XRP’s Breakout Faces Hurdles From $143 Million Whale Sell-Off

XRP price has fallen almost 10% over the past month despite a slight 1.5% gain this week. The price remains locked inside a $2.31–$1.98 range, failing to secure any meaningful breakout. This tension reflects a split in market behavior: whales are selling into strength while key holder groups continue accumulating. The push and pull between

XRP price has fallen almost 10% over the past month despite a slight 1.5% gain this week. The price remains locked inside a $2.31–$1.98 range, failing to secure any meaningful breakout. This tension reflects a split in market behavior: whales are selling into strength while key holder groups continue accumulating.

The push and pull between these two sides is keeping the XRP price inside a falling wedge that has yet to confirm a bullish reversal.

Whales Trim While Key Holder Groups Resist the Pressure

Whale activity shows a clear shift toward caution.

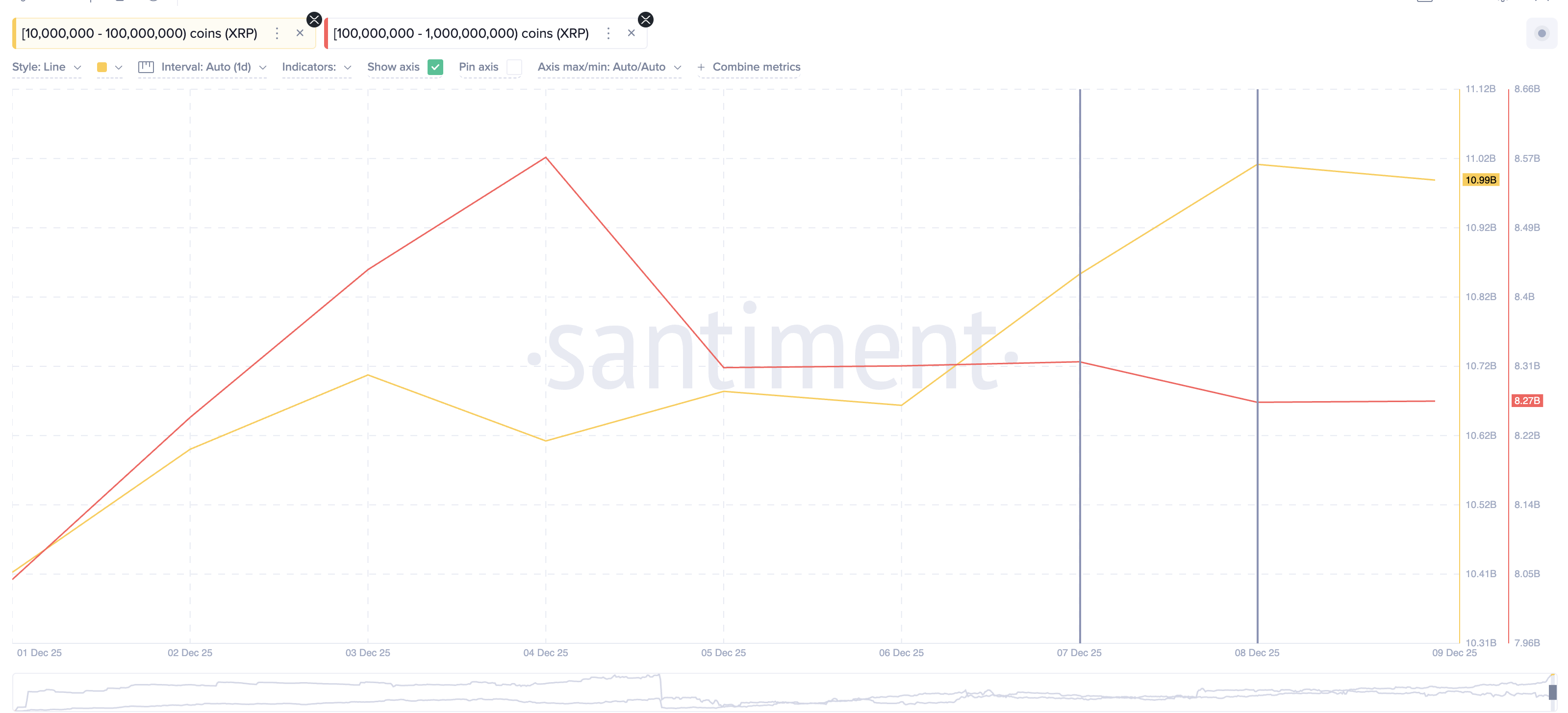

Wallets holding 100 million–1 billion XRP cut their balances from 8.32 billion to 8.27 billion, starting December 7. Another group holding 10–100 million XRP reduced its supply from 11.01 billion to 10.99 billion on December 8. Together, they offloaded about 70 million XRP over the past 48 hours, worth roughly $143 million at the current price.

XRP Whales Sell:

XRP Whales Sell:

The selling is not dramatic in token terms, but it arrives at a sensitive moment — exactly when XRP is trying to stabilize. This sell pressure helps explain why every breakout attempt has stalled before gaining momentum.

