Pepe Coin price pops 14% but signals point to fragile, bearish setup

Pepe Coin rose 14% on mostly retail buying, while whales cut longs and technicals show hidden bearish divergence and a possible head-and-shoulders pattern capping upside.

- PEPE gained about 14% in 24 hours, but large holders and the top 100 wallets did not add to positions, with some outflows suggesting profit-taking.

- Derivatives data show whales and top traders trimming long exposure, while indicators flag hidden bearish divergence and a possible head-and-shoulders pattern.

- Price must hold nearby support and clear resistance roughly 15% higher with stronger volume to confirm a reversal; otherwise, downside continuation remains likely.

Pepe Coin price increased approximately 14% in the past 24 hours, marking one of the stronger performances among memecoins during the trading session, according to market data. The token remains significantly lower for the month and the past three months, placing the recent gain within a broader downward trend.

The price increase occurred without corresponding support from large holders, spot data indicated. Whale wallets and the top 100 addresses did not increase their PEPE ( PEP ) holdings over the 24-hour period, while institutional investor groups remained inactive during the price movement, suggesting limited conviction in the rally.

PEPE Coin price shows diverging pattern

Exchange outflow data showed most buying activity originated from smaller retail wallets, according to on-chain metrics. The pattern indicates the price rise lacked substantial backing from major holders, with outflows potentially reflecting sales by top PEPE holders during the price strength.

Derivatives market data pointed to cautious positioning among large traders. Cryptocurrency whales reduced long positions, while top traders substantially cut long exposure during the price advance. Smart-money traders, while maintaining a net bearish stance, showed a slight shift toward long positions, the data showed.

Technical analysis identified a hidden bearish divergence between late November and early December, with price forming a lower high while the Relative Strength Index formed a higher high. This pattern typically indicates potential continuation of a downtrend following short-term gains, according to technical analysts.

The token must maintain levels above nearby support to demonstrate stability, market observers noted. A confirmed trend reversal would require breaking through resistance approximately 15% above current price levels. A decline below nearby support would bring the next major support level into focus, potentially erasing recent gains.

Some market analysts have identified a potential head-and-shoulders pattern formation, though confirmation would require increased trading volume. Current volume levels have not confirmed a trend reversal, according to chart analysis. The recent rally may represent the right shoulder of a bearish pattern, consistent with the lower high observed in price action.

Trading volume must increase substantially to validate any trend change, technical data indicated. The divergence between the price advance and activity from large holders, top traders, and momentum indicators suggests the rally faces sustainability challenges without broader market support.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto Market Today: Bitcoin and Ethereum Pump After Jane Street Lawsuit

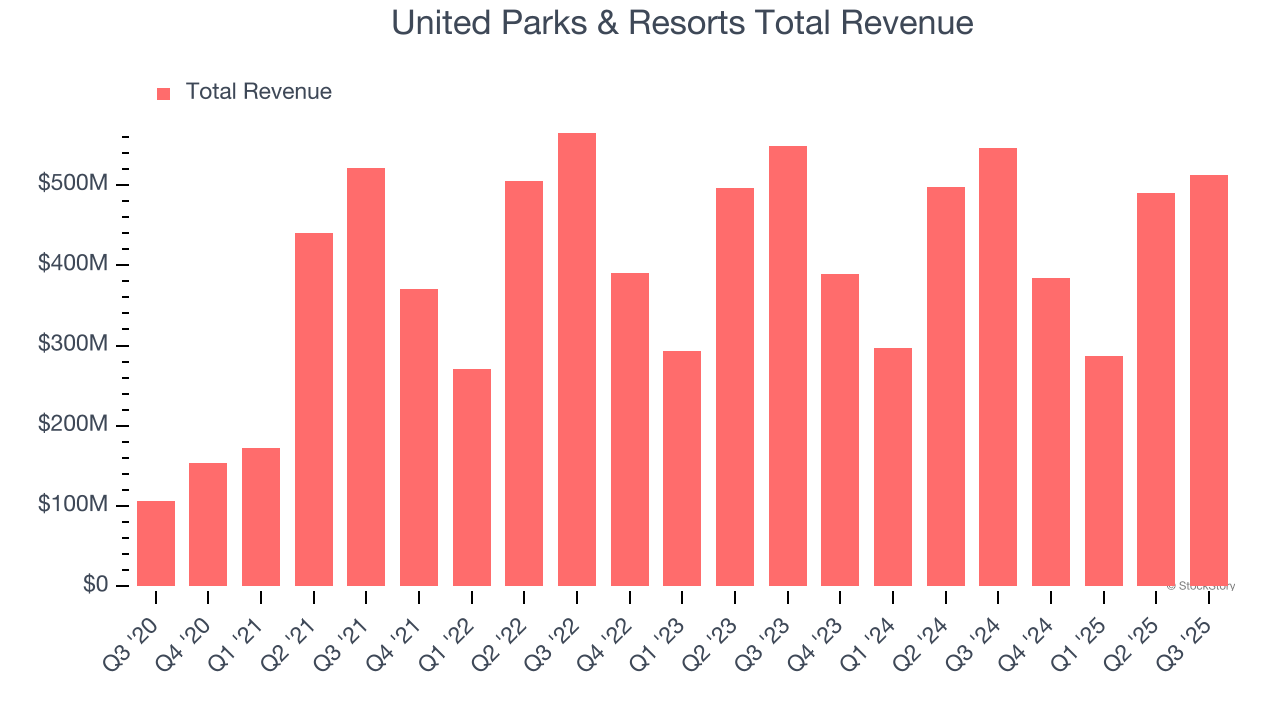

United Parks & Resorts (PRKS) Reports Earnings Tomorrow: What To Expect

Zscaler (ZS) Reports Earnings Tomorrow: What To Expect

Earnings To Watch: J. M. Smucker (SJM) Reports Q4 Results Tomorrow