AI and cloud technologies drive the advancement of BAYC's metaverse

- BAYC re-enters metaverse via AI/cloud partnerships with Microsoft, AMD, and Alphabet to build dynamic virtual worlds. - Tech giants' AI/cloud investments (e.g., Nvidia +56% revenue) enable real-time avatars and generative content in BAYC's ecosystem. - Regulatory challenges like Florida's Roblox subpoenas prompt BAYC to adopt AI moderation and age-verification tools. - Market rally (Nasdaq +19%, AMD +80%) underscores AI-driven metaverse potential, with 38/47 analysts rating Nvidia a "Buy".

The Bored Ape Yacht Club (BAYC), a trailblazing NFT project, is making a return to the metaverse, this time focusing on AI-powered systems and advancements in cloud technology. This renewed push reflects a wider movement in the tech industry, as companies such as

BAYC has always prioritized the metaverse, but new tech innovations are now allowing the project to move past static NFTs and create lively, interactive digital spaces. "The metaverse has shifted from an idea to a tangible reality, built on AI and cloud technology," a BAYC representative stated. This evolution is in step with industry trends, such as Nvidia’s 56% year-over-year revenue jump to $46.7 billion in Q3 2025, fueled by the rising need for generative AI chips, according to a

BAYC’s latest metaverse strategy involves collaborating with top AI and cloud companies to build robust, persistent digital environments. For example, AMD’s recent $14 billion partnership with OpenAI and Oracle’s initiative to use 50,000 AMD GPUs for AI infrastructure point to the expanding access to powerful computing. These developments make it possible for BAYC to offer real-time AI features, including custom avatars and AI-generated content, within its virtual realms. "The metaverse demands enormous computing resources, and the sector is now meeting that need," a technology expert commented.

The project is also set to benefit from Alphabet’s $24 billion commitment to AI supercomputers and data centers, which could help BAYC realize its vision for large-scale, AI-driven social experiences. Meanwhile, Meta Platforms (META) reported a 22% revenue increase in Q2 2025—thanks to AI-powered ad targeting and 3.48 billion daily active users—demonstrating the potential for monetizing metaverse platforms through data-centric engagement, as highlighted in the TS2 report.

Yet, obstacles persist. Florida’s recent criminal subpoenas to Roblox over child protection, as mentioned in a

BAYC’s resurgence comes amid a broader surge in the tech market. The Nasdaq-100 climbed 19% in 2025, driven by investments in AI, while AMD’s shares jumped 80% so far this year due to successful AI collaborations. Experts view BAYC’s shift toward the metaverse as a calculated move to capitalize on ongoing AI expansion, with 38 out of 47 analysts rating

As BAYC reimagines its place in the digital world, its achievements will depend on successfully merging advanced AI and cloud technologies while addressing regulatory and ethical hurdles. With industry leaders like Microsoft and AMD transforming the foundation of the metaverse, a new chapter of immersive, AI-driven digital experiences is on the horizon.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Foxconn reports that the Iran conflict has had minimal effects up to now

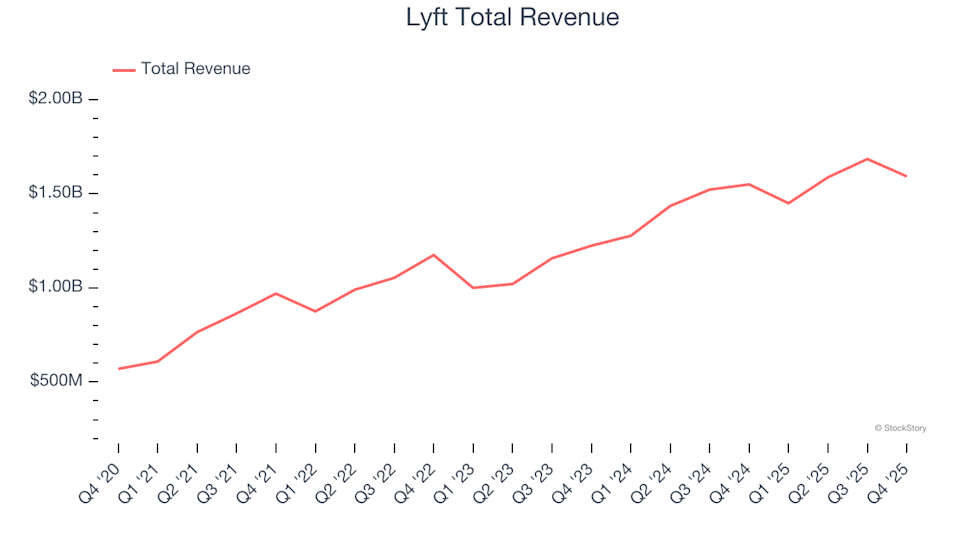

Spotting Top Performers: Lyft (NASDAQ:LYFT) and Gig Economy Shares in the Fourth Quarter

Bittensor (TAO) Tests Crucial $180 Level Amid Renewed AI + Crypto Interest

Compass Point Moves Innovative Industrial Properties (IIPR) to Neutral