movement reliant on Bitcoin’s direction. A BTC rebound above $108,000 could lift HBAR toward $0.188.

Hedera (HBAR) continues to face downward pressure after confirming its three-month-long wedge pattern. The recent decline reflects fading investor confidence, leaving the cryptocurrency dependent on Bitcoin’s recovery.

With BTC showing early signs of strength, HBAR’s next move could hinge on the crypto king’s ability to sustain upward momentum.

Hedera Investors Are Pessimistic

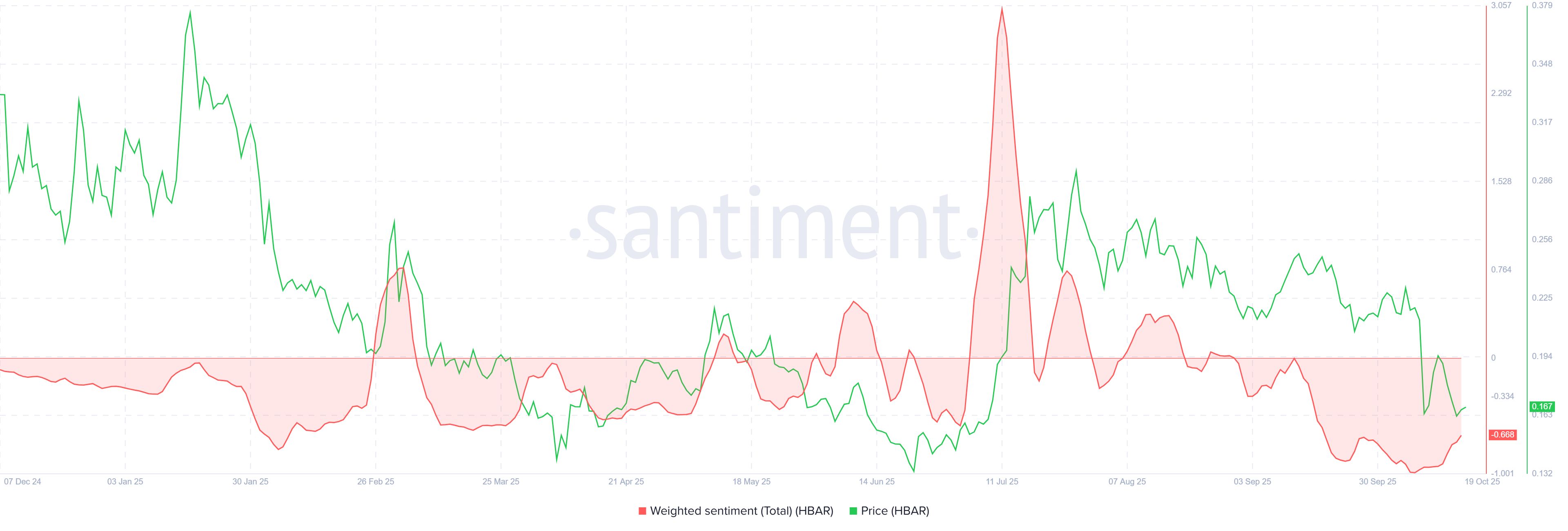

HBAR’s weighted sentiment indicator has dropped to an all-time low, suggesting that traders are increasingly skeptical about HBAR’s short-term potential.

This lack of conviction highlights the cautious mood in the market, particularly as broader volatility keeps participants hesitant to re-enter positions.

The decline in sentiment could directly affect capital flows, limiting potential inflows into the network. As selling pressure persists, Hedera’s market activity risks stagnation unless renewed optimism surfaces.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

HBAR Weighted Sentiment. Source:

Santiment

HBAR Weighted Sentiment. Source:

