Solana Price on the Edge — A Sharp Break Could End the Buyer-Seller Stalemate

Solana price is locked in a tight range as buyers and sellers battle for control. On-chain data shows long-term holders selling less and mid-term buyers stepping in. The standoff could end soon, with key levels between $188 and $211 likely to decide the next breakout direction.

Solana’s price is caught between stubborn buyers and active sellers, with neither side backing off. The coin is up 4.5% in the past 24 hours but still down 7% over the month, showing how every bounce gets met with selling pressure.

Now, on-chain and chart signals suggest this standoff may be nearing a turning point.

Long-Term Sellers Slow Down, Short-Term Traders Shift Gears

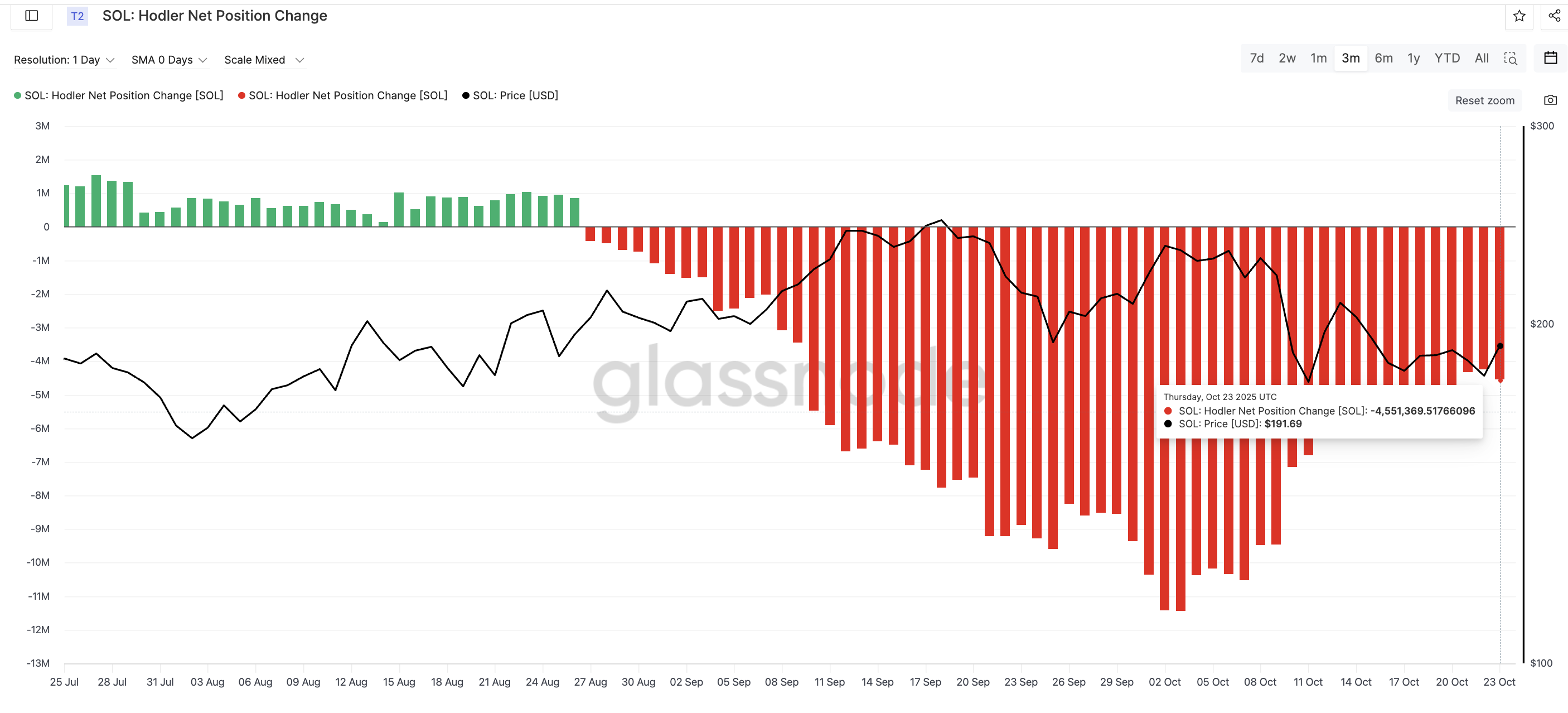

The Hodler Net Position Change, which tracks whether long-term investors are adding or selling, remains negative — meaning Solana holders are still cashing out. But the pace of selling has eased sharply.

On October 3, long-term holders sold around 11.43 million SOL, compared to 4.55 million SOL on October 23. That’s a major 60% drop in selling pressure. They’re not buying yet, but they’re clearly slowing down, a pattern that often appears near local bottoms.

