Top 6 Altcoins with Important Events Worth Noting This Week: SOL, BTC, ASTER, LUNA, TAO, AVAX

The crypto market faces a pivotal week between December 8 and 13, 2025, as six major events converge to impact prices and sentiment. With multiple critical events condensed into a few days, the interplay of macroeconomic policy, technology milestones, legal proceedings, and regulatory action creates a unique dynamic. Together, these forces are likely to influence

The crypto market faces a pivotal week between December 8 and 13, 2025, as six major events converge to impact prices and sentiment. With multiple critical events condensed into a few days, the interplay of macroeconomic policy, technology milestones, legal proceedings, and regulatory action creates a unique dynamic.

Together, these forces are likely to influence altcoin valuations and shape investor confidence across the sector.

FOMC Interest Rate Decision Sets the Tone for Bitcoin

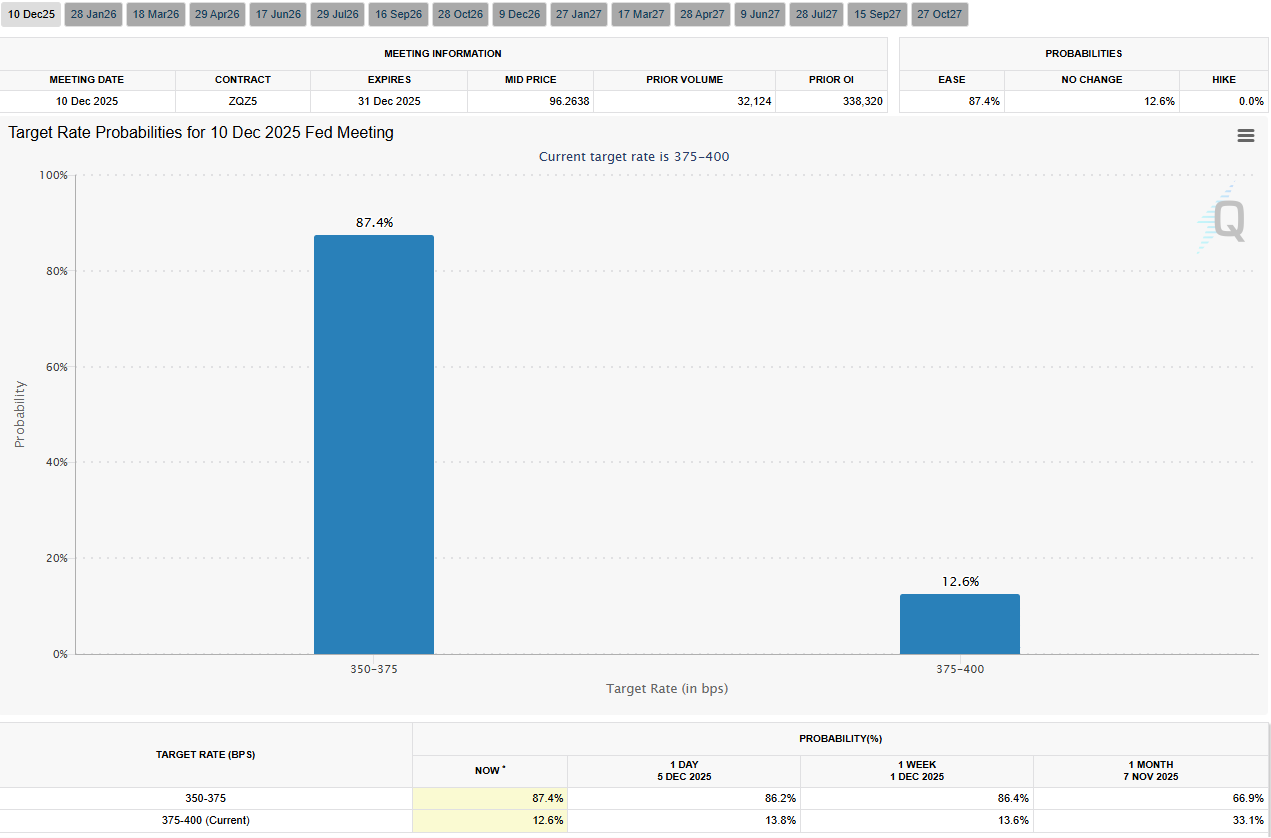

The Federal Open Market Committee (FOMC) will reveal its interest rate decision on Wednesday, December 10, 2025, at 2:00 p.m. ET. According to the CME FedWatch tool, there is an 87.4% chance of a rate cut, a 12.6% probability of no change, and no expectation of an increase.

