Swiss Bank Sygnum Backs First Bitcoin Loan Platform With Custody

Swiss digital asset bank Sygnum has teamed up with Bitcoin lender Debifi to launch the world’s first bank-backed Bitcoin loan platform. Crucially, that lets users keep control of their coins. The new product is named MultiSYG. Specifically, it combines regulated banking with self-custody technology. That marks a major milestone for Bitcoin lending and institutional finance.

A New Era of Bitcoin Lending

Sygnum announced the partnership during Switzerland’s Plan B Forum in Lugano. This marks the first anniversary of its office opening there. The MultiSYG platform is expected to go live in the first half of 2026. It will allow clients to draw fiat loans against their Bitcoin collateral. While maintaining partial control of their holdings. Through a 3-out-of-5 multi-signature escrow wallet, borrowers and Sygnum will share control over the Bitcoin used as collateral.

This means no single party has full custody of the assets. A key principle behind Bitcoin’s self-sovereignty ethos. The setup also ensures that clients can verify their collateral on-chain. It stays true to the “not your keys, not your coins” philosophy. Unlike traditional Bitcoin loans, which require full custody by banks. MultiSYG’s system distributes control using multiple private keys. This offers security and transparency while giving borrowers access to regulated lending terms. Such as competitive rates, flexible drawdowns and premium banking services.

Bridging Bitcoin and Banking

Max Kei, CEO and Founder of Debifi, said the partnership addresses a growing market need. “A Bitcoin loan should not require blind trust in a custodian,” Kei explained. “MultiSYG’s structure lets borrowers verify their collateral while benefiting from Sygnum’s regulated banking relationship and service.” Pascal Eberle, who leads the Bitcoin@Sygnum and MultiSYG initiative. It emphasized that this innovation bridges two worlds.

“With MultiSYG, we are bringing Bitcoin-native technology to regulated bank lending,” he said. “Borrowers get bank-grade pricing and flexibility, while retaining cryptographic proof and control of their Bitcoin.” This approach prevents rehypothecation. This is a practice where banks re-use clients’ collateral for other loans, something Bitcoin investors have long criticized. By offering cryptographic guarantees. Therefore, MultiSYG ensures that clients’ assets remain untouched throughout the loan period.

Institutional Demand on the Rise

The new service arrives just as institutional demand for Bitcoin-backed financial products continues to climb. This is because companies and funds increasingly want access to regulated Bitcoin lending that doesn’t compromise self-custody. Therefore, Sygnum’s initiative directly addresses that demand. It gives institutions confidence that their assets are both secure and verifiable. The product will be available to all Sygnum Bank customers globally once it launches.

With more corporations are adding Bitcoin to their balance sheets. Consequently, Sygnum’s hybrid model could become a blueprint for future crypto-banking integrations. Ultimately, by combining regulatory compliance with decentralization principles. The bank is setting a precedent for how traditional finance can evolve alongside blockchain technology.

A Milestone for Sygnum

The launch of MultiSYG is part of the broader Bitcoin@Sygnum initiative. Which, specifically, focuses on advancing regulated Bitcoin products, technology and research. In fact, Sygnum already offers Bitcoin and Ethereum investment services, tokenization and institutional-grade custody solutions. The firm, founded in Switzerland and Singapore . It holds multiple licenses across major financial hubs, including Abu Dhabi, Luxembourg and Liechtenstein. With MultiSYG, Sygnum is reinforcing its position as a leader in digital asset banking. It proves that Bitcoin lending can evolve without sacrificing the core values of the crypto community.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Experiences Bullish Pump Reclaiming $73,000 in the Last 24 Hours and Sparking Hope

