Will Solana’s Price Trajectory Be Defined By Losses?

Solana is in a critical phase as its recent decline continues to validate a channel pattern that has shaped its price action over the past week. The downward movement highlights growing uncertainty, with investors now playing a key role in determining whether SOL continues slipping or finds support for a reversal. Solana Investors Remain Bearish

Solana is in a critical phase as its recent decline continues to validate a channel pattern that has shaped its price action over the past week.

The downward movement highlights growing uncertainty, with investors now playing a key role in determining whether SOL continues slipping or finds support for a reversal.

Solana Investors Remain Bearish

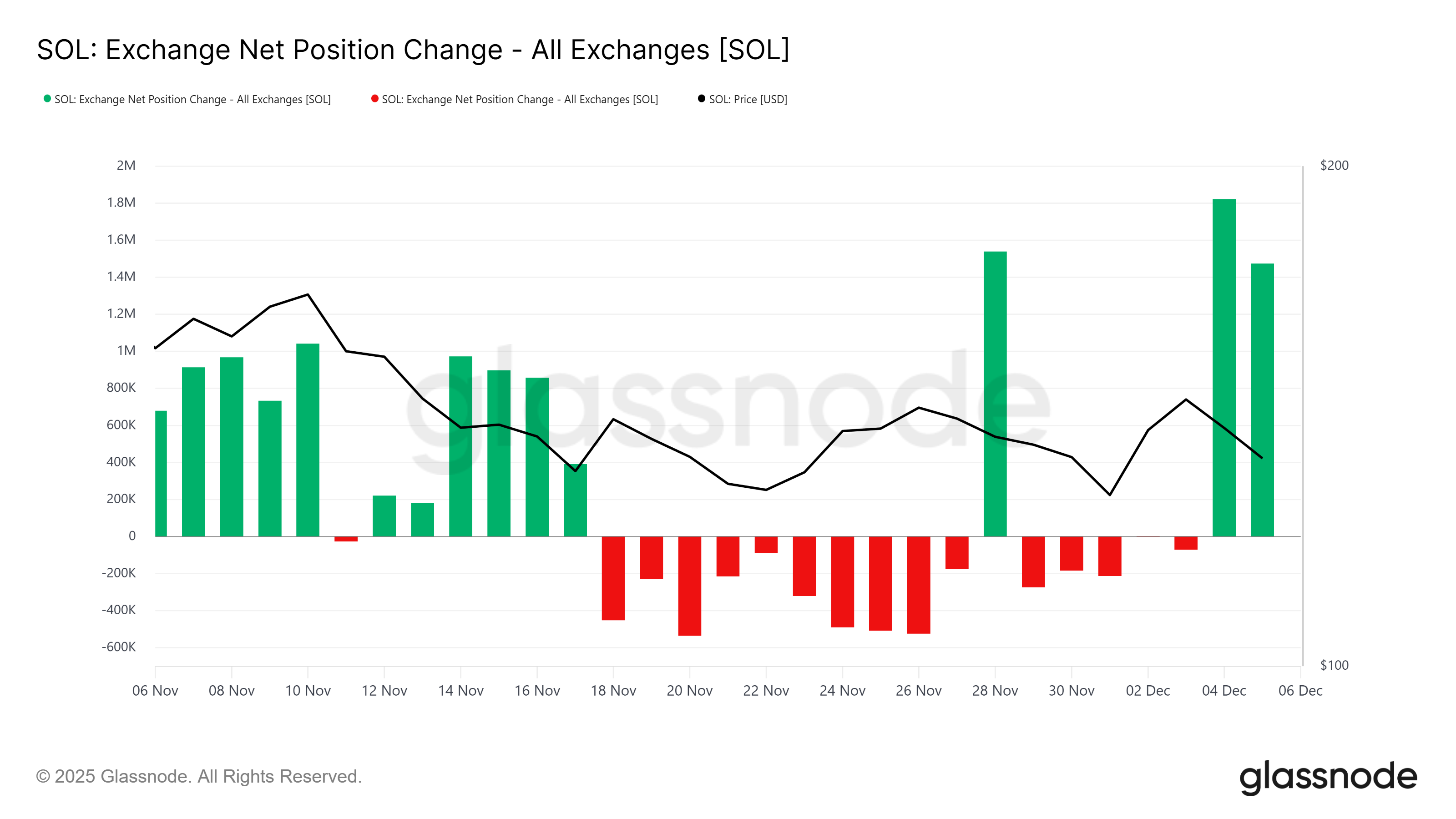

The exchange net position change reflects conflicting signals from Solana holders. Throughout the past week, SOL wallets have oscillated between accumulation and distribution, creating an unstable backdrop.

Notably, the last 48 hours recorded a dominance of green bars, indicating heavier outflows from exchanges.

Such inconsistent behavior points to uncertainty among holders rather than strong conviction. The repeated switches between buying and selling reflect a market struggling to find direction.

With selling currently outweighing accumulation, Solana’s short-term outlook remains vulnerable.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

Solana Exchange Net Position. Source:

Glassnode

Solana Exchange Net Position. Source:

Glassnode

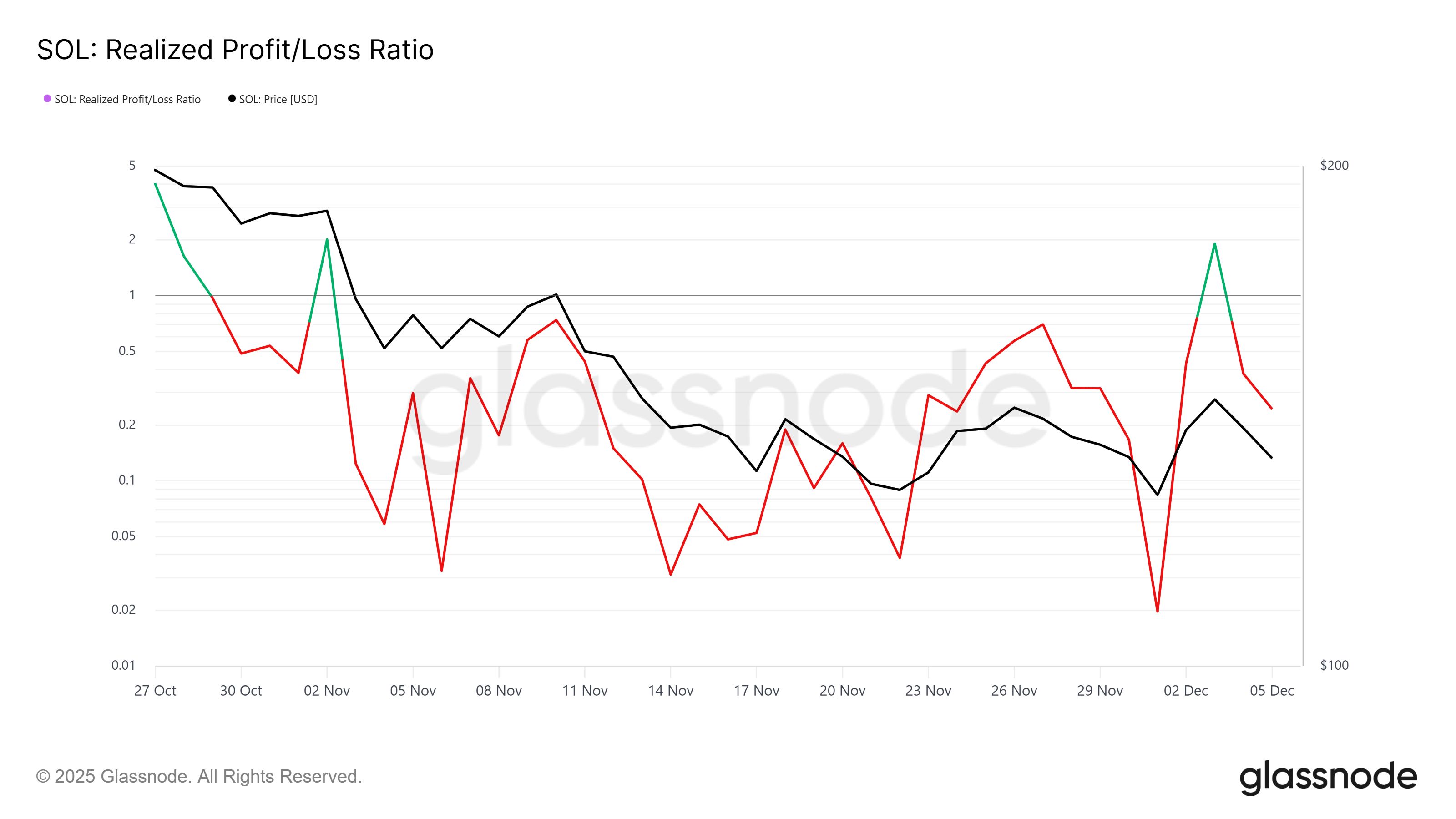

The Realized Profit/Loss Ratio further reinforces this bearish sentiment. The indicator shows that losses are dominating Solana as holders increasingly sell at lower prices to avoid deeper drawdowns. Panic-driven exits, even on a smaller scale, point to fading confidence.

When losses dominate, price tends to face additional downward pressure unless broader sentiment shifts. At present, the macro environment suggests investors are bracing for potential declines rather than preparing for accumulation.

Solana Realized Profit/Loss. Source:

Glassnode

Solana Realized Profit/Loss. Source:

Glassnode

SOL Price Needs To Find Direction

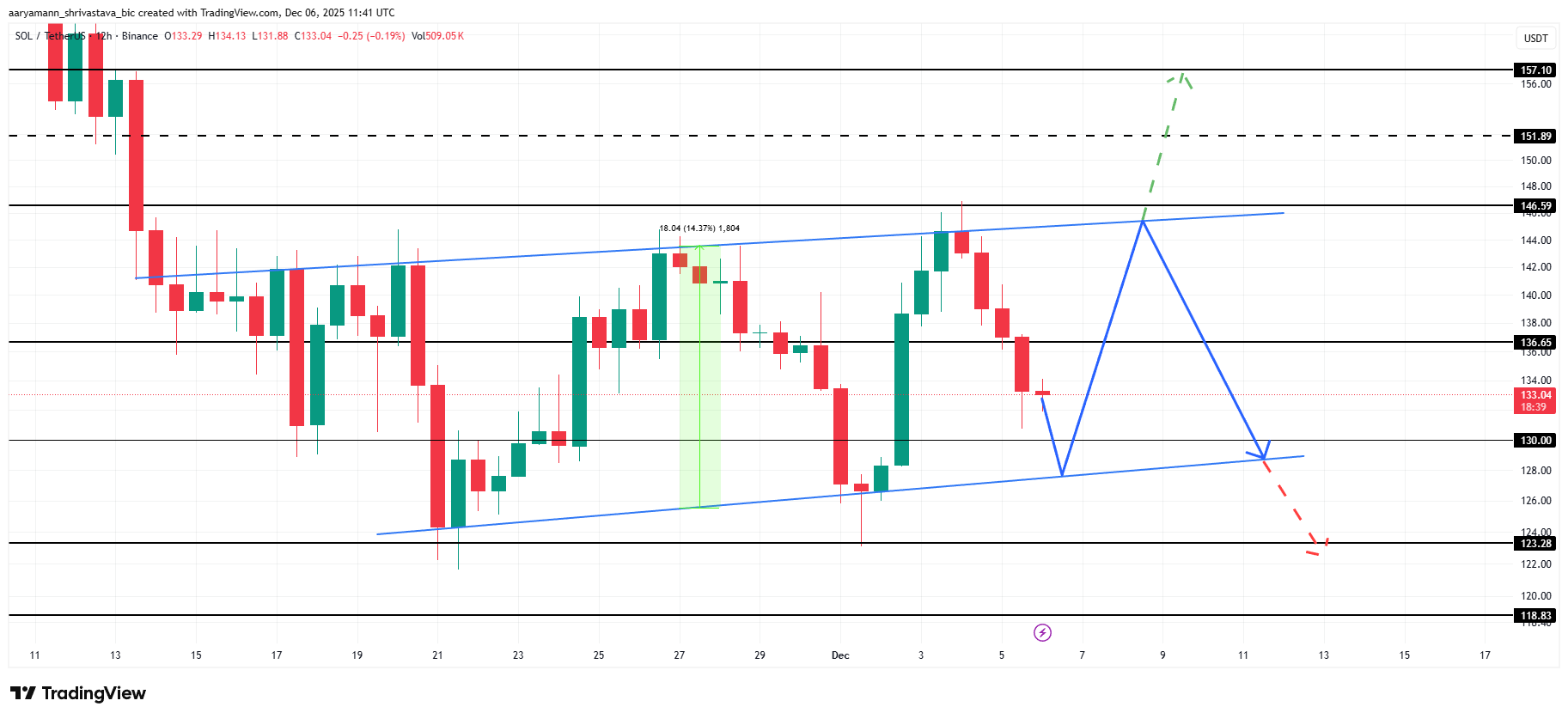

Solana’s price continues to trend within a descending channel after failing to break past the $146 resistance earlier this week. This structure leaves two potential paths depending on upcoming market cues and investor behavior.

If the channel remains intact and bearish sentiment persists, SOL risks falling below the lower trend line. Such a breakdown could drag the price toward $123 or even $118 if selling pressure continues to build.

Solana Price Analysis. Source:

TradingView

Solana Price Analysis. Source:

TradingView

Alternatively, a successful bounce off the channel support could spark a recovery attempt. If SOL regains strength and challenges the $146 resistance once more, a breakout could push the price toward $151 and eventually $157.

However, this outcome requires a renewed shift to bullish market conditions to invalidate the current bearish thesis.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The PENGU USDT Sell Alert: Is This a Turning Point for Stablecoin Approaches?

- PENGU/USDT's 2025 collapse triggered a $128M liquidity shortfall, exposing algorithmic stablecoin fragility and accelerating market shift to regulated alternatives. - USDC's market cap surged to $77.6B by 2025, while MiCA-compliant euro-stablecoins gained $680M in cross-border adoption amid regulatory clarity. - DeFi protocols adopted oracle validation and reserve-backed models post-PENGU, reducing exploit losses by 90% since 2020 through institutional-grade security upgrades. - Regulators now prioritize

Emerging Prospects in EdTech and AI-Powered Learning Systems: Ways Educational Institutions Are Transforming Programs and Enhancing Student Achievement