Interest Rate Cut Probabilities. Source:

CME FedWatch Tool

Interest Rate Cut Probabilities. Source:

CME FedWatch Tool

Markets anticipate easier financial conditions, which could boost risk assets like Bitcoin. However, the greatest market movement is expected from Fed Chair Jerome Powell’s 2:30 p.m. ET press conference, which will provide key guidance for future monetary policy.

I’m okay with a little fear before FOMC, even a sweep down toward the $BTC 87k area. If that happens and price snaps back quickly, that’s strength, not weakness.For me it’s clear levels only: Lose 86k and this idea fails, with risk of a deeper move toward 80k. Reclaim and hold… pic.twitter.com/vins0z3wn8

— Ak47♛ (@HolaItsAk47) December 7, 2025

Solana Breakpoint Conference

The flagship Solana Breakpoint Conference begins December 11 at the Etihad Arena, Abu Dhabi. Organizers say this will be the largest Breakpoint yet, running through December 13.

The event overlaps with Abu Dhabi Finance Week and the Formula 1 Grand Prix, placing Solana at the center of financial and technological attention.

Panels will focus on institutional adoption, with sessions on staking infrastructure for Solana ETFs and network security.

Breakout events like MEV Day, Block Zero, and Colosseum Breakpoint Arena will cover blockchain scaling and decentralized applications. Registration prices range from $100 for students to $700 for late-bird admission, keeping the event accessible to a broad audience.

Solana Breakpoint 2025… we’re landing. ✈️🔥 The Super Phoenix Sports team will be there everyday; racing, building, and hanging with the community. Who else is pulling up? pic.twitter.com/z9MVpsz1Pk

— SUPER PHOENIX SPORTS (@SuperPhoenixSPS) December 8, 2025

Industry leaders and institutional investors will meet to discuss how to generate revenue within the Solana ecosystem.

The conference’s emphasis on strong infrastructure signals Solana’s increasing appeal for traditional finance participants seeking blockchain exposure.

0/ It's Breakpoint week! Me and the entire MCC team will be around. Say hi!Going into Breakpoint, I wanted to share some thoughts on what I think was the most important development in Solana in the last 12 months.

— Kyle Samani (@KyleSamani) December 7, 2025

Announcements made during the event could influence the Solana price, which traded for $138.49 as of this writing.

Solana (SOL) Price Performance. Source:

BeInCrypto

Solana (SOL) Price Performance. Source:

BeInCrypto

Do Kwon Sentencing and Implications for Terra

Terraform Labs founder Do Kwon will be sentenced on December 11, 2025, before Judge Engelmayer in the Southern District of New York.

Kwon pleaded guilty in August 2025 to conspiracy to commit commodities fraud, securities fraud, and wire fraud following the May 2022 collapse of the Terra blockchain, which included LUNA and UST stablecoin.

This collapse wiped out around $40 billion in market value and led to a broad crypto downturn, drawing more scrutiny to algorithmic stablecoins.

Kwon faces a possible maximum of 25 years in prison, though the final sentence will depend on various factors, such as cooperation and victim impact statements.

This sentencing is a key moment for accountability in crypto. It may shape global regulatory attitudes toward stablecoins and algorithmic projects.

Do Kwon's plea for clemency in sentencing gets off to a pitch-perfect start: he takes responsibility for the failure of the system.But he says nothing about the well-documented active fraud, including fake Chai txs, for which he remains to be tried in Korea.#dokwon #luna pic.twitter.com/8x72YJCZsw

— David Z. Morris (@davidzmorris) December 5, 2025

Many in the industry see this as a potential precedent for how authorities will pursue future crypto fraud, which may influence confidence in emerging projects.

