HBAR Price’s Recovery To $0.20 Could Be Marred By Weak Inflows

HBAR faces fading investor inflows and indecisive momentum at $0.170. A push above $0.178 may revive bullish sentiment, but failure could drag prices lower.

Hedera’s native token, HBAR, has struggled to stage a convincing recovery in recent weeks, with its price movement reflecting waning investor enthusiasm.

However, improving market sentiment suggests that HBAR could still find support if bullish momentum strengthens in the near term.

Hedera Investors Are Losing Faith

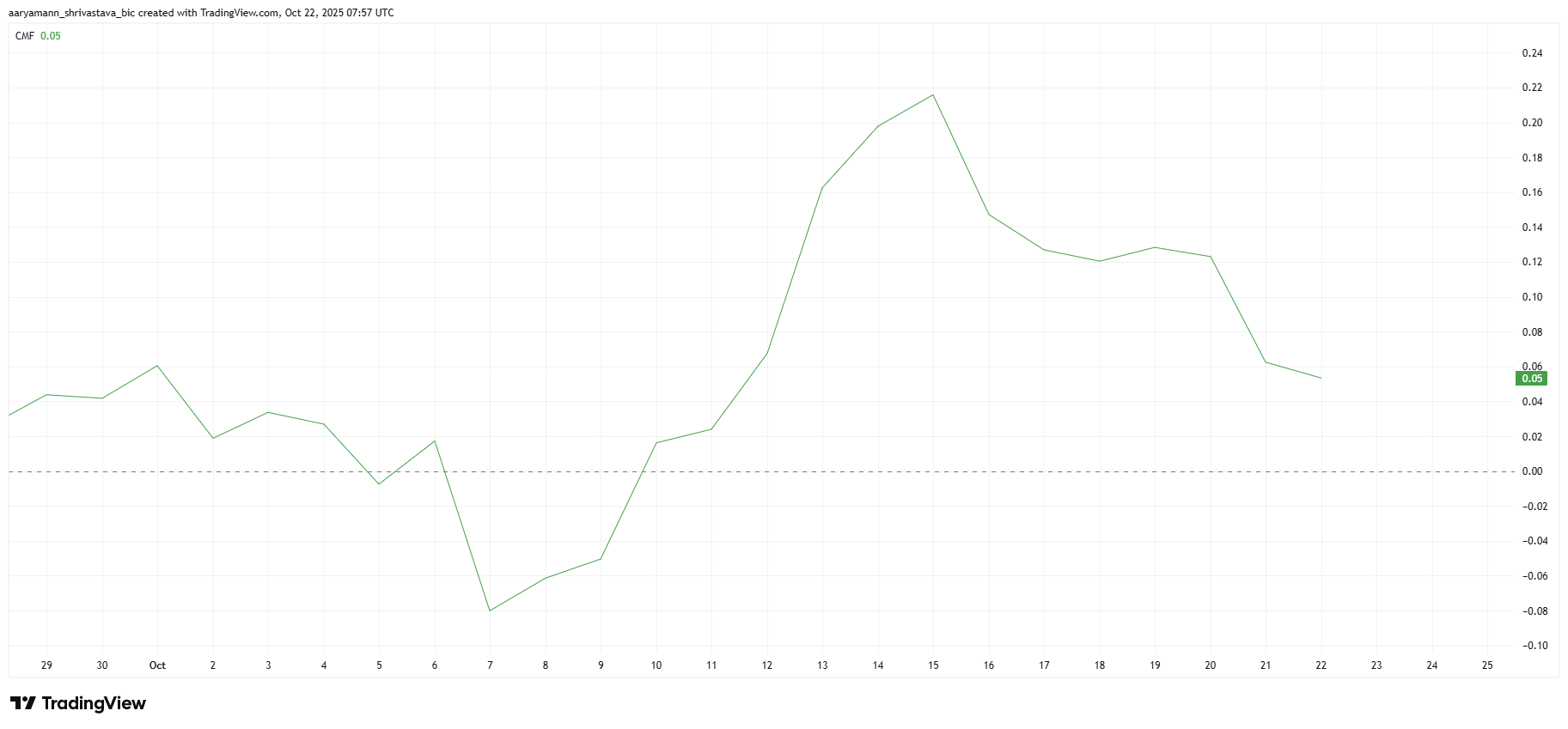

The Chaikin Money Flow (CMF), a key indicator of capital inflows and outflows, is showing a noticeable downtick. This decline signals that investor interest in HBAR is fading, with fewer funds moving into the asset.