Long-Term Investors Selling Fewer SOL:

Glassnode

Long-Term Investors Selling Fewer SOL:

Glassnode

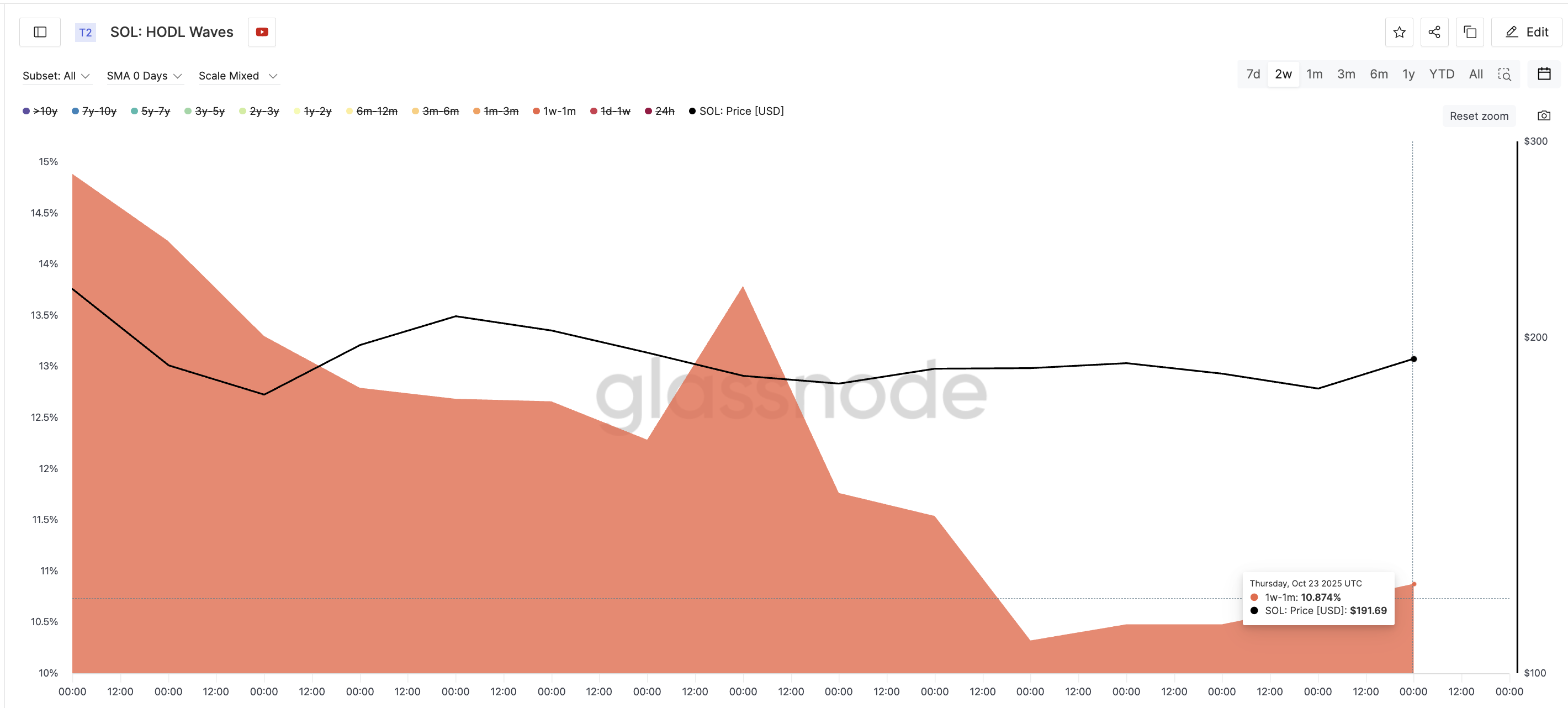

To see what short-term traders are doing, the HODL Waves metric breaks down supply by holding duration.

It shows that 1-week–1-month wallets cut their share from 14.88% on October 9 to 10.87% on October 23, suggesting traders might have been taking profits on small rallies.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

Short-Term Holders Dumping:

Glassnode

Short-Term Holders Dumping:

