As the dust settles from the Federal Reserve’s latest 25 basis point rate cut, Bitcoin (BTC) clings to its breakout threshold amid choppy waters, while stocks flirt with Santa Claus rally dreams. Pro trader Camel Finance sees a classic “dip & rip” setup unfolding.

A YouTube live-trading veteran with a focus on swing trades, macro cycles, and transparent live trades, he cuts through the post-FOMC hype, urging investors to buy cycle lows for huge opportunities into 2026. Could this be the trap that flips the script on one-sided bears?

False Narratives, Real Opportunities

In his X posts this week, Camel Finance frames the entire sequence as a coordinated effort by central banks, particularly the Fed, to push a false narrative around quantitative easing (QE) and rate cuts to shake out weak hands.

Sponsored

This manufactured pessimism, he argues, creates a classic “dip and rip” setup for traders who stay focused instead of reacting to noise.

The “dip and rip” is a tactic where traders scoop up assets during short-term pullbacks and then ride the rebound for quick gains. It’s a way to turn temporary market dips into opportunities in an otherwise strong trend.

According to him, the week’s bearish tone is manufactured, creating the appearance of liquidity while actually trying to scare retail investors into selling. In his view, this trap reliably produces sharp rebounds for anyone willing to buy the dips.

Tracking the action from pre-FOMC positioning on December 9 to the December 10 shakeout and the post-cut spin on December 11, he says the stage is now set for a year-end rally.

Sentiment-wise, Camel Finance takes a contrarian and bullish stance, viewing the loud, know-it-all crowd as a signal to buy the dips.

His strategy is straightforward: tune out the noise, watch for cycle lows, and position early for maximum gains.

Buying the Dip: Timing the Bounce

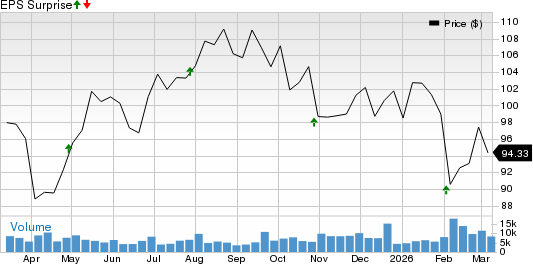

Speaking of his own actions, the trader stayed long Bitcoin all week, holding through FOMC volatility and viewing the $93K–$95K chop as a healthy retrace.

Camel Finance added a small size on the post-cut dip at around $93K cycle support, interpreting the chop as a healthy 30% retrace that trapped bears and set up a breakout retest of trendline levels.

He remained bullish short-term, expecting a year-end breakout to new highs if weekly closes hold, and continued to highlight MicroStrategy’s ongoing BTC accumulation as a potential long-term catalyst.

Looking ahead, the trader plans to scale in on further weakness for the Santa rally, with his biggest focus on accumulating heavily at the 2026 4-year cycle low for a multi-year moonshot.

Eyes on 2026 Cycle Low

Camel Finance calls for buying the dip & rip amid Fed false narratives, with cycle lows unlocking year-end rallies in Bitcoin and stocks.

Ignore hype, trade systems over emotions, and watch for swift risk-on flips. Actionable insight: position at lows for huge opportunities, but hedge wisely as cycles turn fast.

Discover DailyCoin’s hottest crypto news today:

Ripple’s 89% Fee Crash Hints At XRP’s Oversold Price Bounce

Fed Cuts Rates, Announces $40B T-Bill Program, Crypto Dips

People Also Ask:

It’s a trading approach where investors buy an asset during a short-term pullback (the dip) and sell as it rebounds (the rip) for quick gains.

Federal Reserve policies, like rate cuts or quantitative easing, impact liquidity and market sentiment, which can drive short-term price movements in Bitcoin.

Yes—if a dip continues into a deeper downtrend, traders can face losses. Risk management and timing are crucial.