As inflows weaken, confidence among traders appears to be eroding, leading to a slowdown in accumulation. This growing caution has made it difficult for HBAR to sustain any short-term rallies. Such a shift would likely weigh heavily on HBAR’s price and delay its efforts to recover from recent losses.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

HBAR CMF. Source:

HBAR CMF. Source:

HBAR CMF. Source:

HBAR CMF. Source:

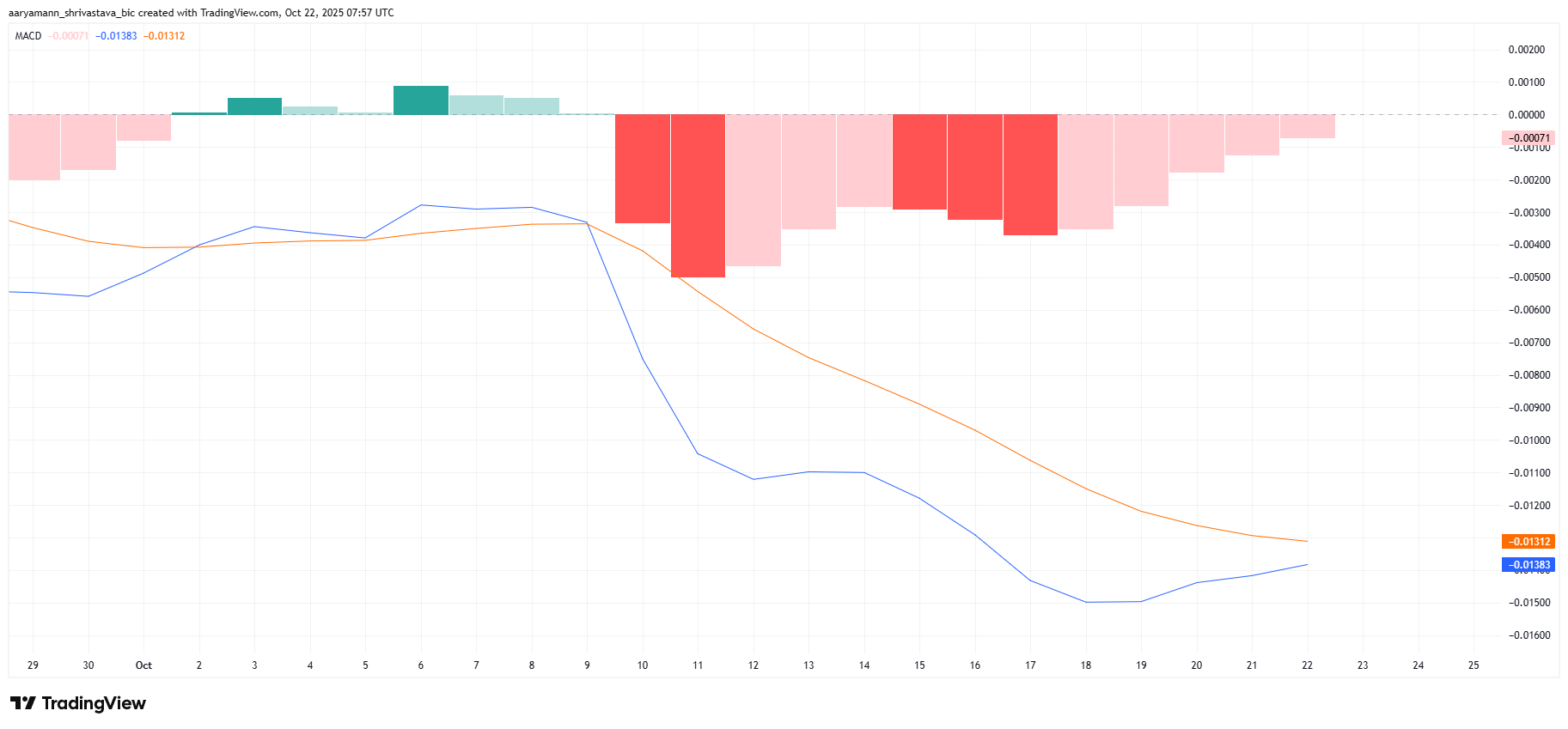

From a technical perspective, HBAR’s macro momentum presents a mixed outlook. The Moving Average Convergence Divergence (MACD) indicator is showing early signs of improvement, hinting that bullish momentum may be building. The MACD line is nearing a potential crossover above the signal line — a key event often viewed as a precursor to short-term price recovery.

If the MACD confirms this bullish crossover, it could attract renewed buying activity and strengthen HBAR’s recovery outlook. However, until this crossover materializes, cautious optimism is warranted as volatility remains elevated.

