What To Expect From Pi Coin Price in December 2025

Pi Coin price has held up better than most majors through November, but the charts now show a mix of strength and early warning signs. November has been Pi’s calmest month since summer, and the token is still trying to turn green for only the third time this year. The question now is whether this

Pi Coin price has held up better than most majors through November, but the charts now show a mix of strength and early warning signs. November has been Pi’s calmest month since summer, and the token is still trying to turn green for only the third time this year.

The question now is whether this momentum can survive December, even do better than November, or if the larger downtrend reclaims control.

History And Its Negative Correlation With Bitcoin

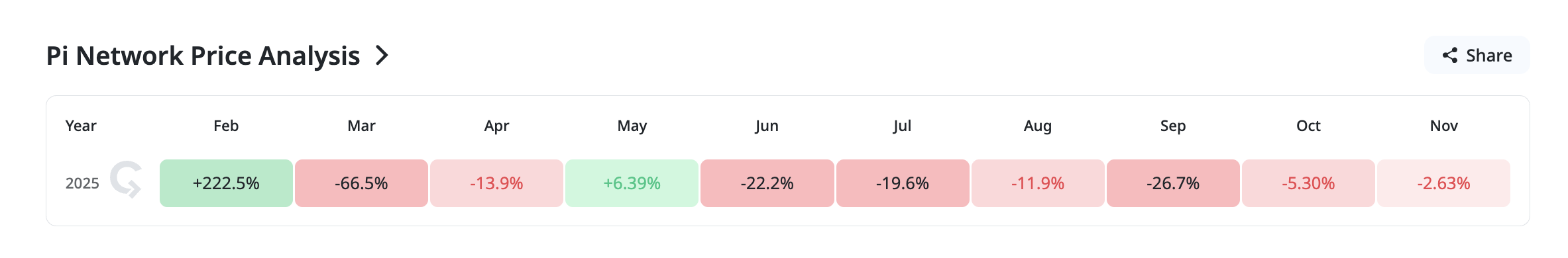

Pi Coin is still young, so its price history leaves a short but clear story. Most of 2025 has been red. Only February and May printed green months. November is trying to join that list.

Price History:

Price History:

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter .

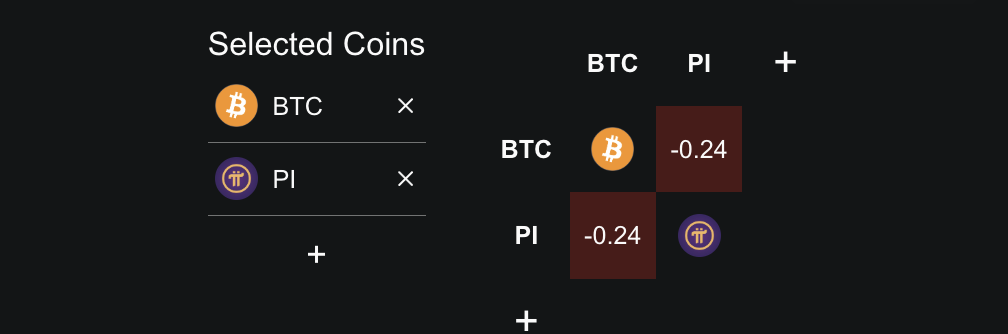

What stands out is PI’s negative monthly correlation with Bitcoin, currently around –0.24. When Bitcoin drops, Pi often holds firmer or even rises. Since Bitcoin has been weakening since October, Pi has found support.

Over the last month, Pi is down only about 2.6%, while Bitcoin has dropped much more sharply. Almost 19%.

Pi Coin- BTC Correlation:

Pi Coin- BTC Correlation:

Weekly performance also reflects this. Pi is still up about 2.7% over the last seven days, making it one of the steadier coins during a weak market. However, some signals on the three-day chart now suggest that December could be more challenging than November.

Hidden Bearish Divergence Appears As Big Money Weakens

Pi Coin’s broader structure remains inside a converging falling wedge, which is usually a bullish pattern. The PI price is now close to the upper trendline of that wedge. A breakout from here would normally look positive. But two indicators show early weakness.

