SpaceX moves $270 million worth of bitcoin in first transfer since July: Arkham

Quick Take Elon Musk’s SpaceX moved 2,495 BTC to two unmarked addresses earlier on Tuesday, which is a first transfer since late July. Arkham data reveals this transfer is the first material change to the company’s total bitcoin holdings since June 2022. Meanwhile, one analyst noted that this may simply be wallet reorganization by SpaceX.

SpaceX, the aerospace manufacturer founded by Elon Musk, made a bitcoin transfer of approximately $268.5 million on Tuesday, marking its first movement of its BTC holdings since July 24.

According to Arkham Intelligence data , SpaceX moved a total of 2,495 BTC to several wallet addresses that remain unmarked on the platform. Up to now, these addresses have not moved or sold the bitcoin.

Arkham data also reveals this transfer is the first material change to the company's total bitcoin holdings since June 2022, a reserve that had consistently stood at around 8,285 BTC.

While the purpose of this bitcoin movement has not been publicly disclosed by the company, crypto analyst Aunt Ai (ai_9684xtpa) wrote on X that the transfer may be later identified as just part of its wallet reorganization. Some of the past SpaceX transfers on Arkham were later rediscovered as the company's interactions with a custody address on Coinbase Prime, the analyst noted.

In mid-2022, SpaceX reportedly reduced its holdings by around 70%, possibly prompted by a market-wide shock caused by the meltdown of Terra-Luna in May, the collapse of FTX in November and the subsequent domino effect. The company has not purchased more bitcoin since, according to Arkham data.

Musk's Tesla also sold off a bulk of its bitcoin holdings in 2022. It currently holds 11,509 BTC, worth $1.24 billion, according to Arkham data .

Meanwhile, bitcoin is down 3.21% in the past day to trade at $107,685, as the wider crypto market is experiencing a 3.4% decline, according to The Block's crypto price page .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

又一美联储理事呼吁:谨慎对待进一步降息!