- AI is transforming education by reshaping curricula, enhancing student engagement, and optimizing institutional efficiency. - Universities like Florida and ASU integrate AI literacy across disciplines, offering microcredentials and fostering innovation. - AI tools like Georgia Tech’s Jill Watson and Sydney’s Smart Sparrow boost performance and engagement through personalized learning. - AI streamlines administrative tasks but faces challenges like ethical misuse and skill gaps, requiring structured train

Anthropological Perspectives on Technology and Their Impact on Education and Workforce Preparedness for the Future

- Interdisciplinary STEM/STEAM education integrates technology tools like AI and VR to bridge theory and real-world skills, driven by $163B global edtech growth. - U.S. faces 411,500 STEM teacher shortages and 28% female workforce representation gaps, prompting equity-focused programs like Girls Who Code. - STEM occupations earn $103K median wages (vs. $48K non-STEM), with 10.4% job growth projected through 2033, driving investor opportunities in edtech and workforce alignment. - Strategic investments in t

The Revival of Educational Technology in Higher Education After the Pandemic

- Global EdTech market grows to $7.3T by 2025, driven by hybrid learning and AI/AR/VR adoption in higher education. - Institutions like MIT and Harvard integrate AI across disciplines, boosting enrollment and workforce alignment through $350M-$500M investments. - EdTech platforms enabling personalized learning and immersive experiences see rising demand, with 45% annual growth in AI-related programs since 2020. - Undervalued EdTech stocks offer investment opportunities as $16B+ VC funding accelerates innov