Trump recently purchased over $82 million in bonds, covering industries that benefit from his policies.

On November 16, it was reported that Trump purchased at least $82 million in corporate and municipal bonds from late August to early October, involving new investments in industries benefiting from his policies. According to forms released by the U.S. Office of Government Ethics, Trump made over 175 financial purchases during this period. The disclosure documents do not list the specific amount for each transaction, only providing approximate ranges. Trump's new bond investments span multiple industries, including: chip manufacturers: Broadcom (AVGO.O), Qualcomm (QCOM.O); technology companies: Meta Platforms (META.O); retailers: Home Depot (HD.N), CVS Health (CVS.N); Wall Street banks: Goldman Sachs (GS.N), Morgan Stanley (MS.N).

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Texas Pacific Land: The Anticipation Gap Behind a 51.9% Surge

Company Updates on March 4, 2026

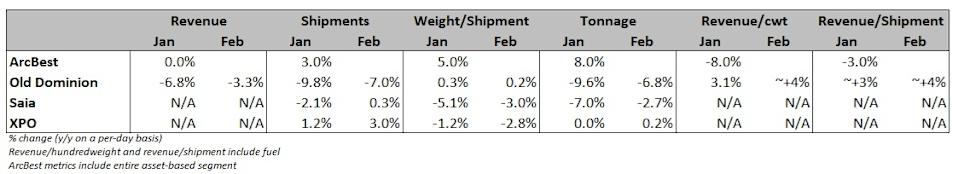

Old Dominion feels ‘optimistic’ as downturns ease in February

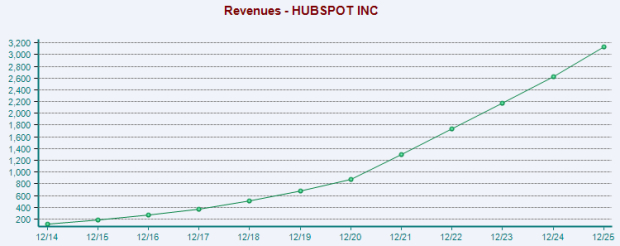

HubSpot Pursues Comprehensive Expansion: Is It Worth Your Attention?