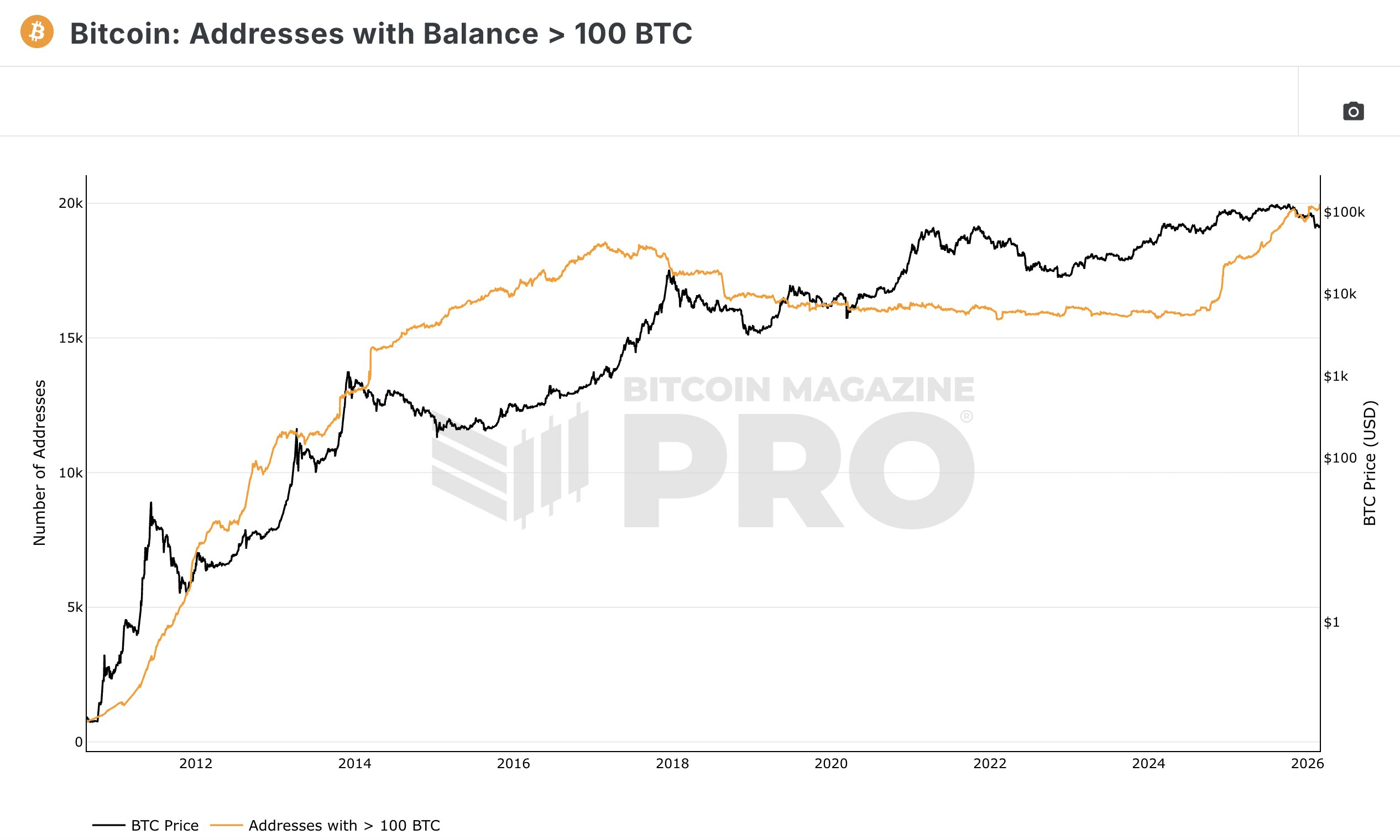

Bitcoin whale addresses holding 100 BTC hit ATH – Strategic play for H2 rally?

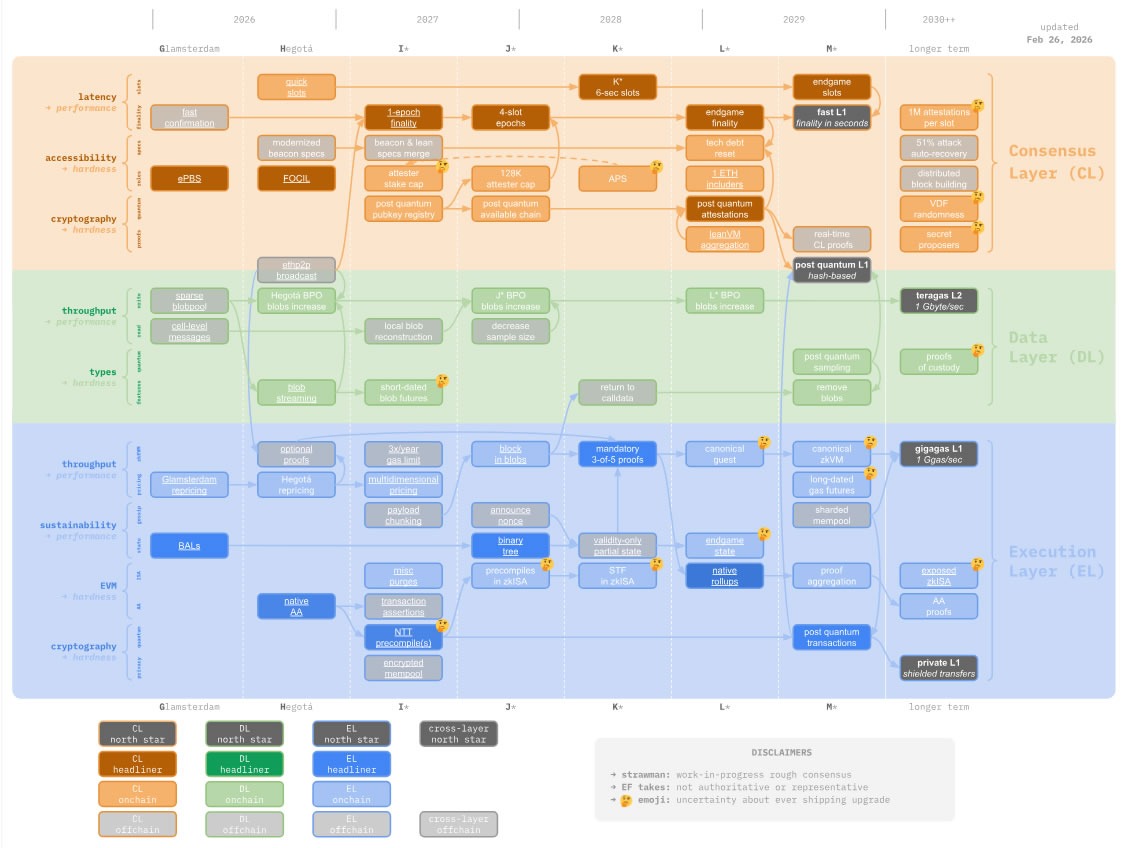

Ethereum smart accounts are finally coming 'within a year' — Vitalik Buterin