UAE telecom group e& to trial dirham-backed stablecoin payments across digital services

Key Takeaways

- e UAE is piloting AE Coin, a stablecoin pegged to the UAE dirham, for everyday consumer payments.

- The initiative follows a partnership between e and Al Maryah Community Bank to advance digital asset payment solutions.

UAE telecom giant e is testing a dirham-backed stablecoin called AE Coin for everyday payments after signing a memorandum of understanding with Al Maryah Community Bank.

The initiative will integrate AE Coin into e UAE’s infrastructure, enabling customers to use it for bill payments, recharges, self-service kiosks, and future e-commerce touchpoints. The move brings regulated stablecoin utility to one of the country’s most widely used consumer ecosystems.

Bank CEO Mohammed Wassim Khayata said the pilot broadens real-world adoption of compliant virtual assets, while AED Stablecoin GM Ramez Rafeek called it a milestone for mainstream stablecoin integration.

Last month, Tether announced the launch of a new UAE Dirham-pegged stablecoin in collaboration with Phoenix Group and Green Acorn Investments, aiming to boost the regional digital economy through regulatory compliance with the UAE Central Bank.

Earlier this year, OKX expanded to the UAE, offering dirham-denominated trading and local bank integration to attract institutional and retail crypto investors.

Earlier this year, Tether disclosed plans for a UAE Dirham-pegged stablecoin in partnership with Phoenix Group, seeking to diversify its stablecoin offerings and leverage the UAE’s crypto-friendly reputation.

In May, Dubai’s Department of Finance partnered with Crypto.com to enable crypto payments for government services, aligning with its Cashless Strategy to enhance its global digital city stature.

Earlier this week, Circle introduced CCTP V2, facilitating seamless USDC transfers across Stellar and other blockchains, thereby improving the security and efficiency of cross-chain transactions.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

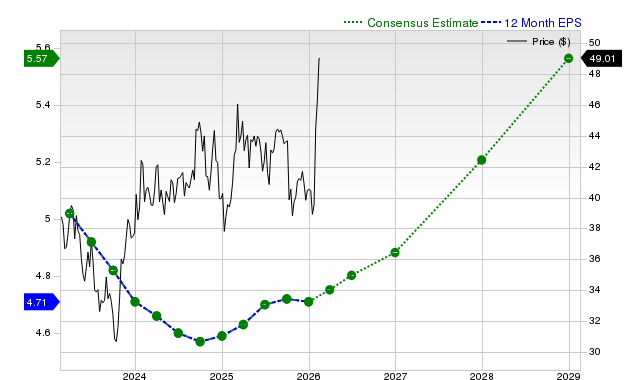

Investors Heavily Search Caterpillar Inc. (CAT): Here is What You Need to Know

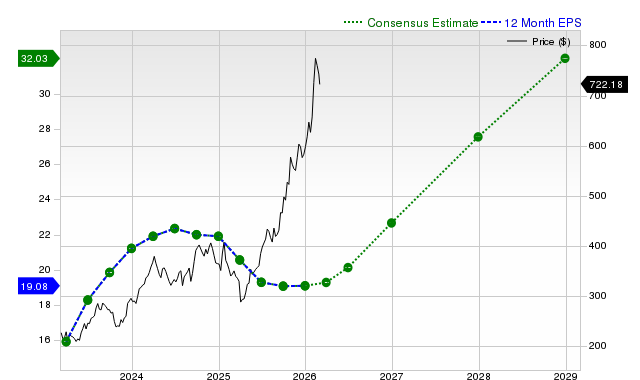

Starbucks Corporation (SBUX) Is a Trending Stock: Facts to Know Before Betting on It

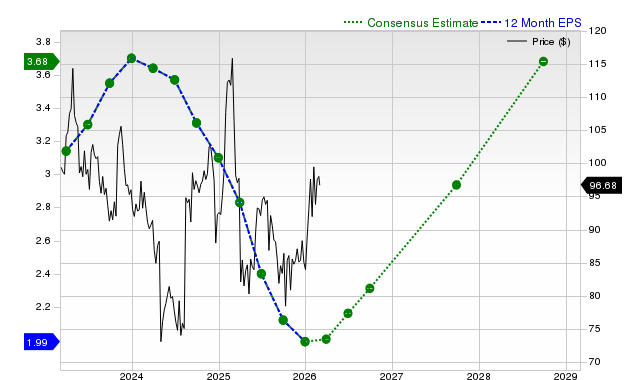

AT&T Inc. (T) Is a Trending Stock: Facts to Know Before Betting on It

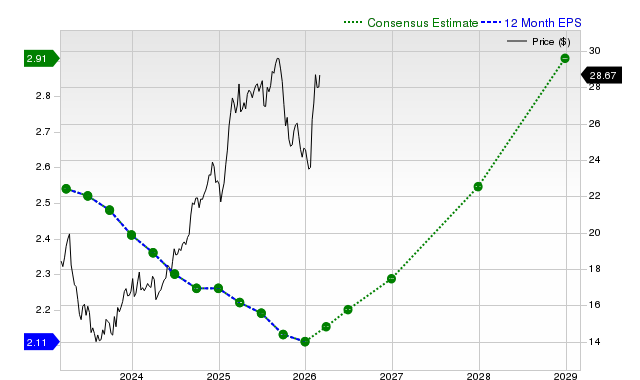

Is Most-Watched Stock Verizon Communications Inc. (VZ) Worth Betting on Now?