XRP News Today: XRP ETFs Ignite Discussion: Could Institutional Investments Drive a 465% Price Increase?

- Franklin Templeton and Grayscale's XRP ETFs cleared NYSE Arca approval, set for Nov 24 launch, marking institutional adoption of digital assets. - XRPZ ETF (0.19% fee) and Grayscale's entry boost institutional credibility, with XRP rising 5% amid 26% higher trading volume. - Analysts project 465% XRP price potential by 2028 via ETF-driven demand, though BlackRock's potential entry could strain XRP's 60B token supply. - Regulatory clarity and pro-crypto policies, including the Genius Act, reinforce invest

The U.S. crypto sector is approaching a significant turning point as Franklin Templeton and Grayscale's

Franklin Templeton's

The anticipation of these launches has already impacted the market.

Looking forward, speculation is mounting about BlackRock, a major player yet to enter the XRP ETF space.

The current ETF enthusiasm echoes the path taken by Bitcoin ETFs, where a dozen funds now collectively hold $117 billion in BTC. For XRP, the arrival of institutional funds could heighten price swings, especially if several ETFs amass large holdings. Although some doubt the plausibility of Kendrick's $220 price prediction,

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

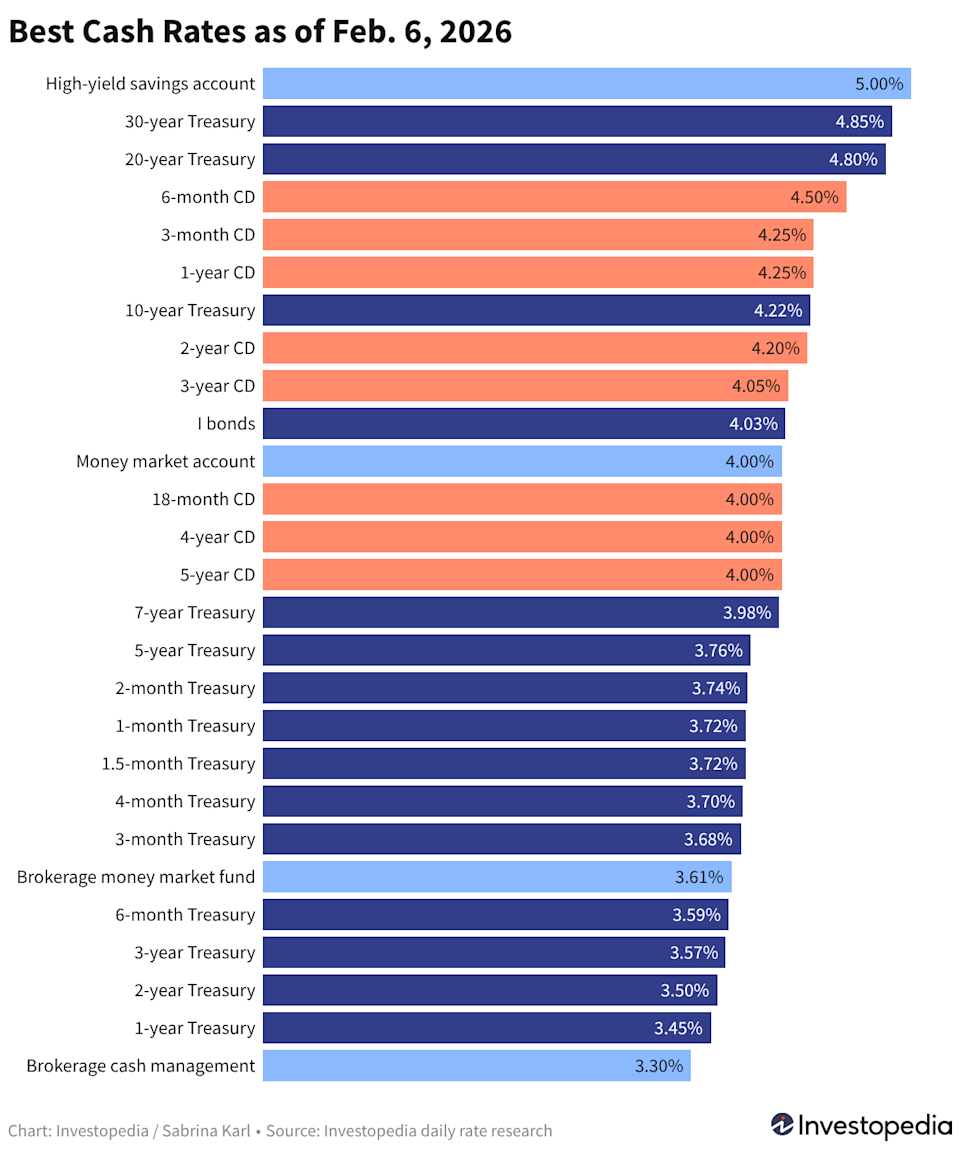

Where You Can Currently Get 3%–5% Returns on Your Money

Why crypto is down and when it might bottom: Insights from Bitwise’s Matt Hougan

TrumpRx Explained: Why Markets are Watching This New Pharma Website

Solana Crashes Hard — And Big Money Isn’t In A Hurry To Save It