Dogecoin News Today: Dogecoin Faces Critical $0.23 Threshold as Major Holders Clash with New Challenges

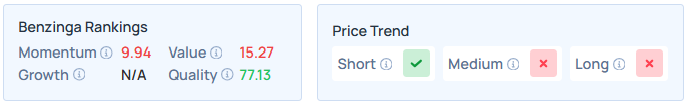

- Dogecoin (DOGE) faces a critical $0.23 threshold, with whale accumulation and on-chain metrics suggesting potential for a parabolic rally toward $0.30. - Structural indicators like MVRV (0.63) and NVT (93.4) highlight modest profitability and rising transaction activity, while a 71.75% long-position dominance underscores bullish sentiment. - Emerging projects like Remittix (RTX) and $LYNO challenge DOGE's dominance, with whale capital shifts and presale hype signaling a competitive shift toward utility-d

Dogecoin (DOGE) is once again at the center of speculation regarding a potential explosive rally before 2025, fueled by a mix of on-chain data, significant whale transactions, and growing optimism among market participants. The

The recent move up from the $0.175–$0.18 support range has shifted focus to the $0.21 mark, where large investors have accumulated over 10.5 billion

On-chain indicators further support a cautiously optimistic view. Dogecoin’s MVRV ratio is at 0.63, pointing to moderate gains for holders, while its NVT ratio has jumped to 93.4, indicating a rise in transaction activity compared to its market value. These patterns hint at stronger network engagement, but ongoing improvement in these metrics will be necessary to confirm a new phase of accumulation. At the same time, the Stock-to-Flow ratio has climbed to 110, suggesting a tighter supply and less selling pressure—often a sign of early accumulation stages.

Despite these shifts, a true recovery for Dogecoin depends on breaking above the $0.23 mark. A decisive move past this level could open the door to further gains, but failure to do so might result in short-term sell-offs before another attempt higher. Analysts warn that although the groundwork for a rally is being laid—supported by whale activity and a tightening supply—overcoming structural resistance is essential before the next growth phase can begin.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Supermicro Eyes Telecom Boom With Scalable AI RAN Infrastructure

March Turnaround or Just a Pause? The Expectation Gap for the S&P 500

Oil: Risk premium builds on Hormuz threat – MUFG