Bitcoin Miners Face Worst Profitability Crisis in 15-Year History

Bitcoin miners are experiencing their most severe economic downturn in the industry's 15-year history, with hashprice falling from $55 per petahash per second in the third quarter to roughly $35 PH/s. According to Cointelegraph, TheMinerMag characterizes this as a structural low rather than a temporary dip. The deterioration followed Bitcoin's price correction from a record high near $126,000 in October to below $80,000 in November.

New-generation mining machines now require more than 1,000 days to recoup their costs. This timeline poses a growing concern given the next Bitcoin halving is roughly 850 days away. CleanSpark recently repaid its Bitcoin-backed credit line with Coinbase, reflecting the industry's broader shift toward deleveraging and liquidity preservation.

Mining stocks suffered steep losses alongside the price decline. MARA Holdings dropped roughly 50% from its October 15 closing high. CleanSpark declined 37% over the same period, while Riot Platforms fell 32%. HIVE Digital Technologies experienced the steepest decline at 54% from its October peak.

Operational Pressures Force Industry Adaptation

The combination of falling Bitcoin prices, record network difficulty, and low transaction fees has pushed mining profitability to multi-month lows. CoinDesk reported that hashprice dropped to $43.1 PH/s in early November as the network hash rate remained above 1.1 ZH/s.

Miners face mounting pressure as cost-per-hash has emerged as a critical metric. This measurement reveals how efficiently operations convert electricity and capital into computational output. The data exposes a widening gap between average operators and only the most efficient survivors.

Electricity pricing now determines which mining operations remain viable. The current environment has forced miners to extract maximum value from every watt of power consumed. Operations with access to cheap, reliable power maintain advantages over competitors paying higher energy costs.

Strategic Shifts Reshape Mining Landscape

The mining industry is undergoing a transformation driven by operational efficiency rather than Bitcoin price dependence. We reported that the US Bitcoin mining industry generated more than $4.1 billion in gross product annually and supported over 31,000 jobs nationwide, demonstrating the sector's economic impact even during challenging periods.

Miners are now diversifying revenue streams beyond Bitcoin mining. Some operations have pivoted to AI and high-performance computing data center operations to secure more reliable revenue. By locking in longer-term contracts with data companies, miners stabilize cash flow and reduce reliance on volatile Bitcoin market conditions.

Hardware efficiency has become essential for survival. Cointelegraph reports that the latest ASIC models from Bitmain and MicroBT are optimizing energy required per hash. Bitmain's Antminer S21+ delivers 216 TH/s at 16.5 J/TH, while MicroBT's WhatsMiner M66S+ achieves 17 J/TH with immersion cooling.

The 2024 halving reduced block rewards from 6.25 BTC to 3.125 BTC, forcing miners to rethink operations. Hashprice fell from $0.12 in April 2024 to about $0.049 by April 2025. Network difficulty surged to an all-time high of 123T, making it harder for miners to generate returns.

Geographic expansion continues as miners seek favorable regulatory environments and energy costs. Operations in regions with government-backed subsidies and lower electricity rates maintain competitive advantages. The industry's shift toward leaner, more optimized operations means only the most power-efficient miners can thrive in the current environment.

The challenges are complex but addressable through strategic investments in efficiency, hardware upgrades, and diversified revenue models. The next 12 to 18 months will determine which operations successfully navigate this transition and which exit the market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Fed Beige Book Reveals Steady US Growth as Geopolitical Tensions Persist

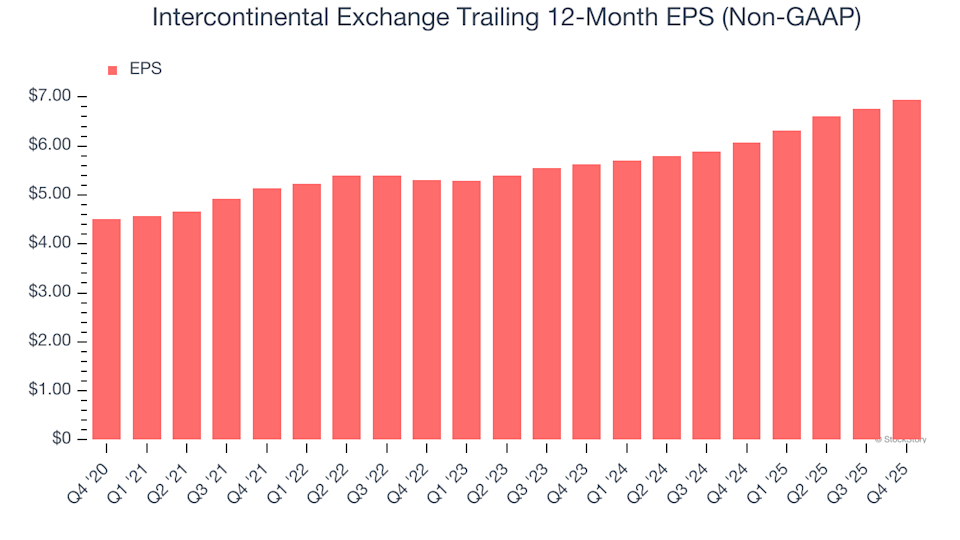

1 Reason ICE carries risk and an alternative stock worth considering

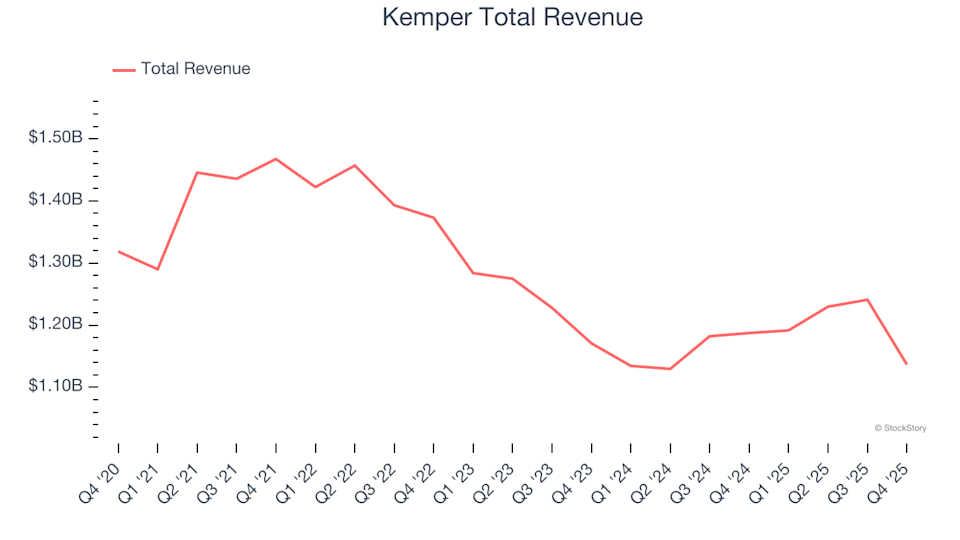

Unveiling Q4 Results: How Kemper (NYSE:KMPR) Compares to Other Multi-Line Insurance Companies

Defense Metals conditionally approved for Canadian infrastructure funding