HBAR MACD. Source:

HBAR MACD. Source:

HBAR MACD. Source:

HBAR MACD. Source:

HBAR Price Can Reach $0.20

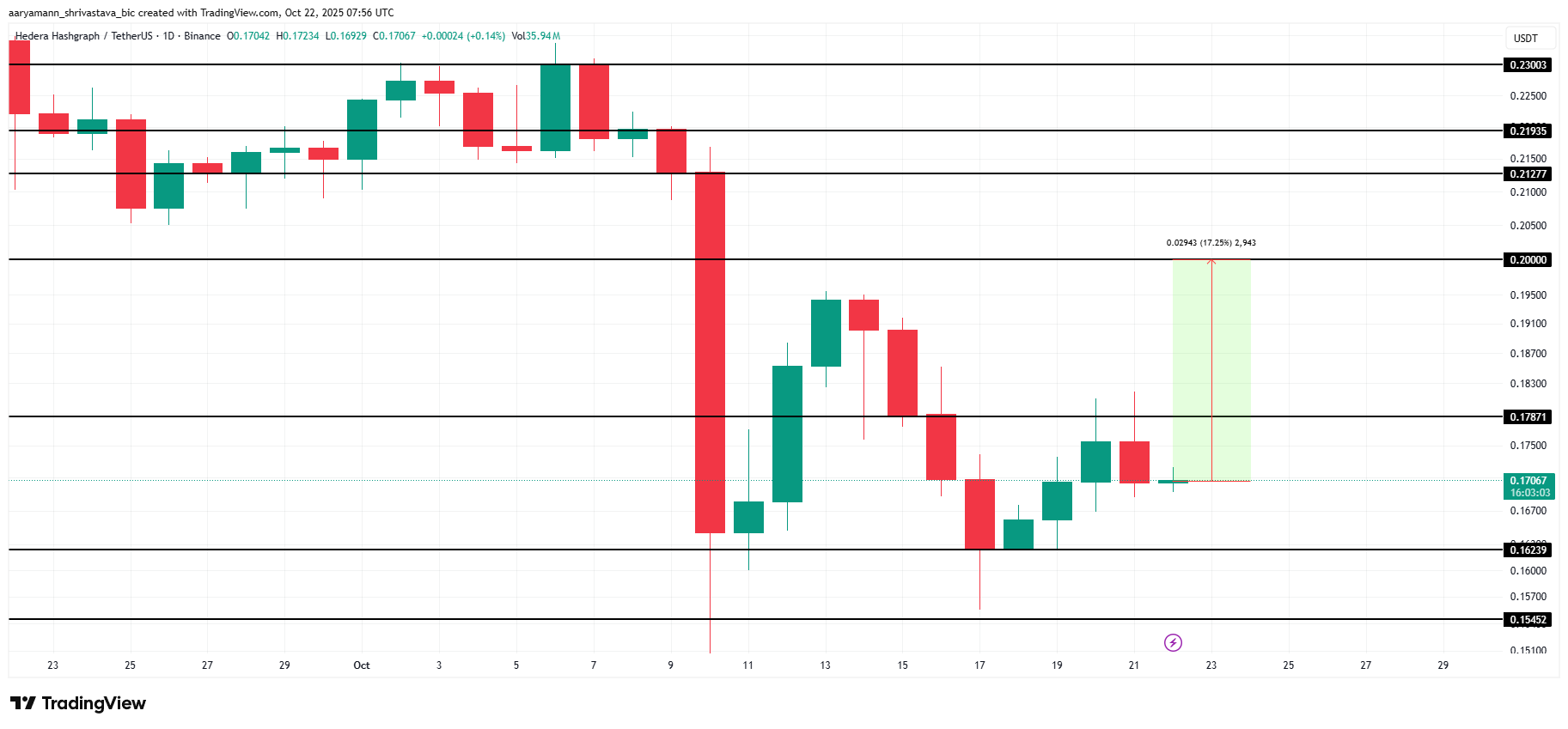

At press time, HBAR trades at $0.170, just below the key resistance at $0.178. These conflicting technical signals point to an indecisive market. While short-term traders may continue to accumulate near current levels, broader participation remains limited.

If momentum strengthens, HBAR could breach the $0.178 barrier and aim for a move toward $0.200 — a 17.25% increase from its current price. Reclaiming this psychological threshold is vital for confirming a sustained recovery and restoring bullish conviction among investors.

HBAR Price Analysis. Source:

HBAR Price Analysis. Source:

HBAR Price Analysis. Source:

HBAR Price Analysis. Source:

Conversely, if HBAR fails to surpass $0.178, the price could fall back to the $0.162 support zone. A breakdown below this level might send the token toward $0.154, undermining the bullish outlook and signaling further downside risk.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ripple-Supported Evernorth Now Possesses a Whopping 261 Million XRP

Securing Massive XRP Treasury Ahead of Nasdaq Public Listing through Armada Acquisition Corp II Merger

Bitcoin and ETH ETFs Lose Ground as Investors Pivot Back to Bitcoin: Is Altseason Over?

Shifting Market Preferences: Over $128 Million Withdrawn from ETH ETFs as Bitcoin Futures Activity Soars to Record Highs

Stablecoin Revolution: When Payments Are No Longer Tied to Banks, How High Is the FinTech Startup Ceiling?

The Federal Reserve is not only exploring stablecoins and AI payments, but also piloting a new proposal called "streamlined master accounts," which would allow qualified companies to directly access the Fed's settlement system. This move could open new doors for fintech innovation.

A $2 billion "game of probabilities": Is the prediction market approaching its "singularity" moment?

The prediction market is evolving from a marginalized "crypto toy" into a serious financial instrument.