Santiment

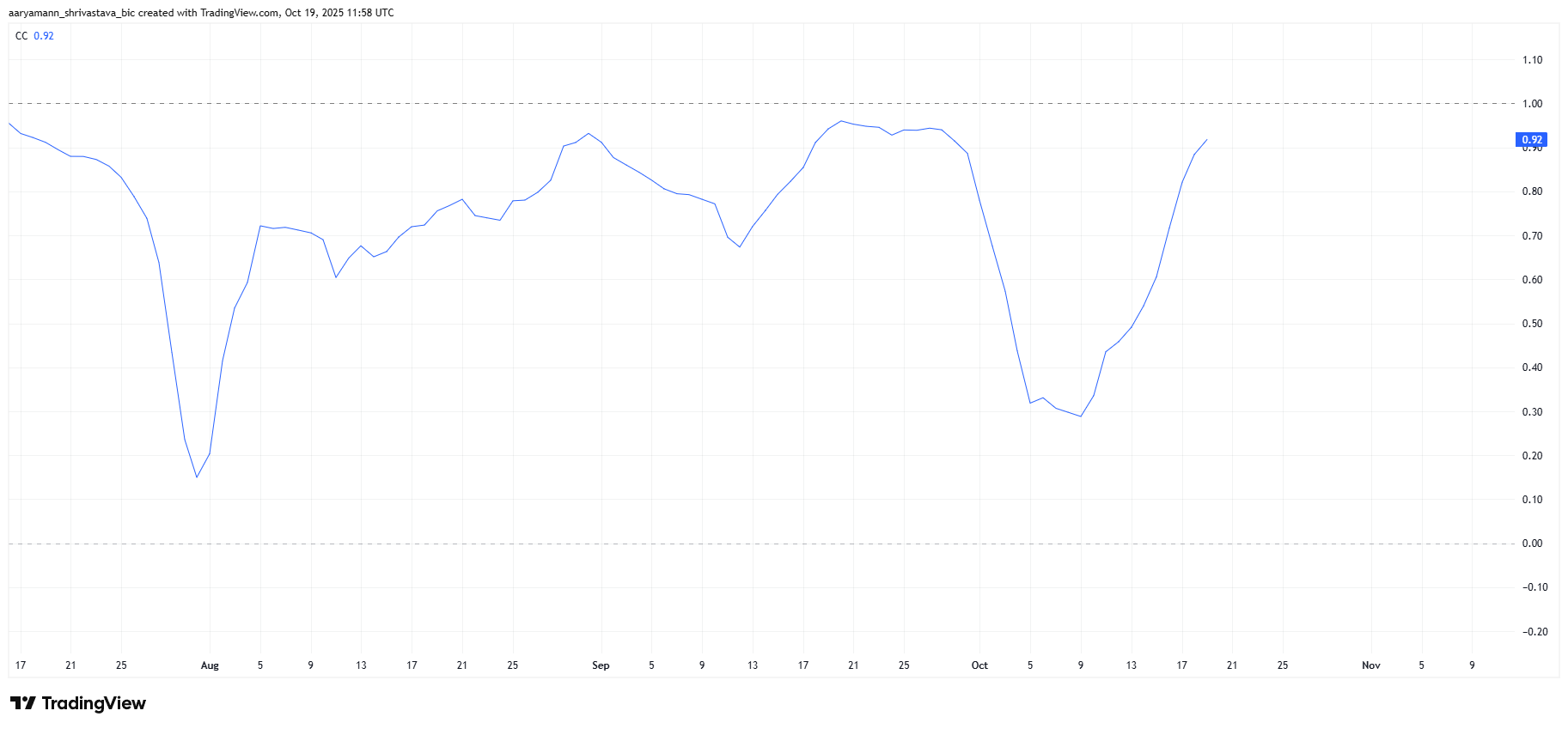

From a macro perspective, Hedera’s correlation with Bitcoin stands at 0.92, marking a strong relationship between the two assets.

This correlation suggests HBAR’s performance is largely tied to Bitcoin’s direction. If BTC maintains its current rebound and rises above $108,000, HBAR could experience a similar upward push.

This connection could prove beneficial in the near term, especially as Bitcoin begins to stabilize. However, the downside remains if BTC faces renewed selling. In such a case, HBAR’s dependency could expose it to further declines.

HBAR Correlation To Bitcoin. Source:

TradingView

HBAR Correlation To Bitcoin. Source:

TradingView

HBAR Price Can Note Recovery

HBAR trades at $0.167, hovering just below the key resistance of $0.172. The altcoin remains within a descending broadening wedge. This is a pattern that often precedes a bullish breakout once market conditions align with investor sentiment.

If Bitcoin continues to strengthen, HBAR could breach $0.172 and $0.180, targeting $0.188 in the short term. This rise is crucial for the altcoin to eventually validate the above-mentioned pattern.

HBAR Price Analysis. Source:

TradingView

HBAR Price Analysis. Source:

TradingView

Conversely, if bearish sentiment persists and investor apathy deepens, HBAR could fall through $0.163 and reach $0.154. Losing this support would invalidate the bullish outlook and signal further downside risk.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Daily Mirror-owner faces largest loss in ten years as Google traffic declines

Target’s newly appointed CEO reveals his strategy for revitalizing the company

Palantir Returns to Wall Street’s Recommended Stocks Following a 38% Drop

Options Income Daily: MU, SOFI, CRWV and More