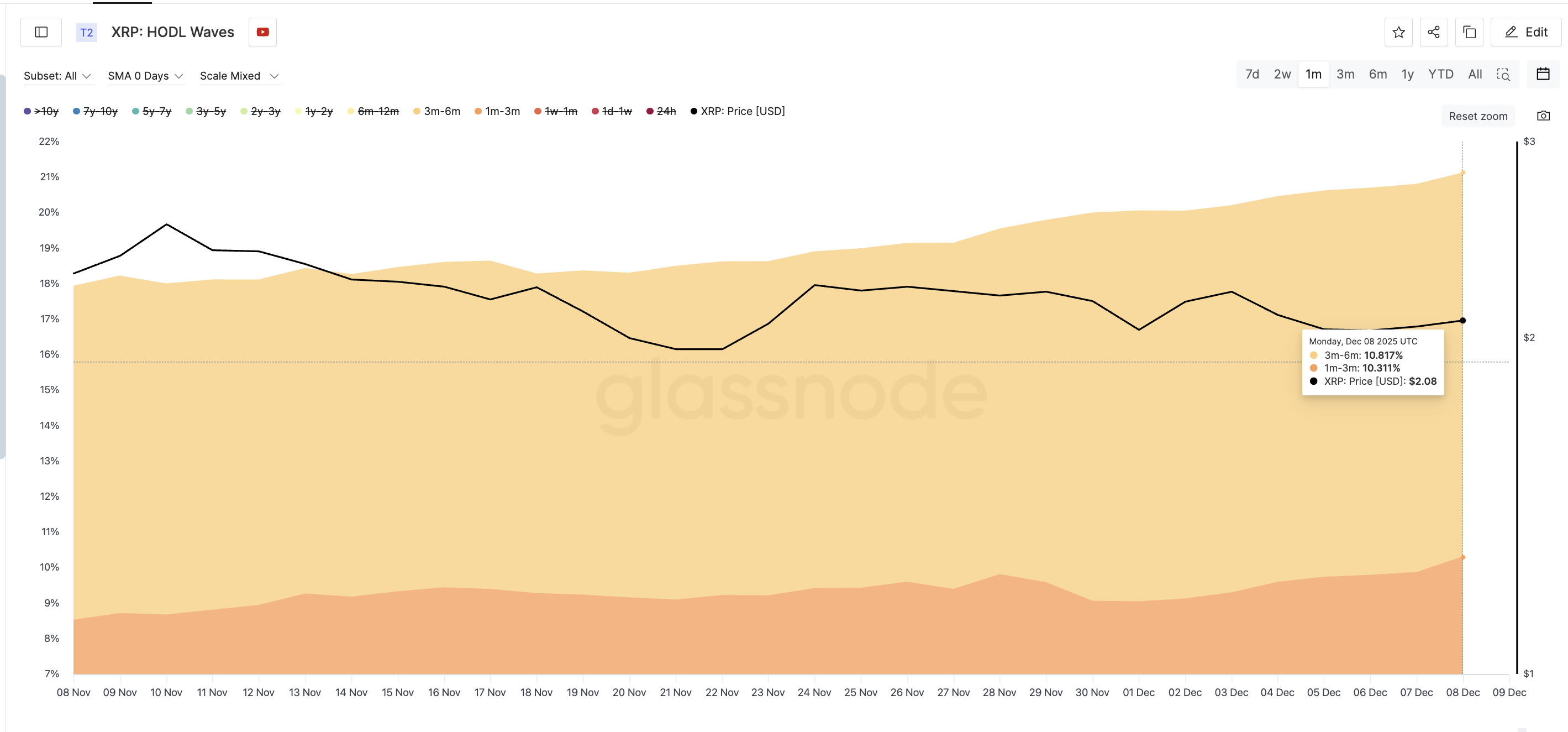

The counterforce comes from short- and mid-term holders, and this shows up clearly on HODL Waves. HODL Waves track how much XRP is held in each “coin age band,” showing how long tokens remain unmoved.

The one-to three-month group increased from 8.52% to 10.31%. The three-to six-month group rose from 9.40% to 10.87%.

Key Holders Keep Buying:

Key Holders Keep Buying:

These holders typically accumulate when they believe selling pressure is easing. Their buying into a 10% monthly decline suggests they expect the wedge structure to resolve to the upside eventually.

So XRP sits in a clear push-pull dynamic: whales selling on one side, active dip-buyers on the other.

That tension is holding the XRP price inside the same narrowing structure.

XRP Price Pattern Shows a Stalemate as Buyers and Sellers Pull in Opposite Directions

XRP is forming a falling wedge, a pattern that usually favors bullish reversals — but only if buyers can force a decisive breakout. Right now, the wedge is functioning more as a stalemate, with whale selling capping momentum and accumulating holders preventing deeper downside.

The breakout point sits near $2.46, where the descending trendline meets current price action. The XRP price needs a strong daily close above this level to confirm a reversal. If that happens, upside targets sit at $2.61, $2.83, and $3.11.

While price trades between $2.31 and $1.98, the wedge remains valid. A break below $1.98, however, weakens the pattern and exposes $1.82, a level that served as structural support earlier in the cycle.

XRP Price Analysis:

XRP Price Analysis:

For now, the outlook is simple: Whale selling delays the breakout. Mid-term accumulation keeps the structure alive. The wedge will not resolve until one side overwhelms the other.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Global Liquidity Set to Shrink in 2026. Here’s Why

