Solana Attracts Institutions with $700 Million in Real Assets and Zero Failures

- Solana Maintains 100% Uptime During AWS Outage

- Network exceeds $700 million in real-world assets

- Institutional validator migrates to bare-metal infrastructure

Solana has been solidifying its presence among financial institutions by registering approximately $700 million in tokenized real-world assets (RWA) and demonstrating operational stability, with no downtime even during the recent global AWS outage on October 20th. These results reinforce the network as an efficient alternative for institutional financial flows and tokenized operations.

Solana currently hosts approximately $628,9 million in RWAs , with a recent peak of nearly $700 million. Highlights include Franklin Templeton's FOBXX fund and Circle's USYC money market fund, which adds cash instruments and Treasury securities to the same infrastructure that houses USDC. These products expand institutional access to regulatory-compliant assets while maintaining liquidity and on-chain programmability.

The technical reliability of the network has also been a determining factor. According to its official status page , Solana has recorded 100% uptime for the last 60 days, even during the widespread AWS outage—a fact that caught the attention of risk committees and infrastructure providers. Data from validators.app indicates that providers such as TeraSwitch (26,3%), Latitude.sh (14%), Cherry Servers (5,2%), and OVH (4%) dominate the ecosystem, while Amazon's combined share represents only 6,4%, signaling decentralization and resilience.

Furthermore, institutional validators like Coinbase have migrated entirely to bare-metal servers, moving away from cloud providers. This trend strengthens operational independence and mitigates related risks. The technical roadmap also includes Firedancer, a client developed by Jump Crypto, which promises greater efficiency and redundancy in block production.

In terms of cost efficiency, the network's average fees hover around 0,0000234 SOL per transaction—less than a cent—making Solana highly competitive with Ethereum's L2 solutions. For high-frequency treasury operations, this cost difference represents a significant advantage.

With the entry of new issuers and the expansion of the USYC and FOBXX programs, conservative projections point to a total of between $0,9 and $1,05 billion in RWAs on Solana by March 2026, solidifying blockchain's role as an institutional infrastructure for tokenized real assets.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

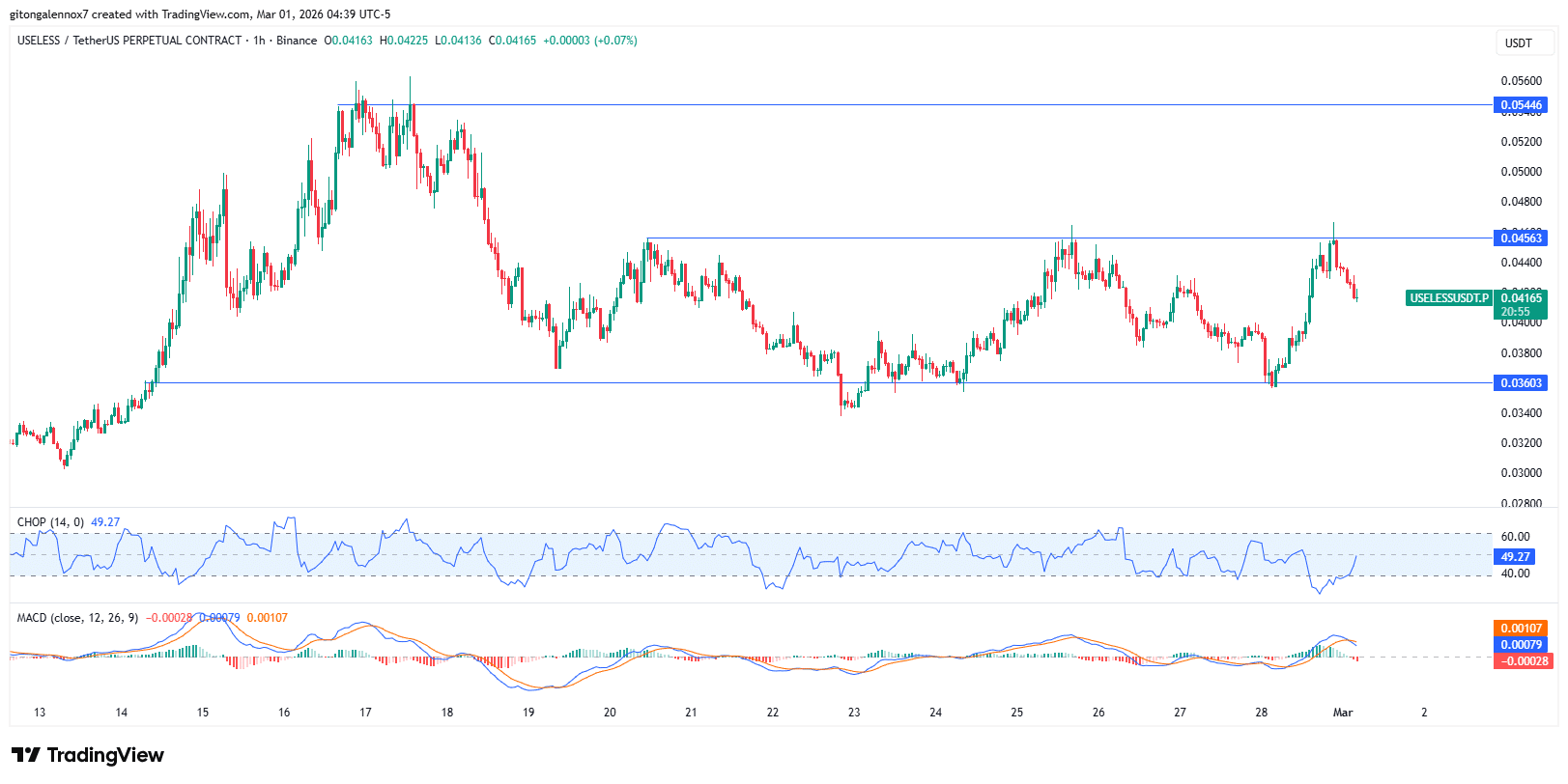

USELESS jumps 17% as whales load up – Why THIS support is KEY!

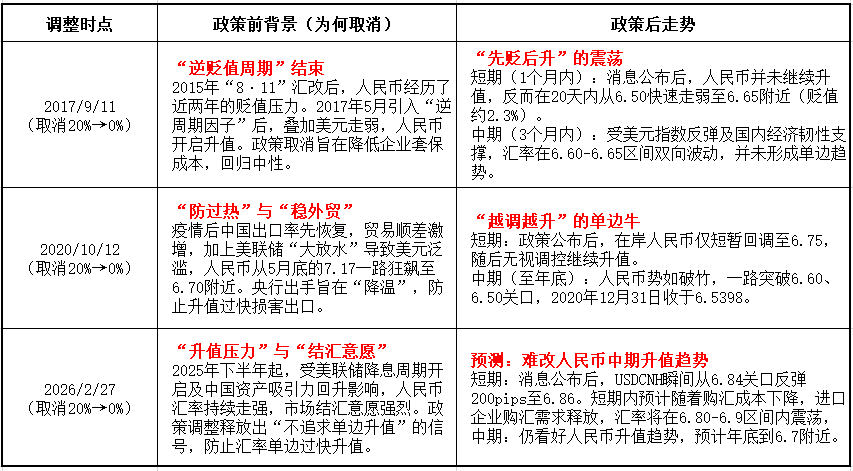

Market Impact of Cancelling Forward Foreign Exchange Risk Reserve Ratio

Explosions Echo Throughout the City! Witnessing History on Monday