Revolut reaches $75 billion valuation following completion of latest share sale

Quick Take Revolut has completed a share sale led by Coatue, Greenoaks, Dragoneer, and Fidelity Management & Research Company, taking its valuation to $75 billion. The valuation follows a period of improved financial performance and continued international expansion, including obtaining banking authorizations in Mexico and Colombia.

Revolut announced Monday it has completed a share sale led by Coatue, Greenoaks, Dragoneer, and Fidelity Management & Research Company that valued the company at $75 billion.

NVentures, NVIDIA's venture capital arm, Andreessen Horowitz, Franklin Templeton, and accounts advised by T. Rowe Price Associates also participated in the transaction. The deal included an option for current Revolut employees to sell some of their holdings — the fifth time it has enabled share sales for staff.

Founded in London in 2015, Revolut began as a challenger fintech focused on cheap foreign exchange and travel spending, and quickly expanded into a global app offering banking, investing, and crypto services.

The valuation marks a significant increase from Revolut's $45 billion valuation in 2024 following completion of a secondary share sale. The firm previously raised $250 million in 2018 at a $1.7 billion valuation, then secured $800 million in a 2021 Series E round led by SoftBank and Tiger Global, valuing the company at around $33 billion at the time.

Revolut did not disclose the size of the latest share sale, though Bloomberg reported in October that it was exploring about $3 billion in combined primary and secondary funding for the private company.

The firm's latest valuation reflects recent growth in both financial and operational metrics. In 2024 the company reported a 72% rise in revenue to $4 billion, with profit before tax growing 149% to $1.4 billion amid a surge in crypto trading volume — up 298% year-over-year to $647 million. That growth was helped in part by the launch of its standalone crypto exchange platform, Revolut X , that May, which later expanded into 30 European markets.

Revolut said its customer base has risen above 65 million in 2025, while expanding its international footprint further by securing banking approvals in Mexico and Colombia and preparing for a launch in India.

"The level of investor interest and our new valuation reflect the strength of our business model, which is delivering both rapid growth and strong profitability," Revolut CFO Victor Stinga said in a statement.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Enpro: Fourth Quarter Earnings Overview

Enso partners with Chainlink for live production deployments of cross-chain minting

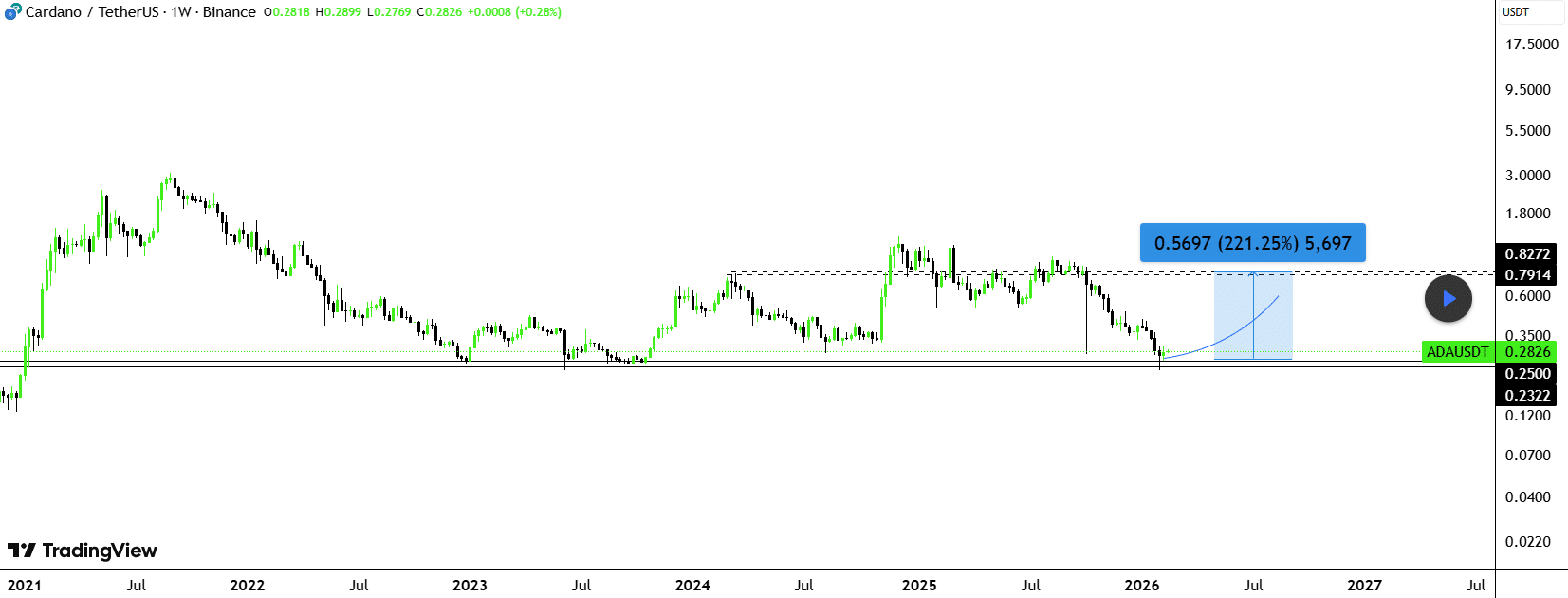

Cardano Long-Term Target as Price Nears Historic Demand Zone

Solana Price Prediction: SOL Consolidates After 55% Drop, Is $98 Next?