The TRUMP price has spent months bleeding out, sliding from over $10 billion peak to barely $1.15 billion today. And now, in a extraordinary move, the token is trying to reinvent itself through mobile gaming. The upcoming “Trump Billionaires Club” game is being sold not as mere promotion, but as the project’s first real attempt at utility. Even this week, its Defi volume has doubled, and activity is soaring this week.

TRUMP crypto has relied heavily on political energy, viral moments, and that was like a more celebrity-style branding. But the market’s patience has thinned. Now developers are pitching a utility-first makeover, hoping a playable product can overturn the declining TRUMP price USD trends.

The game is set to launch by December 30, 2025 which is designed around TRUMP token rewards, Monopoly-like NFT collectibles, and a wealth-building theme echoing Trump’s public persona. Pre-registrations are being baited with a $1 million TRUMP airdrop tied to referrals and token holdings. On paper, it’s clever. In practice, well, we’ve seen this movie before.

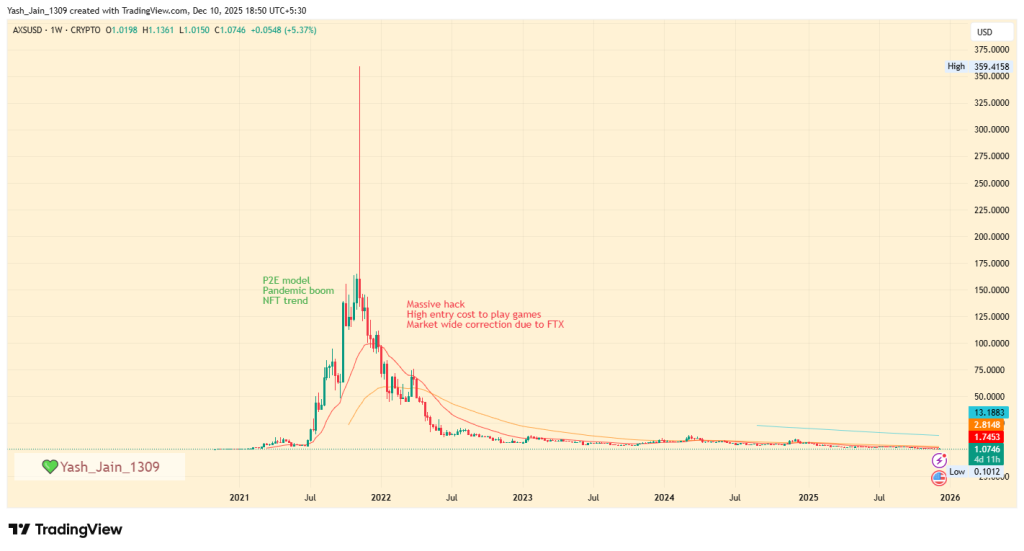

Projects like Axie Infinity proved that gaming can ignite monstrous demand… temporarily. But when token mechanics outrun real gameplay appeal, the result is always the same: an explosive pump followed by a brutal unwind. TRUMP price prediction models face that same dilemma, from investors angle. Sure, the short-term setup could trigger buzz if adoption spikes but post-launch airdrop selling might even choke that momentum quickly.

Developers seem aware of that risk, which is why they’re doubling down on a narrative shift: utility first, branding second. Whether users buy into that philosophy or actually play the game that’s what is the real test is for this meme-token.

When zoomed into the TRUMP price chart on the 4-hour timeframe, the hesitation is obvious. The token is trying to hold the $5.50 support area, but demand is shallow. Traders look cautious its like either waiting for better confirmation or simply too burned by the long fall from peak levels.

To rebuild confidence, bulls need TRUMP crypto to reclaim the 200-day EMA near $6.35 in the near term. And to change the entire TRUMP price forecast narrative, it must push back above the $7 zone and sustain there. Until then, the trend remains fragile.

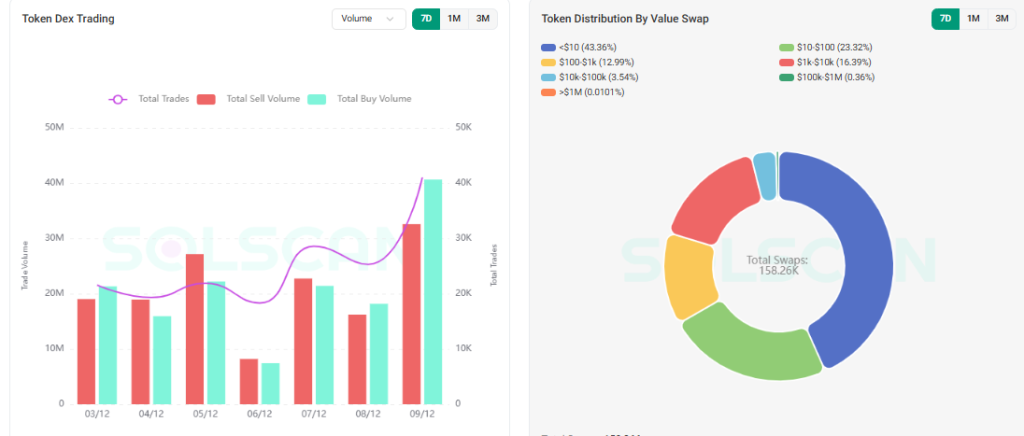

Interestingly, Solscan’s token transfer data shows increased on-chain activity over the past 10 days, which looks like a hint of renewed interest, atleast for now. As DeFi activity nearly doubled in the same window, jumping from around 18,000 interactions to roughly 33,000. Trading volume is ticking higher too, which at least suggests the ecosystem isn’t fully abandoned.

But let’s be real here, as that alone won’t save the project. The upcoming mobile game is the biggest swing yet at anchoring TRUMP in something functional rather than fanfare. Whether it works or becomes another novelty-driven spike will shape where the TRUMP price heads next.