The 2025 crypto market is luring short-term traders as well as long-term holders who want quick and sustainable returns. Bitcoin, Ethereum, Solana, and Ozak AI ($OZ) are the top assets with measurable opportunities. Competing with the three tokens that have massive market, Ozak AI’s AI and blockchain integration make it a worthy competitor.

Bitcoin (BTC)

Bitcoin is the foundation of cryptocurrency trading, priced at $121,268 with a market cap of $2.23 trillion according to CoinMarketCap. Traders go to Bitcoin for its deep liquidity and quick response to global events. Price moves driven by institutional investments, inflation reports, or interest rate changes allow short-term traders to make quick profits.

For long-term holders, Bitcoin is still a hedge against traditional market fluctuations. It's 21 million supply that sustains demand over time. Daily volume of 176 billion Bitcoin has a good momentum for scalpers and for the strategic investors who want to have a constant

Ethereum (ETH)

Ethereum is currently at $3,791 with a $457 billion market cap and is known for its decentralized finance (DeFi) and non-fungible tokens (NFTs). With the shift to Ethereum 2.0, investors can have faster transactions and lower the cost of the energy used.

To the short-term traders, it is ideal to use Ethereum for daily or weekly trading. This is because Ethereum has an ecosystem that is highly volatile ecosystem. Long-term holders benefit from the established developer base and its consistent role as the foundation for DeFi innovation. Ethereum’s upgrades keep investor confidence across all timeframes.

Solana (SOL)

Solana is trading at $184.49 with a market value of $100.81 billion. It is a good alternative to Ethereum due to its low charges and high throughput. The quick trading and the fast-moving charts with frequent swings that offer short-term returns attract traders to Solana.

For long-term investors, Solana’s decentralized applications and NFT marketplaces add to its upgraded utility. Despite past network issues, its continuous improvements in scalability and uptime give confidence. Solana is a good choice for those who want speed with sustainability.

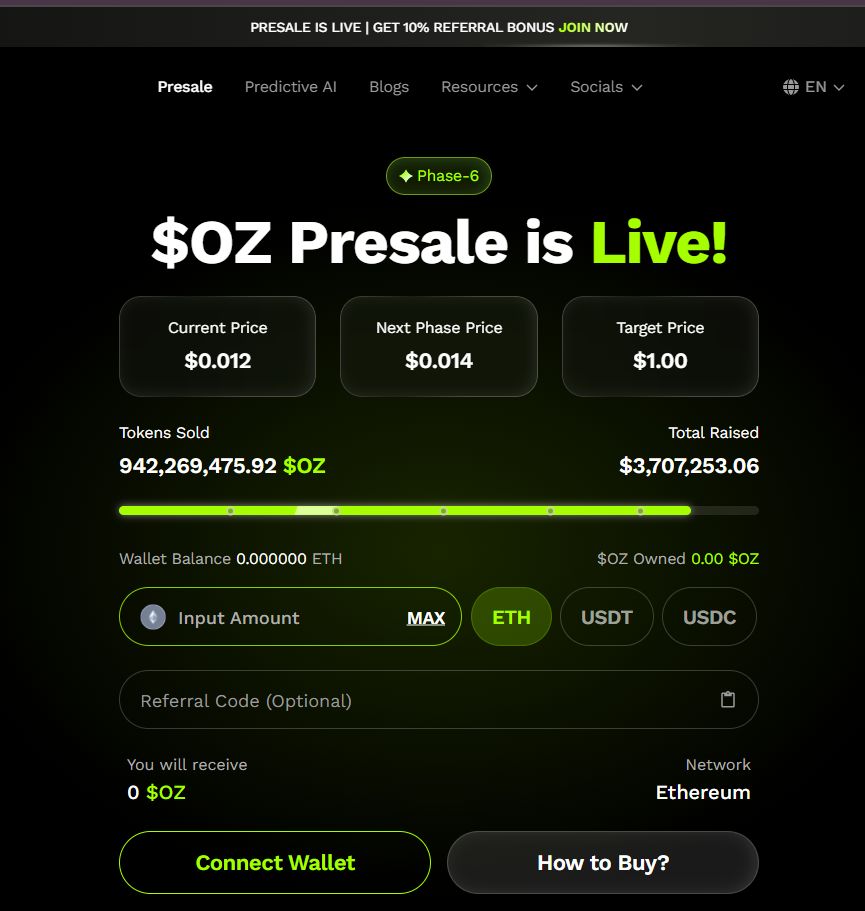

Ozak AI ($OZ)

Ozak AI bridges the gap between trading intelligence and blockchain utility. Its platform offers real-time predictive analytics through machine learning and decentralized technology. Core features of Ozak AI include the Ozak Stream Network (OSN) for data processing, DePIN for secure infrastructure, Ozak Data Vaults for storage, and Prediction Agents (PAs) for customizable AI insights. These provide users with real-time data while giving holders trust for long-term AI adoption.

Its allocation works this way: 30% to ecosystem and community, 20% to reserves, 10% to liquidity, and 10% to the team. A partnership with Dex3, an on-chain AI aggregator, will upgrade the automated trading workflows and risk analysis across Solana and EVM chains, strengthening Ozak AI’s investors' requirements.

Conclusion

Bitcoin, Ethereum, and Solana continue to ignite market activity with their liquidity and innovation, but Ozak AI offers a brand new approach by integrating AI and blockchain networks. It offers traders faster, data-backed insights and gives long-term holders confidence in its lasting potential. Ozak AI stands out as a project that caters to both active investors and those looking for steady growth over time.