Pump.fun Acquires Padre Trading Terminal, Crashing Its Token 80%

Pump.fun’s latest acquisition of Padre aims to boost its professional trading capabilities, but the move has sparked backlash as PADRE token holders face steep losses and accusations of a rug pull.

Pump.fun acquired Padre, an advanced multichain trading terminal, hoping to build out its professional retail user base. This will help the firm capture and tokenize a larger number of opportunities.

However, PADRE has a preexisting token that is apparently being shuttered, causing its value to largely evaporate. This unexpected turn led to community backlash and rug-pull accusations.

Pump.fun Buys Padre

Pump.fun made its first acquisition in July, purchasing a Solana wallet-tracking/analytics tool, but it’s already planning a second one. The meme coin launchpad has been expanding with its PUMP token, and now, Pump.fun is acquiring Padre:

we're excited to announce that pump fun has acquired Padre is an industry leading trading terminal which provides a seamless, high-speed trading experience with next level analytics for professional traders on Solana, BNB Chain, Base, and Ethereum L1read more 👇

— pump.fun (@pumpdotfun)

Padre is a terminal for multichain trading, and Pump.fun hopes to use its infrastructure to expand its own business. The launchpad attempted to create its own advanced trading terminal almost exactly one year ago, but today’s plan will go even further.

Specifically, Pump.fun wishes to “tokenize the world’s highest-potential opportunities,” and said that terminals like Padre capture high levels of activity in the ecosystem.

To that end, the firm believes that expanding its presence in professional retail trading is a top priority for these long-term goals.

A Token in the Crossfire

Still, there’s one group of users that is not happy. Although Pump.fun claimed that Padre’s trading functions will continue as usual, the firm already has its own token.

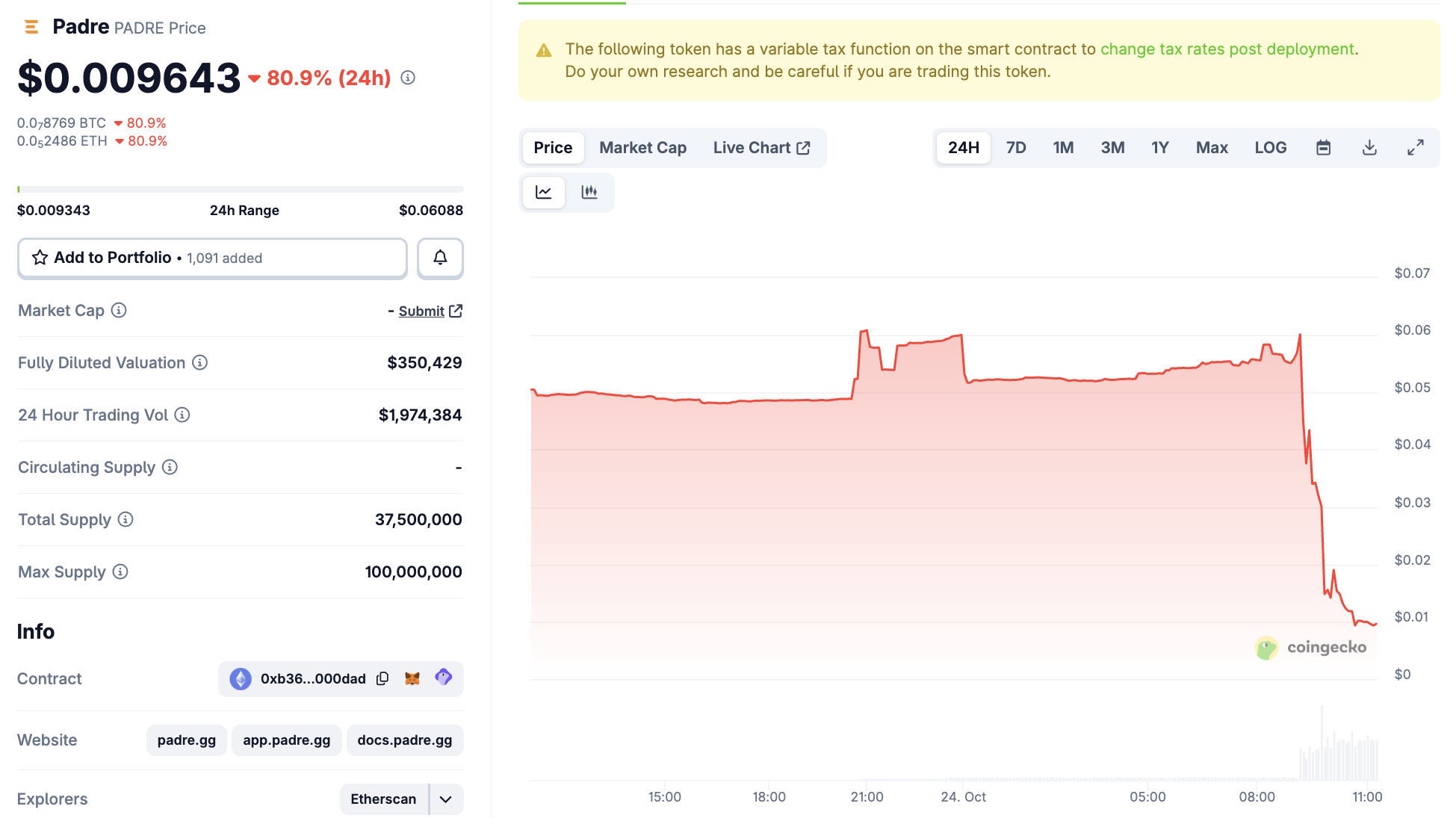

Moving forward, PADRE “will no longer have utility on the platform with no further plans for the future,” causing its value to evaporate practically.

PADRE Price Performance. Source:

PADRE Price Performance. Source:

Many Pump.fun fans were upset with this decision, accusing the platform of performing a rug pull with PADRE holders. Although the asset remains quite small, this unexpected setback could still adversely impact its investors.

Moving forward, it’ll be interesting to see if this controversy looms larger than the potential benefits.

Of course, Pump.fun has already been mired in controversies, and the PADRE crash might not change anything. The firm has been accused of everything from enabling market manipulation to platforming a string of racist and profane tokens, but it hasn’t lost its prominence yet.

For all we know, any downsides to the Padre acquisition might become a mere speed bump on Pump.fun’s continued path forward.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ripple-Supported Evernorth Now Possesses a Whopping 261 Million XRP

Securing Massive XRP Treasury Ahead of Nasdaq Public Listing through Armada Acquisition Corp II Merger

Bitcoin and ETH ETFs Lose Ground as Investors Pivot Back to Bitcoin: Is Altseason Over?

Shifting Market Preferences: Over $128 Million Withdrawn from ETH ETFs as Bitcoin Futures Activity Soars to Record Highs

Stablecoin Revolution: When Payments Are No Longer Tied to Banks, How High Is the FinTech Startup Ceiling?

The Federal Reserve is not only exploring stablecoins and AI payments, but also piloting a new proposal called "streamlined master accounts," which would allow qualified companies to directly access the Fed's settlement system. This move could open new doors for fintech innovation.

A $2 billion "game of probabilities": Is the prediction market approaching its "singularity" moment?

The prediction market is evolving from a marginalized "crypto toy" into a serious financial instrument.