Portal to Bitcoin Raises $25M for Cross-Chain Platform

- Portal to Bitcoin secures $25M investment led by JTSA Global.

- Launches atomic cross-chain trading platform.

- Enhances Bitcoin native interoperability efforts.

Portal to Bitcoin raised $25 million, led by JTSA Global, with limited publicly available data beyond this headline. The protocol facilitates Bitcoin-native interoperability using atomic swap mechanisms but lacks detailed official commentary or technical architecture in non-news sources.

Portal to Bitcoin announced a $25 million funding round led by JTSA Global, introducing an “atomic OTC” cross-chain trading platform.

The investment marks a significant step for Bitcoin’s cross-chain integration, with immediate market interest. Portal to Bitcoin’s new platform aims to enhance native BTC trading across chains.

Funding and Platform Launch

Portal to Bitcoin has raised $25 million to launch its new platform , enhancing Bitcoin interoperability through cross-chain technology. This move is viewed as a pivotal advancement in decentralized finance.

The initiative involves JTSA Global, leading the funding round. The focus is on Bitcoin and other assets, with a push towards cross-chain settlement using atomic swap methods.

Immediate effects on market sectors and token liquidity highlight the significance of this development. It is expected to optimize trading and integration within the broader cryptocurrency ecosystem.

The financial boost is likely aiming at pivotal changes in trading mechanisms across chains. Such innovations may influence regulatory perspectives, impacting market policies globally.

In summary, the new platform by Portal to Bitcoin could revolutionize cross-chain capabilities, promoting efficient and secure decentralized trading methods for cryptocurrencies worldwide.

“We are excited to lead this funding round for Portal to Bitcoin as it aligns with our vision of enhancing cross-chain interoperability.” – JTSA Global, Lead Investor

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

A whale has double shorted LIT and is currently unrealized profit of $1.36 million

HSC Hack Seasons Conference Cannes Unites Institutional Capital and Web3 Leaders to the French Riviera

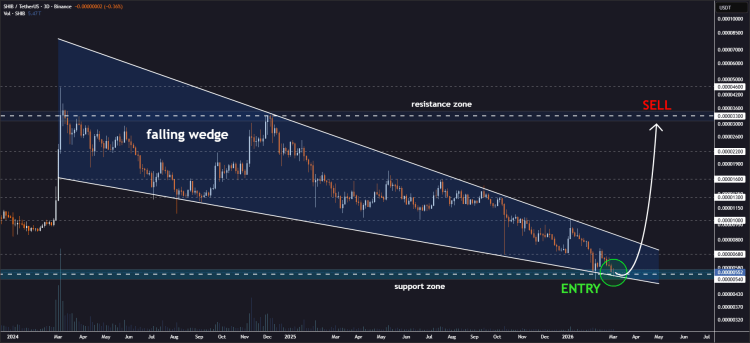

Analyst Shares The Best Time To Buy Shiba Inu, And The Best Time To Sell

Bitcoin faces risk as Hyperliquid long nears liquidation