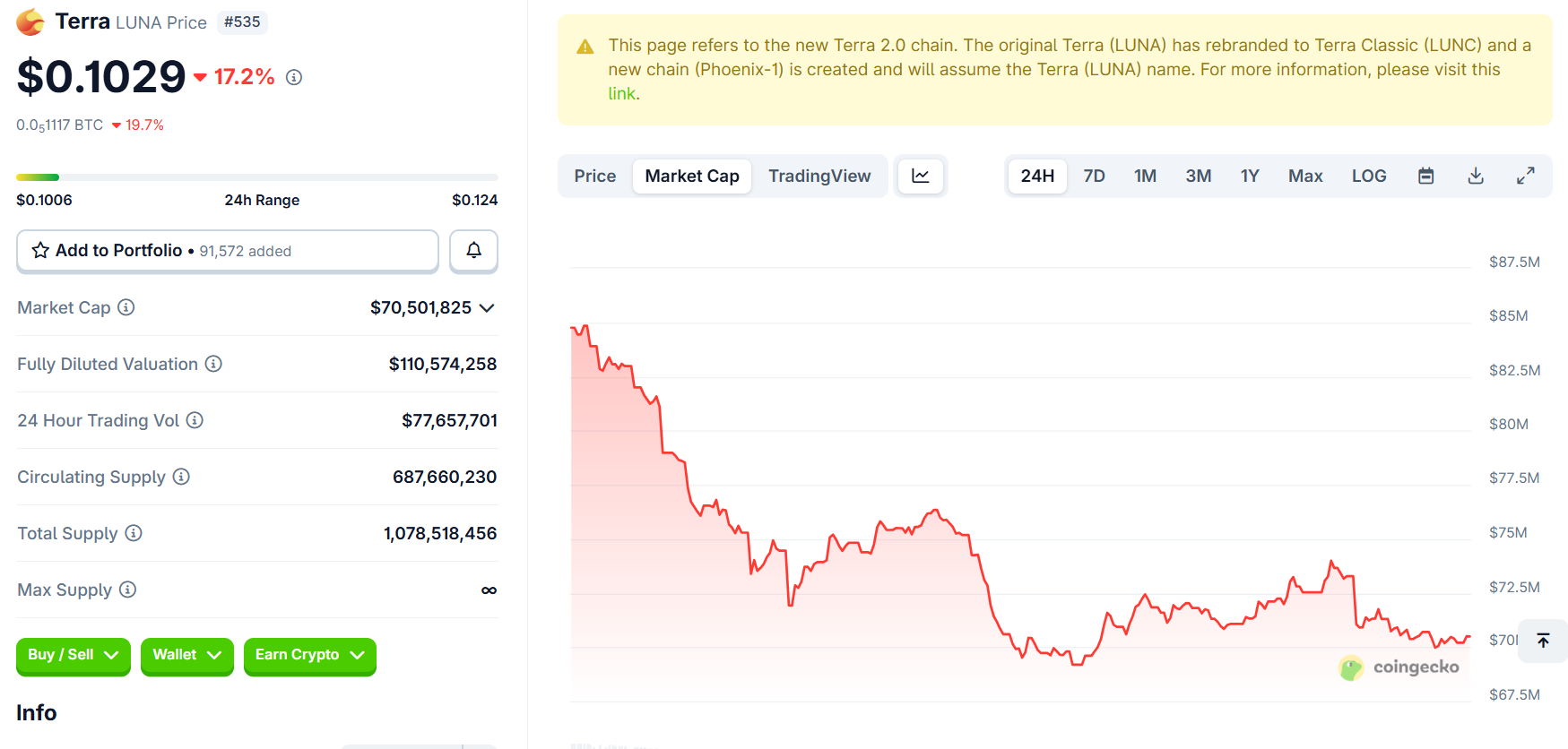

Nonetheless, developments at the court could sway sentiment for the LUNA price, which is down by almost 20% in the last 24 hours.

Terra (LUNA) Price Performance. Source:

Coingecko

Terra (LUNA) Price Performance. Source:

Coingecko

Aster Accelerates Buyback Program to Support Token

Aster will begin an accelerated Stage 4 buyback program on December 8, 2025, purchasing about $4 million in tokens each day for up to 10 days. The aim is to reduce volatility and support token holders through strategic liquidity management.

Aster’s accelerated buyback program details (Source: mehulcrypto)

Aster’s accelerated buyback program details (Source: mehulcrypto)

This approach front-loads liquidity to address concerns and shows Aster’s commitment to token economics. By concentrating purchases within a short window, the project aims to create upward price pressure and absorb excess selling.

The program is transparent, with set timelines and daily targets, contrasting with less structured methods used by other projects.

