Tangem Wallet integrates Aave for stablecoin yield

Tangem Wallet now lets users earn Aave yield on USDT, USDC and DAI inside the app, with hardware security, simple setup and no need for external dApps.

- Tangem Wallet now offers Aave-backed yield through Yield Mode.

- Users can earn on USDT, USDC and DAI without leaving the app.

- Hardware security and full liquidity keep assets under user control.

Tangem has introduced Aave-powered yield inside its wallet, creating a direct bridge between self-custody and decentralized finance.

The update was confirmed in a Dec. 11 note from Aave ( AAVE ), which described the integration as a way for users to earn yield on stablecoins without stepping outside the Tangem app or giving up control of their keys.

Yield Mode brings DeFi inside Tangem Wallet

The new feature, called Yield Mode, sits inside Tangem’s interface as a simple toggle. Once enabled, the wallet’s audited smart contract supplies the selected stablecoin into Aave’s liquidity pools and begins accruing interest through aTokens.

The entire process works in real time and does not rely on external websites, WalletConnect links or a dApp browser. It feels closer to a mobile banking workflow, but the user keeps custody of their private key stored on the Tangem card.

Aave plays a key role in the integration. The protocol holds more than $60 billion in net deposits and around $30 billion in active loans, giving it deep liquidity for tokens like USDC, USDT and DAI.

Those assets often earn variable rates in the mid-single to low-double digits, depending on supply and demand in the pool. Tangem users can now access the same yield curve inside the wallet while retaining full liquidity, since funds can be withdrawn at any time without lockups or exit delays.

The design focuses heavily on security and direct control. The smart contract only activates once the user approves it, and it can manage the chosen token solely for the purpose of supplying and withdrawing from Aave.

The wallet records no off-chain data and keeps every operation tied to hardware-based key protection. This removes the complexity that often comes with DeFi participation and gives less technical users a way to earn yield in a controlled setting.

Stablecoins and consumer app expansion

The timing of the rollout fits into a period where stablecoins are becoming more integrated across consumer apps and payment tools. Tangem has been expanding its feature set throughout the year, including staking support for large networks, swaps across several chains and an upcoming virtual payment product scheduled for mid-December.

The addition of stablecoin yield gives the wallet a wider role as users explore ways to keep assets productive while staying in self-custody. Tangem says the integration is only the first step, with more supported assets and networks planned as the wallet moves toward a broader “neobank-style” experience.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Earnings To Watch: Guidewire Software (GWRE) Reports Q4 Results Tomorrow

Smith & Wesson (SWBI) Q4 Earnings: What To Expect

What To Expect From Stratasys's (SSYS) Q4 Earnings

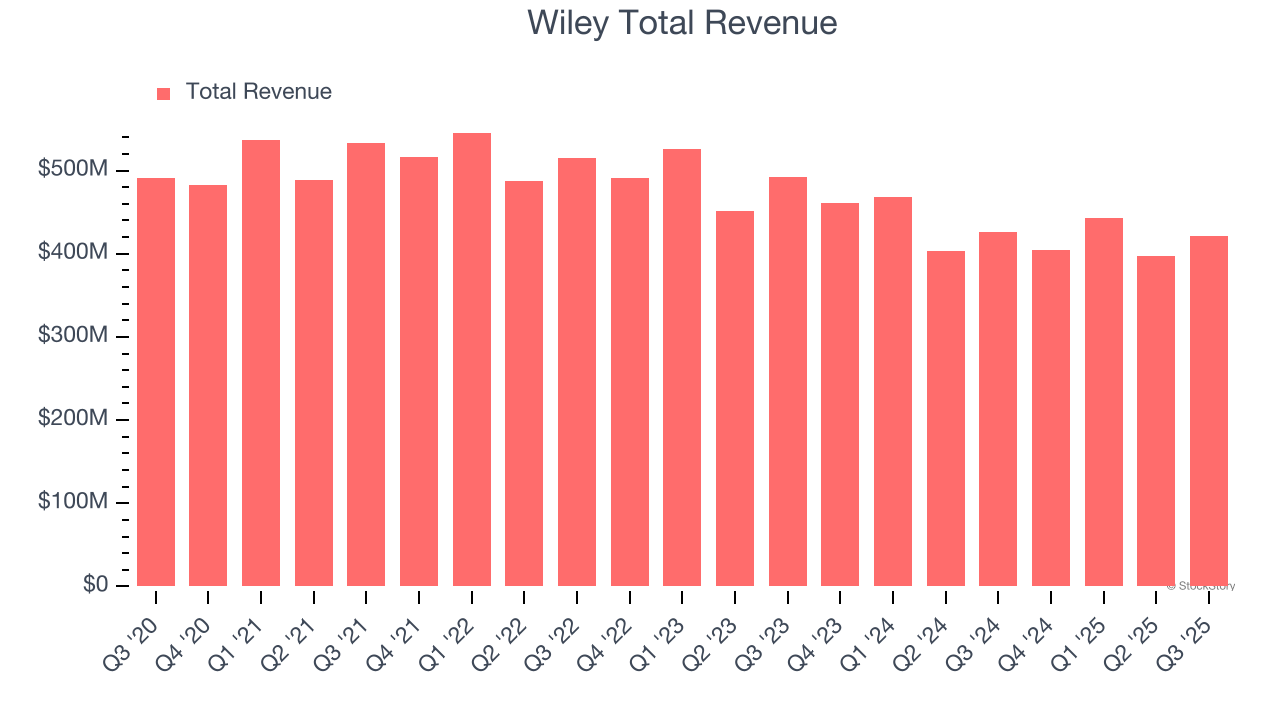

Earnings To Watch: Wiley (WLY) Reports Q4 Results Tomorrow