Clean Energy Market Fluidity: Ushering in a New Age with CFTC-Sanctioned Platforms

- REsurety's CleanTrade, the first CFTC-approved SEF for clean energy , is transforming market liquidity and transparency by standardizing VPPAs, PPAs, and RECs. - The platform attracted $16B in notional value within two months, enabling institutional investors to hedge energy risks while aligning with ESG goals through verifiable decarbonization metrics. - Renewable developers benefit from streamlined financing and securitization tools, creating predictable revenue streams and expanding access to capital

Investing in Human Capital for a Greener Tomorrow: The Growth of Education and Career Training in Renewable Energy

- Global energy transition drives rapid growth in renewable workforce demand, with U.S. wind turbine technician roles projected to surge 60.1% by 2033. - Institutions like Farmingdale State College bridge skill gaps through industry-aligned programs, offering hands-on training and partnerships with firms like Orsted and GE . - Investors gain strategic opportunities by funding vocational training and microcredentials, addressing decarbonization needs while boosting social equity through inclusive initiative

Clean Energy Market Fluidity: The CFTC-Endorsed Transformation

- CFTC approved CleanTrade as the first SEF for clean energy , addressing market fragmentation and liquidity gaps. - The platform enables institutional-scale trading of VPPAs and RECs with automated compliance and $16B in early trading volume. - Integrated analytics and regulatory compliance enhance transparency, reducing risks for investors in renewable energy assets. - Early adoption by Cargill and Mercuria highlights CleanTrade's potential to reshape $1.2T clean energy investment landscape.