Glassnode

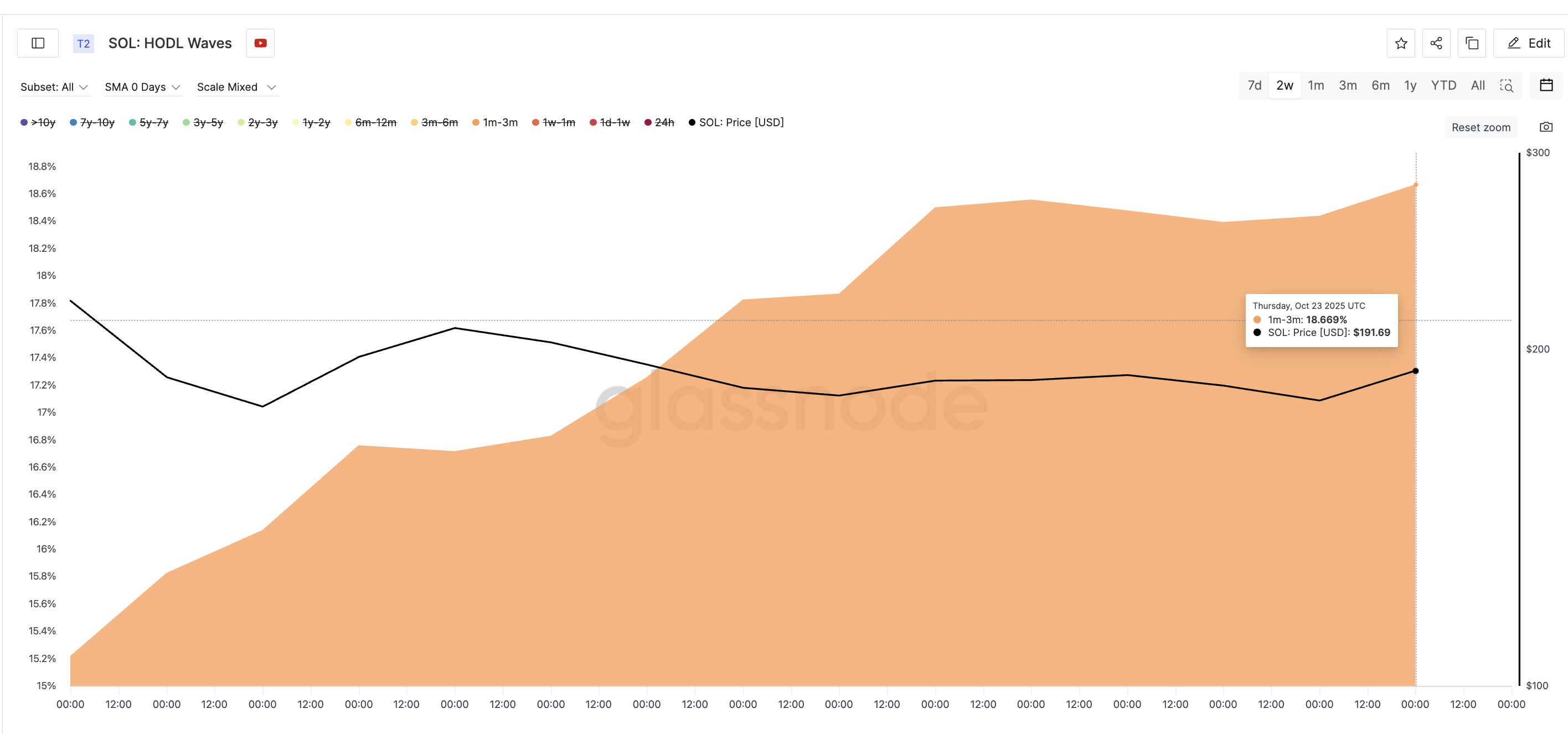

Meanwhile, the 1–month–3–month group raised its share from 15.21% to 18.66%, showing that slightly longer-term players are quietly buying dips.

Mid-Term Solana Holders Buying:

Glassnode

Mid-Term Solana Holders Buying:

Glassnode

In simple terms, short-term sellers are fading out, mid-term buyers are stepping in, and long-term holders are just waiting. That balance explains why SOL has stayed in a range and not dipped massively.

A decisive change in the range-bound nature of SOL price could happen if any of the mentioned groups make a move. For instance, if the long-term investors start buying (position change in green), the Solana price could get a bullish boost.

However, if they continue to sell, aligning with the short-term holders, a price breakdown theory could surface.

Triangle Pattern Sets the Stage for a Solana Price Breakout

On the daily chart, the Solana price has been trading inside a symmetrical triangle since mid-September, a structure that shows market indecision. Each swing high is lower, and each swing low is higher, forming a tightening range.

The fight could end soon. A breakout above $211 would give buyers the upper hand and mark a move beyond the triangle’s top. A breakdown below $174 would signal that sellers have regained control.

Solana Price Analysis:

TradingView

Solana Price Analysis:

TradingView

Until then, $197 serves as the first resistance, and $188 remains key support. A close below $188 could open $174, while a rebound above $197 might kick off a run toward $211 (over 9% surge from the current levels) and higher.

Solana’s buyer-seller battle is still balanced, but not for long. The charts and on-chain data agree: the next decisive break is close.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Core Scientific's BTC Sale: A $175M Liquidity Move and Its Price Impact

Circle's 20% Jump: Crude Prices, Bond Returns, and Reserve Earnings Movement

Acrivon Therapeutics, Inc. (ACRV) Raised to Buy: Discover the Reasons

XRPL Validator Says Anything Under $10 for XRP Is Extremely Undervalued. Here’s Why