LAKE Launches Its Water Shop — A Key RWA Proof-of-Concept Bridging Web3 and the Traditional Water Industry

LAKE, a disruptive Real World Asset (RWA) company aiming to disrupt the trillion-dollar global water economy, has officially launched the LAKE Water Shop, now live within its growing RWA blockchain-based ecosystem. Built on LAKE’s pioneering “Spring to Consumer” (S2C) model, this Water Shop is a user-friendly Web3 water marketplace deployed on the Polygon blockchain. It

LAKE, a disruptive Real World Asset (RWA) company aiming to disrupt the trillion-dollar global water economy, has officially launched the LAKE Water Shop, now live within its growing RWA blockchain-based ecosystem.

Built on LAKE’s pioneering “Spring to Consumer” (S2C) model, this Water Shop is a user-friendly Web3 water marketplace deployed on the Polygon blockchain. It allows EU-based $LAK3 holders to purchase premium spring water directly from verified sources, with delivery managed entirely by LAKE. This launch reinforces LAKE’s mission to broaden and decentralize access to this vital resource, creating new borderless distribution channels.

This unique model is transforming the way we’ve interacted with water — replacing traditional intermediaries with blockchain-powered transparency and direct access, where LAKE sets the new standard: just like sourcing produce straight from a farm, you get pure, high-quality spring water directly from the source — no middlemen.

Powered by the LAK3 token — the company’s token launched in January — the Water Shop provides a solid utility for the token. LAK3 acts as a true cryptocurrency and is the sole means of payment accepted on the platform. LAK3 serves as the universal cryptocurrency for water and is the only asset specifically designed to unlock real-world access and opportunities in the profitable and growing water market.

The LAKE Water Shop is more than a marketplace — it’s a technological achievement. The platform integrates blockchain technology with real-world logistics, syncing in real time with LAKE’s partnered water sources, storage facilities, and delivery systems.

“This is a major proof-of-concept for LAKE and the entire RWA space. The Water Shop represents the culmination of years of hard work and innovation” said Jean-Hugues Gavarini, CEO and Co-founder of LAKE. “We’re not just talking about utility — we’re delivering it, literally. European LAK3 holders can now turn their digital assets into real spring water at their doorstep.”

The Water Shop also serves as a logistics pilot, enabling LAKE to test and optimize its full supply chain—starting in Europe—laying the groundwork for the global rollout of Digital Water, the company’s upcoming flagship service. Digital Water transforms premium spring water into secure, portable, and globally accessible digital assets, which are convertible on demand—effectively turning digital water rights into real-world water deliveries worldwide. For the first time, retail, including individuals, will gain access to these assets, enabling participation in the water industry and unlocking financial opportunities that were previously out of reach.

The Water Shop paves the way for a more efficient, strategic, and borderless water economy led by Digital Water, the next global asset class.

This launch is just the first step in LAKE’s ambitious roadmap. As part of its RWA ecosystem, LAKE is developing a suite of innovative services—including Digital Water, Community-to-Business (C2B) Water Deals, LAKE Launchpad, and DeFi protocols—designed to make everyone an active player in the global water economy.

The Water Shop marks the beginning of an ongoing journey into the Future of Water—built upon innovation, transparency, and real-world utility.

About LAKE

LAKE is a Real World Asset (RWA) company transforming the global water economy through its blockchain-based ecosystem and LAK3 token, empowering everyone to seamlessly buy, own, trade, invest in, and secure high-quality spring water — making every user an active player in the trillion-dollar water economy.

LAKE introduces the world’s first ecosystem to digitalize and financialize water, turning spring water into Digital Water, the next strategic global asset class, enabling borderless access, ownership, and monetization of water globally.

By combining Digital Water with the LAK3 token, LAKE pioneers a new paradigm where water is not only consumed but also owned, traded, and secured as a strategic investment.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Texas Pacific Land: The Anticipation Gap Behind a 51.9% Surge

Company Updates on March 4, 2026

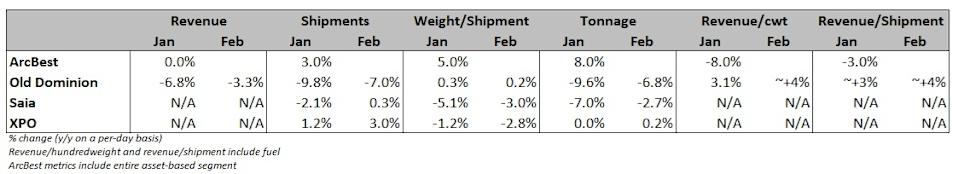

Old Dominion feels ‘optimistic’ as downturns ease in February

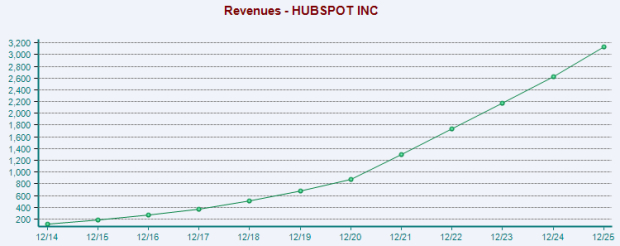

HubSpot Pursues Comprehensive Expansion: Is It Worth Your Attention?