CFTC Greenlights Bitcoin, Ether as Derivatives Collateral in Landmark Pilot Program

The US Commodity Futures Trading Commission (CFTC) launched a digital assets pilot program on December 8, permitting bitcoin, ether, and USDC as margin collateral in derivatives markets—a move industry leaders are calling a watershed moment for crypto adoption. Acting Chairman Caroline D. Pham announced the initiative alongside new guidance on tokenized collateral and the withdrawal

The US Commodity Futures Trading Commission (CFTC) launched a digital assets pilot program on December 8, permitting bitcoin, ether, and USDC as margin collateral in derivatives markets—a move industry leaders are calling a watershed moment for crypto adoption.

Acting Chairman Caroline D. Pham announced the initiative alongside new guidance on tokenized collateral and the withdrawal of Staff Advisory 20-34, a 2020 directive that had restricted the use of virtual currency in segregated accounts.

Pilot Program Sets Three-Month Trial With Strict Reporting and Risk Standards

The announcement follows the passage of the GENIUS Act, which establishes a federal framework for payment stablecoins. The law requires 1:1 reserve backing and restricts issuance to approved entities.

The pilot establishes a framework for Futures Commission Merchants (FCMs) to accept non-securities digital assets as customer margin collateral. During the initial three-month phase, eligible assets are limited to BTC, ETH, and USDC. FCMs must submit weekly reports and notify regulators of any significant issues. FCMs clearing at multiple derivatives clearing organizations must apply the most conservative haircut percentage across all DCOs.

“Under my leadership this year, the CFTC has led the way forward into America’s Golden Age of Innovation and Crypto,” Pham stated. “Americans deserve safe US markets as an alternative to offshore platforms.”

The CFTC also issued guidance enabling tokenized real-world assets—including US Treasury securities and money market funds—as collateral under existing regulatory frameworks.

Industry response was swift. Coinbase Chief Policy Officer Faryar Shirzad noted, “Congress passed the GENIUS Act on a bipartisan basis to set the stage for stablecoins to become a critical settlement instrument in our financial system of the future.”

Crypto.com CEO Kris Marszalek highlighted practical implications: “This means 24/7 trading is a reality in the United States.”

Regulatory Clarity Could Shift Institutional Capital From Offshore Venues to US Markets

The framework unlocks significant capital efficiency gains. Traditional margin requirements force participants to hold cash or low-yield securities; digital asset collateral allows traders to maintain crypto exposure while meeting margin obligations.

However, implementation will be gradual. FCMs must build custody infrastructure, establish valuation procedures for 24/7 markets, and train staff. The industry will monitor the rollout closely in the coming months.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Fed clarifies capital rules for tokenized securities, says framework is ‘technology neutral’

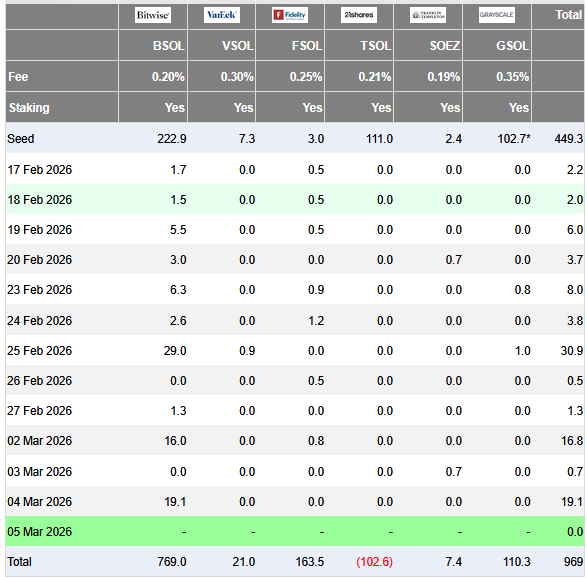

Solana & Ripple ETFs Pull In Fresh Inflows, But Crypto’s Rally Narrows

A.k.a. Brands: Fourth Quarter Financial Highlights

Perú frena exportación de gas natural debido a crisis energética, dice ministro