Agentic AI: Opportunities and Risks as Businesses Tackle Innovation and Legal Challenges

- Agentic AI's rise is reshaping global workforces, offering productivity gains but posing governance challenges for enterprises. - Zeta Global's Athena and Joget's no-code AI tools demonstrate autonomous systems streamlining marketing, HR, and supply chain workflows. - C3.ai's legal battles and financial decline highlight risks of AI mismanagement, with lawsuits alleging securities fraud and revenue drops. - Industry experts warn agentic AI demands balancing innovation with accountability, as it redefines

Veteran AI specialists warn that the emergence of agentic artificial intelligence is set to reshape the global job market in ways that may be difficult for businesses to manage. As organizations rush to implement autonomous technologies capable of making decisions independently, the disruptive impact of these systems is already apparent, driving both remarkable advancements and notable corporate setbacks.

For example, Zeta Global introduced Athena by Zeta™, a conversational, highly intelligent agent aimed at transforming marketing and productivity processes. According to a Business Wire announcement, Athena is integrated into the company’s

However, the fast-paced growth of the AI field has not been without difficulties. C3.ai, once a leading AI platform company, is now contending with increasing legal and financial troubles. Several law firms—including Levi & Korsinsky, Gross Law Firm, and Glancy Prongay & Murray—have initiated class-action lawsuits alleging securities violations: Levi & Korsinsky issued a notice about a lead plaintiff deadline (

The difficulties faced by C3.ai mirror larger issues within the AI sector. Rival BigBear.ai also suffered from federal spending reductions, lowering its 2025 revenue projection to $125–140 million from $158.2 million in 2024. At the same time, C3.ai’s leadership change and dependence on Microsoft’s sales channels underscore the industry’s delicate balance between breakthrough innovation and practical execution. Experts point out that while C3.ai’s reduced forward price-to-sales ratio could attract investors, the company’s operational uncertainties are still considerable.

The contrasting nature of agentic AI—its opportunities and dangers—poses pressing challenges for businesses. As demonstrated by Zeta and Joget, autonomous technologies can boost efficiency and improve decision-making. Yet, the situation at C3.ai highlights the legal, governance, and leadership hurdles that come with AI’s rapid rise. “Agentic AI is more than just a tool—it’s a transformative force changing how companies operate, assign responsibility, and develop strategies,” one industry analyst commented. For organizations, the priority is clear: leverage the advantages of this technology while managing its risks with openness and adaptability.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

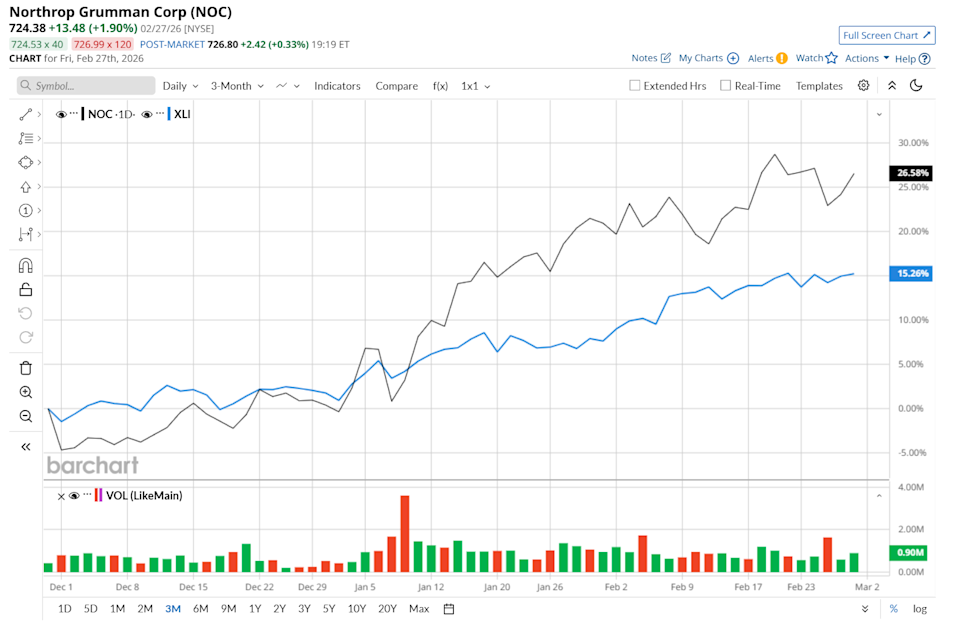

Northrop Grumman Shares: Is NOC Surpassing the Performance of the Industrial Sector?

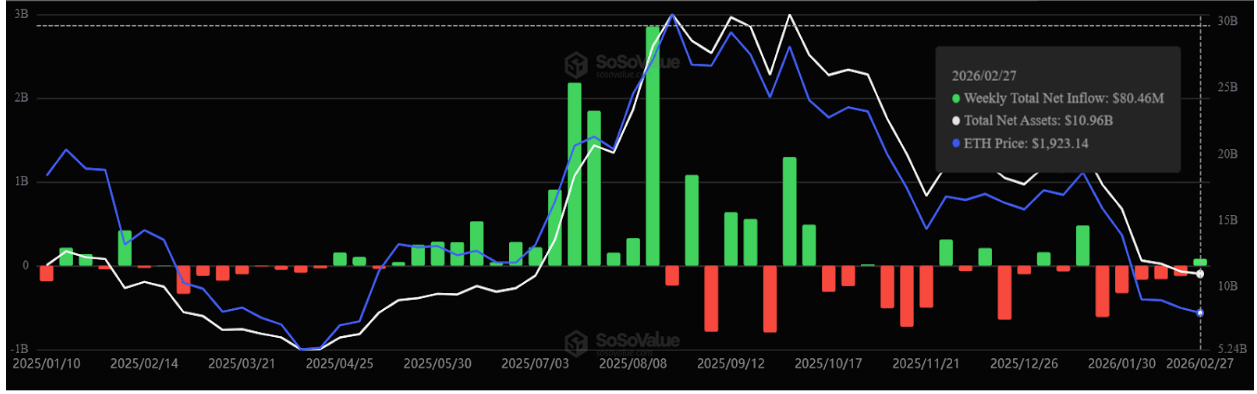

Spot Bitcoin ETFs Record $787 Million Inflows, End 5-Weeks Of Consecutive Outlows

Analyst Says 99% of XRP Investors Will Lose Everything. Here’s why

Wanchain Bridges $163M to Cardano, Fueling $80M in Inflows and a DeFi Revival