XRP Staking Arrives with the Launch of Firelight Protocol

The newly launched Firelight Protocol introduces staking rewards for XRP through a novel on-chain economic security primitive designed to protect DeFi assets from exploits. Enabling New Use Cases for XRP XRP, while being one of the largest crypto assets by market cap, does not have any native staking or yield opportunities. Firelight aims to add

The newly launched Firelight Protocol introduces staking rewards for XRP through a novel on-chain economic security primitive designed to protect DeFi assets from exploits.

Enabling New Use Cases for XRP

XRP, while being one of the largest crypto assets by market cap, does not have any native staking or yield opportunities. Firelight aims to add a new layer of value for XRP by providing a staking layer that utilizes the staked XRP for providing on-chain cover. This cover can be contracted by DeFi protocols in order to safeguard asset value in case of hacks and exploits.

Bridging the Gap to Institutional-Grade DeFi

DeFi has just come through one of its strongest growth periods ever, surpassing $170 billion in TVL in October, driven largely by institutional demand. At the same time, more than $1 billion is lost to DeFi exploits every year, and recent high-profile incidents like the Balancer exploit have sharpened concerns around asset safety. In traditional finance, insurance is embedded into every market, but DeFi still largely lacks this critical layer of protection, creating a major bottleneck for the next wave of institutional adoption. Firelight is designed to close this gap by providing robust DeFi cover, and the real, growing demand for this protection will help drive value back to XRP holders.

Security-First Approach

Firelight, incubated by Sentora and backed by Flare, utilizes Flare’s FAssets to bring XRP into the protocol. Unlike many generic bridges, FAssets is fully decentralized, and extensively audited, providing a robust on/off-ramp for XRP into DeFi.

At launch, Firelight has completed three audits—one by OpenZeppelin and one by Coinspect and a bug bounty program supported by Immunifi to help ensure maximum protocol security.

How Firelight Enables XRP to Enter DeFi

Firelight will launch across two phases. In the launch phase, XRP holders can deposit XRP and receive stXRP, a 1:1 fully backed, ERC-20 compliant liquid vault token.

stXRP serves as a transferable receipt for users’ deposits and can be freely used across the Flare DeFi ecosystem, from swapping on DEXs, to serving as collateral in lending protocols, or contributing to liquidity pools. Participants in the launch vault will also be eligible to earn Firelight Points.

In Phase 2, staking will back DeFi cover. ensuring a high-impact use-case with real demand to provide rewards for stakers. This will be the sole purpose of the protocol; capital deployed on Firelight will be allocated to this DeFi cover mechanism.

Backed by Industry Leaders

Sentora, as the technical service provider, and Flare Network, as the protocol enabling the creation of FAssets (e.g., FXRP), are the primary contributors to Firelight. Both organizations are backed by Ripple and share a mission to expand XRP’s role in DeFi. Their combined expertise in secure interoperability, protocol design, and network operations provides Firelight with deep technical support and a clear path for long-term ecosystem growth—so XRP holders and developers can build, secure, and scale real-world applications with confidence.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Plug Power Stock Pauses Ahead Of Q4 Earnings: What Investors Need To Know

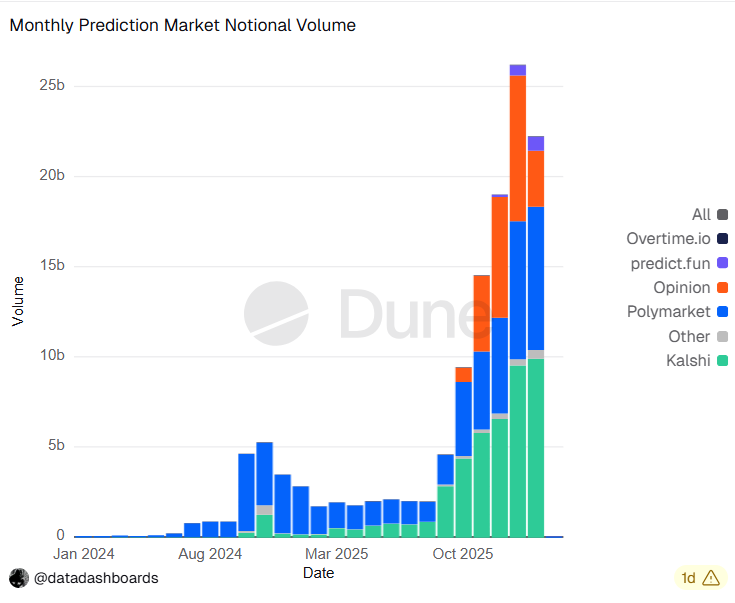

Prediction markets post first monthly volume decrease since August 2025

Polkadot targets tokenonomics reset as DOT remains under pressure

XRP Price About To Enter ‘Face-Melting Phase’, And The Target Is $27