JPMorgan Chase Calls for S&P 500 Rally Into 2026, Unveils Highest-Conviction Sectors

Banking titan JPMorgan Chase says the S&P 500 will rally into next year, driven by high-conviction sectors such as financials and blue-chip tech.

In a new podcast, Andrew Tyler, the bank’s global head of market intelligence, says that investors should expect a surge for the S&P 500 heading into 2026 as large tech firms continue to separate themselves from the pack.

“So we are tactically bullish and we look for markets to rally into early 2026. So, we think that the tech sector continues to outperform, but we also think that there’s going to be a broadening of this rally as we’ve seen the non-tech portions of the stock market look attractive.

And when you look at the differential between the largest tech companies and the rest of the S&P 500, the earnings growth differential continues to narrow, which has typically been an indicator that it’s time to see the rally broaden from here.”

Tyler goes on to note the sectors the bank believes will perform well, including mega cap tech firms, artificial intelligence (AI), banks, materials, financials, energy and other related industries.

“We really like the idea of a barbell trade, and taking some of your assets and splitting them almost evenly between a couple of things. So first would be mega cap tech and the AI theme. And the other part of this, to take advantage of the reboot in economic growth, it’s going to be cyclicals.

Sectors that include banks, financials, materials, energy to a certain extent, but it’s also to some of the consumer related sectors and subsectors, such as retailers, airlines or transports more generally.”

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

How iRobot Strayed from Its Original Path

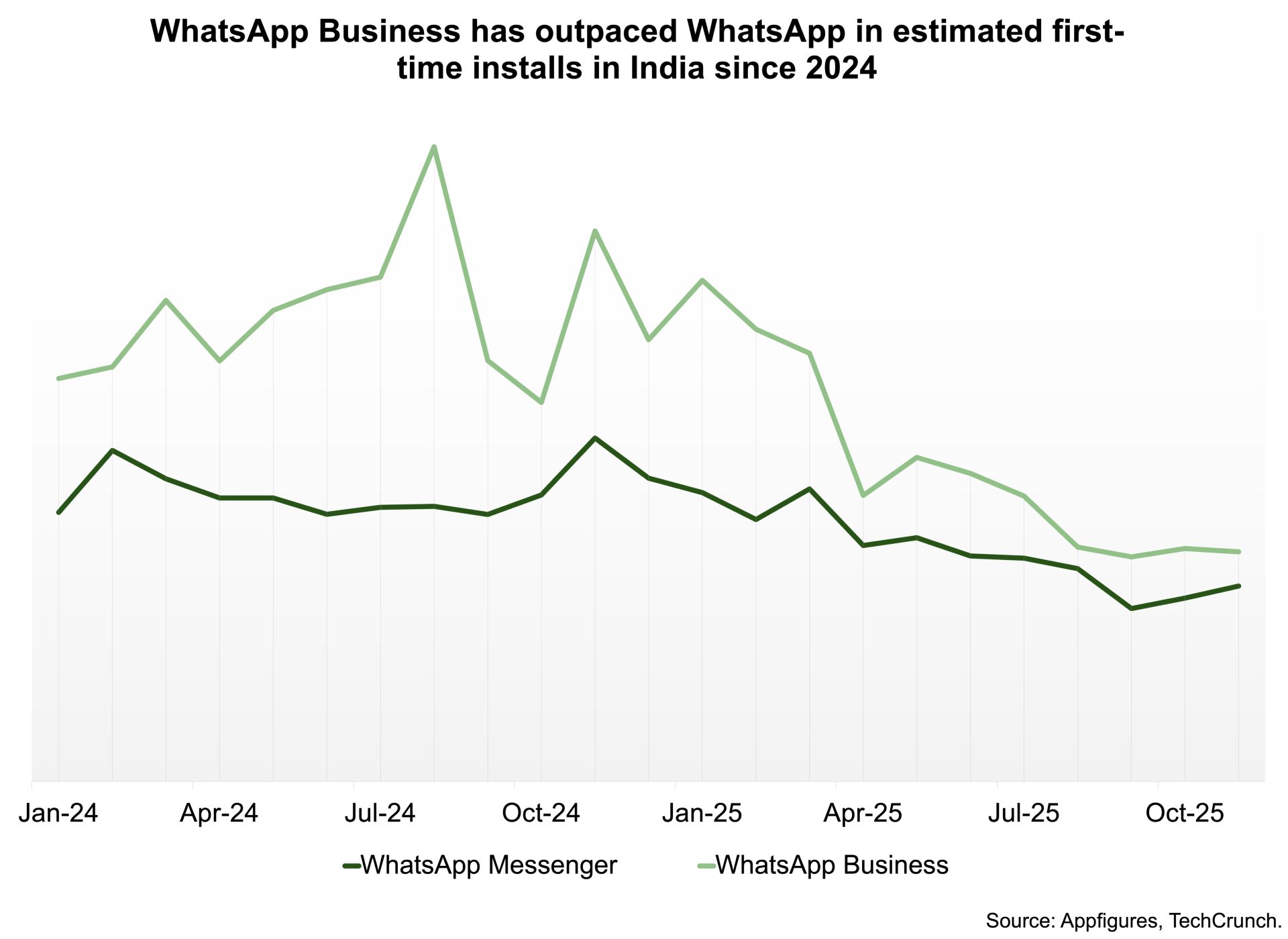

WhatsApp’s largest user base is now presenting its greatest challenge

Assessing Bitcoin’s Price Movement in Light of Macroeconomic Changes and Positive ETF Sentiment in November 2025

- Bitcoin faces macroeconomic headwinds in 2025, with Fed tightening causing a 15% crypto market cap drop, but ETF approvals drove 45% growth in institutional Bitcoin ETF AUM to $103B. - Institutional investors navigate $81k-$91k Bitcoin consolidation, balancing Fed policy risks against 68% adoption rates and regulatory clarity from EU MiCA and U.S. GENIUS Act. - Strategic entry strategies include core positions at $85k-$87k support, hedging with stablecoins/altcoins, and timing Fed rate cut expectations t

Moonbirds to launch BIRB token in early Q1 2026