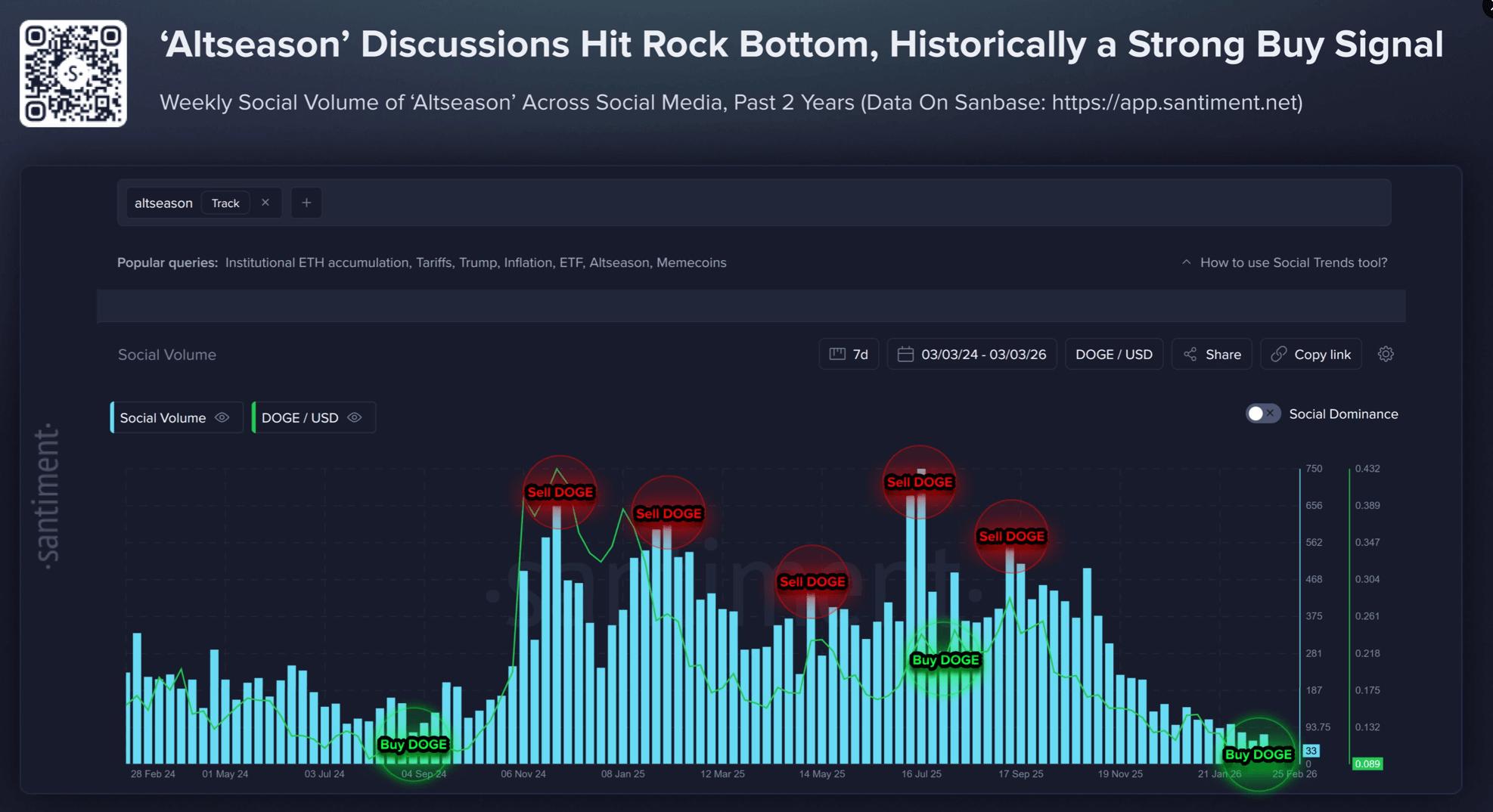

Altcoin chatter sinks to 2-year low as Bitcoin holds attention

WISeKey Reports FY 2025 Preliminary Financial Results

Analyzing why crypto is trending again DESPITE markets being in ‘extreme fear’