[Important Update] Stage 4 Buyback Accelerated to ~$4M DailyTo maximize support for $ASTER holders, we're increasing Stage 4 buyback execution speed within the existing framework.Accelerated buyback rate: ~$4M/day (from ~$3M/day)Effective Date: Dec 8This acceleration…

— Aster (@Aster_DEX) December 8, 2025

In token markets, buybacks can reduce supply, signal confidence, and align team incentives with holders. Aster’s aggressive schedule suggests urgency about market conditions or future announcements.

Bittensor’s TAO Halving

Bittensor’s first TAO halving will occur between December 12 and 15, 2025, depending on block timing. Daily token emissions drop from about 7,200 TAO to 3,600 TAO, copying Bitcoin’s fixed-supply model.

Since nearly half of the 21 million tokens are already in circulation, this marks a vital milestone for the AI-focused blockchain.

🚨 UPDATE: Const (co-founder of Bittensor), about the upcoming $TAO halving. pic.twitter.com/6uU31Q1KXm

— The TAO Daily (@taodaily_io) December 7, 2025

Grayscale Research notes the halving could increase scarcity and fuel price speculation as the network attracts developers building AI applications. The halving mechanism ensures predictable supply and rewards long-term validators.

Avalanche ETF Decision

Meanwhile, December 12 is the next deadline for US regulators to decide on an Avalanche ETF. The SEC has delayed decisions on applications from VanEck and Grayscale since mid-2025.

Approval could unlock institutional access to AVAX, while further delays may strengthen Bitcoin and Ethereum’s lead among regulated crypto products.

BITWISE FILES $AVAX ETF WITH STAKING YIELDS Bitwise is updating its Avalanche ETF (ticker: $BAVA ) to become the first U.S. crypto fund offering staking yields. Key points: – Stake up to 70% of $AVAX holdings to generate rewards for investors. – Lowest-cost fund in the… pic.twitter.com/K3VvbbpvK8

— CryptosRus (@CryptosR_Us) November 30, 2025

The SEC’s response will signal attitudes toward investment products for blockchains beyond Bitcoin and Ethereum. Approval may lead to more ETF filings, while further delays could reinforce the dominance of existing regulated assets.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Revival of STEM Learning as a Driving Force for Tomorrow’s Technology Investments

- Emerging STEM universities are driving tech innovation through interdisciplinary curricula and industry partnerships, focusing on AI, biotech , and advanced manufacturing. - U.S. programs like STEM Talent Challenge and NSF Future Manufacturing allocate $500K-$25.5M to bridge skills gaps and fund projects in quantum tech and biomanufacturing. - Leadership-focused STEM programs at institutions like Florida State and Purdue boost startup success rates (75-80%) and align with venture capital trends favoring

Assessing KITE’s Price Prospects After Listing as Institutional Interest Rises

- Kite Realty Group (KRG) reported Q3 2025 earnings below forecasts but raised 2025 guidance, citing 5.2% ABR growth and 1.2M sq ft lease additions. - Institutional investors showed mixed activity, with Land & Buildings liquidating a 3.6% stake while others increased holdings, reflecting valuation debates. - Technical indicators suggest bullish momentum (price above 50/200-day averages) but a 23.1% undervaluation vs. 35.1x P/E, exceeding sector averages. - KRG lags peers like Simon Property in dividend yie

Evaluating How the MMT Token TGE Influences Crypto Ecosystems in Developing Markets

- MMT's volatile TGE highlights tokenized assets' dual role as liquidity engines and speculative risks in emerging markets. - Institutional investors allocate up to 5.6% of portfolios to tokenized assets, prioritizing real-world integration and cross-chain utility. - Regulatory fragmentation and smart contract risks demand CORM frameworks to mitigate operational vulnerabilities in DeFi projects. - MMT's deflationary model and institutional backing face macroeconomic challenges, requiring hedging against gl

Trust Wallet Token's Latest Rally and Growing Institutional Interest: Driving Sustainable Value

- Trust Wallet Token (TWT) surged in 2025 due to institutional partnerships, utility upgrades, and real-world asset (RWA) integrations. - Collaborations with Ondo Finance (tokenizing $24B in U.S. Treasury bonds) and Onramper (210M+ global users) expanded TWT's institutional-grade utility. - Governance upgrades, FlexGas payments, and Binance co-founder CZ's endorsement boosted TWT's credibility and institutional appeal. - Analysts project TWT could reach $5.13 by year-end, driven by cross-chain integrations