Banks Introduce Hybrid Token to Challenge Stablecoin Supremacy

- Custodia Bank and Vantage Bank Texas launched a blockchain platform enabling traditional banks to issue tokenized deposits and GENIUS Act-compliant stablecoins, bridging traditional finance and crypto. - The patent-protected system integrates Custodia’s blockchain and Infinant’s Interlace network, allowing seamless conversions between tokenized deposits and stablecoins while maintaining FDIC insurance and regulatory compliance. - With the stablecoin market projected to grow to $2 trillion by 2028, the pl

Custodia Bank and Vantage Bank Texas have introduced a blockchain-based platform that enables conventional banks to issue both tokenized deposits and stablecoins, placing themselves at the cutting edge of the changing financial sector. This patented system, which incorporates tokenized deposits and stablecoins compliant with the GENIUS Act into current online banking systems, lets banks retain oversight of digital wallets while benefiting from the security and efficiency of blockchain technology, according to a

The platform builds on Custodia’s achievement in July 2025 as the first American bank to launch tokenized deposits on a public blockchain, aiming to challenge the increasing influence of private stablecoin providers. With the stablecoin sector expected to grow from $300 billion to $2 trillion by 2028, according to U.S. Treasury projections, the Coinotag article highlights the urgency for banks to embrace digital innovation to safeguard deposits and stay competitive in a digital economy. The GENIUS Act, enacted in July, has accelerated this transition by establishing clear regulations for tokenized assets, ensuring adherence to banking laws while promoting technological progress, as reported in a

The platform’s technology merges Custodia’s blockchain framework with Infinant’s Interlace network, allowing for effortless exchanges between tokenized deposits and stablecoins. A protocol currently under patent review utilizes both on-chain oracles and off-chain mechanisms to adjust tokens’ regulatory status without the need for redemption or modification, according to Decrypt. This adaptability means tokens can act as FDIC-insured deposits within banks and as stablecoins when moved to other banks or wallets, maintaining regulatory protections and enabling instant settlements. Early uses include international payments, supply chain finance, and payroll, showcasing the platform’s broad applicability, as noted in a

Securing regulatory clearance is still essential. Although pilot programs have concluded, Custodia CEO Caitlin Long stated that the platform is still awaiting final approval to expand, as previously reported by Decrypt. This reflects a wider industry movement, with more regional banks looking to adopt blockchain to boost efficiency and improve customer services. For instance, SouthState Bank Corporation recently upheld a $0.60-per-share dividend following strong third-quarter 2025 results, demonstrating confidence in its competitive strategy, according to a

This launch highlights a significant transformation in banking, where institutions are turning to technology to manage regulatory hurdles and the threat of being bypassed. By providing a ready-to-use solution for tokenized deposits, Custodia and Vantage seek to enable banks of all sizes to join the digital asset space without needing to overhaul their current systems, as mentioned in a

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Canton Foundation Welcomes Fireblocks as Super Validator to Drive Institutional On-chain Settlement

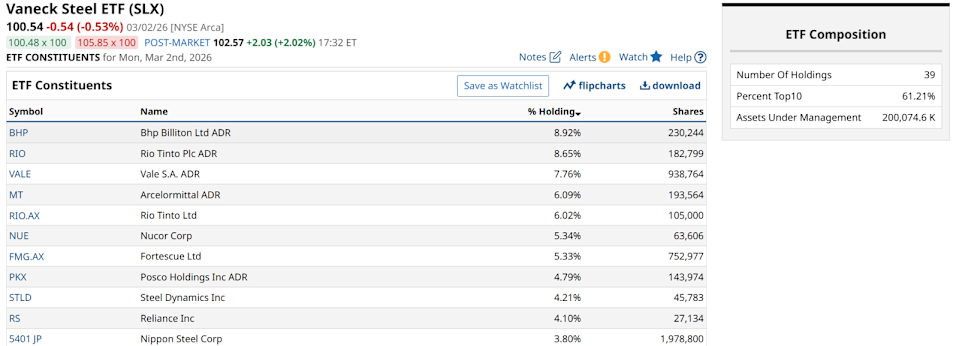

Steel stocks have been soaring lately. The chart suggests another significant surge may be on the horizon.

The Demise of Traditional Energy Security

SANAE TOKEN’s Turbulent Debut on Solana Draws Scrutiny and Official Refusal