The first is the RSI divergence on the three-day chart. The RSI, or Relative Strength Index, measures momentum. Between October 25 and November 24, Pi Coin made a lower high, but RSI made a higher high. This is a hidden bearish divergence. It usually means the downtrend underneath is still strong, even if the price looks stable.

Pi Coin Faces Divergence Risk:

Pi Coin Faces Divergence Risk:

The second is the CMF, or Chaikin Money Flow, which tracks whether large amounts of money enter or exit the market. CMF is still in negative territory on the three-day chart and is now sliding toward its ascending trendline.

The last time CMF revisited this trendline in early October, Pi dropped more than 42%.

Big Money Keeps Flowing Out:

Big Money Keeps Flowing Out:

Both signals together mean that PI’s November strength may not fully translate into December unless money returns and CMF avoids a breakdown.

Pi Coin Price Levels To Watch In December

The chart shows a simple picture. PI price needs to break $0.28 to build momentum. That level lines up with the wedge’s upper boundary.

A clean close above $0.28 can open moves to $0.36, and if momentum improves further, even $0.46 becomes possible. But the indicators suggest this is less likely unless CMF improves.

On the downside, $0.21 and $0.20 are the first levels to watch. A drop under $0.20 exposes the $0.18 zone. If Bitcoin suddenly flips bullish, PI’s negative correlation can cause short-term underperformance. That may pull the Pi Coin price toward the lower wedge band.

Pi Coin Price Analysis:

Pi Coin Price Analysis:

The most important line for December is $0.20. Maintaining that level preserves the long-term structure. Losing it brings $0.18, and possibly $0.15, back into view.

Pi Coin still has a chance to close the year stronger than expected. However, that depends entirely on CMF stabilizing and whether the falling wedge finally allows the price to break through $0.28.

There is hope still if Bitcoin weakens and the negative correlation makes Pi Coin more desirable to big money.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Revival of STEM Learning as a Driving Force for Tomorrow’s Technology Investments

- Emerging STEM universities are driving tech innovation through interdisciplinary curricula and industry partnerships, focusing on AI, biotech , and advanced manufacturing. - U.S. programs like STEM Talent Challenge and NSF Future Manufacturing allocate $500K-$25.5M to bridge skills gaps and fund projects in quantum tech and biomanufacturing. - Leadership-focused STEM programs at institutions like Florida State and Purdue boost startup success rates (75-80%) and align with venture capital trends favoring

Assessing KITE’s Price Prospects After Listing as Institutional Interest Rises

- Kite Realty Group (KRG) reported Q3 2025 earnings below forecasts but raised 2025 guidance, citing 5.2% ABR growth and 1.2M sq ft lease additions. - Institutional investors showed mixed activity, with Land & Buildings liquidating a 3.6% stake while others increased holdings, reflecting valuation debates. - Technical indicators suggest bullish momentum (price above 50/200-day averages) but a 23.1% undervaluation vs. 35.1x P/E, exceeding sector averages. - KRG lags peers like Simon Property in dividend yie

Evaluating How the MMT Token TGE Influences Crypto Ecosystems in Developing Markets

- MMT's volatile TGE highlights tokenized assets' dual role as liquidity engines and speculative risks in emerging markets. - Institutional investors allocate up to 5.6% of portfolios to tokenized assets, prioritizing real-world integration and cross-chain utility. - Regulatory fragmentation and smart contract risks demand CORM frameworks to mitigate operational vulnerabilities in DeFi projects. - MMT's deflationary model and institutional backing face macroeconomic challenges, requiring hedging against gl

Trust Wallet Token's Latest Rally and Growing Institutional Interest: Driving Sustainable Value

- Trust Wallet Token (TWT) surged in 2025 due to institutional partnerships, utility upgrades, and real-world asset (RWA) integrations. - Collaborations with Ondo Finance (tokenizing $24B in U.S. Treasury bonds) and Onramper (210M+ global users) expanded TWT's institutional-grade utility. - Governance upgrades, FlexGas payments, and Binance co-founder CZ's endorsement boosted TWT's credibility and institutional appeal. - Analysts project TWT could reach $5.13 by year-end, driven by cross-chain integrations