Dogwifhat Surpasses $500 Million Market Cap Amid Trading Surge

- $WIF achieves a $547 million market cap.

- Active liquidity shows resilience amid volatility.

- No large institutional investments in $WIF.

Dogwifhat ($WIF) recently surged past a $500 million market cap due to increased trading activity. Supported by community-driven dynamics, $WIF’s rise highlights speculative interest typical among Solana-based meme coins like DOGE and SHIB.

Dogwifhat ($WIF), a Solana-based memecoin, has regained momentum, exceeding the $500 million market cap mark after a surge in trading activity.

The current rally for $WIF highlights increased speculative interest in the memecoin market, reflecting the complex dynamics of community-driven tokens.

Dogwifhat ($WIF) has breached the $500 million mark amid growing speculative interest. A decentralized community backs this memecoin, boosting its market performance. Active trading continues to fuel its momentum.

The significant interest in Dogwifhat ensures a consistent market presence , with a 24-hour trading volume of $182 million. This growth aligns with other meme tokens like DOGE and SHIB, which thrive on community engagement.

“$WIF’s surging market cap shows that hype and community engagement are powerful in the current crypto landscape.” — An analyst from CoinCodex

Market reaction to $WIF’s growth remains robust, with open interest in futures rising over 30%. This indicates heightened speculation. Despite no large institutional flows, $WIF maintains a strong community base.

The lack of a formal leadership team has not hindered $WIF’s progress, as community-driven initiatives push its momentum. The coin’s volatility mirrors previous market cycles, often driven by sentiment rather than core developments.

If speculation continues, $WIF’s market presence may expand further. Historical trends of meme coins suggest potential volatility but also opportunities for significant short-term gains, echoing past performance patterns.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

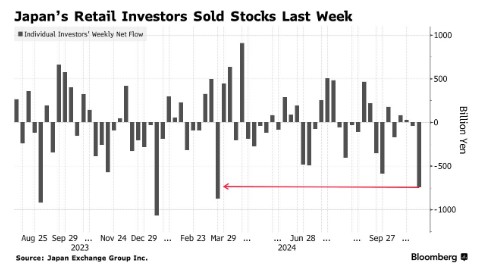

海内外政治动荡引恐慌!个人投资者急忙抛售日股,卖出金额创3月来新高

Trump on the Hormuz Strait and Oil: Not Worried About Anything