Aerodrome Finance has shown remarkable performance during intermittent rise periods this year. Short-term investors have taken advantage of AERO’s volatility throughout the year, and today Robinhood announced the coin’s listing.

The Latest on AERO Coin

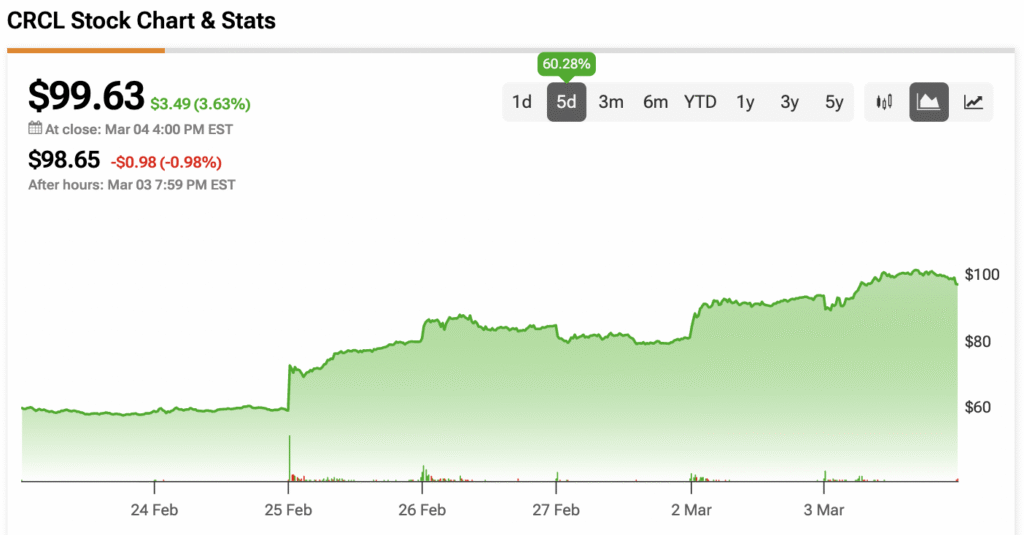

Launched on the BASE network by the Coinbase exchange, Aerodrome Finance (AERO) has experienced significant gains throughout the year. As a decentralized exchange (DEX) and automated market maker (AMM), it has greatly benefited from the BASE network’s rise, being listed by numerous exchanges this year. Following the Robinhood announcement, AERO saw an increase of nearly 4% as it began its rise from the bottom, a move seen as very supportive.

Currently, as a significant cornerstone of the BASE ecosystem, AERO is strongly supported by Coinbase. If it can surpass the $0.740 resistance level, it might again target $0.9166. Although this announcement alone may not lead to double-digit gains in the short term due to its existing listings, a scenario where BTC surpasses $94,000 could facilitate a positive separation.

According to a survey published at the time of writing, 89 of 108 economists anticipate a 25 basis point rate cut in the December 10 meeting. 50 out of 100 economists expect interest rates to be within the 3.25% to 3.5% range during the first three months of 2026.

The prominent positioning of Aerodrome Finance within the crypto market this year has been a focal point for investors. As its visibility on different trading platforms expands, so does the enthusiasm surrounding its potential growth. This development marks a definitive step for Aerodrome Finance as it continues to navigate the dynamic landscape of cryptocurrency trading.

The listing by Robinhood is anticipated to further elevate AERO’s market presence and allure new investors. The current market buzz and economic sentiments seem to favor Aerodrome Finance’s trajectory as it aims for new resistances, driven by both the recent announcements and broader market momentum.