Tether’s Bid to Buy Italian Soccer Club Juventus Rejected by Majority Shareholder Exor

Stablecoin issuer Tether’s dreams of a full takeover of Italian soccer club Juventus appear to have been dashed.

Majority shareholder Exor’s board of directors has unanimously rejected Tether’s binding, all-cash bid to purchase the firm’s 65.4% stake in Juventus, stating in a Saturday press release that it has “no intention of selling any of its shares in Juventus to a third party, including but not restricted to El Salvador-based Tether.”

Tether publicly announced its bid to buy out Exor — the holding company controlled by the Italian Agnelli family, whose multi-industry business dynasty includes the Fiat motor company — yesterday, stating that the company had “deep admiration and respect” for the soccer club and planned to invest an additional $1 billion in its growth if the bid was accepted. Tether already holds a 10% stake in the club, but has long been vocal about its desire to take a more active role in the club.

A spokesperson for Tether did not immediately respond to CoinDesk’s request for comment.

Juventus has faced ongoing financial challenges, posting recurring losses and requiring repeated capital injections, which have totaled more than 1 billion euros ($1.17 billion) over the past seven years.

In its press release, Exor called Tether’s bid “unsolicited” and reiterated the Agnelli family’s continued commitment to the team’s success.

“Juventus is a storied and successful club, of which Exor and the Agnelli family are the stable and proud shareholders for over a century, and they remain fully committed to the Club, supporting its new management team in the execution of a clear strategy to deliver strong results both on and off the field,” the press release stated.

Neither Juventus nor Exor immediately responded to CoinDesk's request for comment.

The price of a token linked to the football club, JUV$0.7712, surged more than 32% in the last 24-hour period after the stablecoin giant revealed it was prepared to acquire the club. At the time of writing it doesn’t appear to have yet reacted to Exor’s announcement.

The stablecoin issuer is currently Juventus’ second-largest shareholder with an 11.53% stake in the club, behind Exor. Juventus shares traded down 0.9% in Friday’s trading session to 2.194 euros ($2.58). The club’s total market capitalization is hovering around $988 million.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Amex Shares Slide 0.48% Amid 16% Dividend Surge, NYSE Ranks 53rd in $1.92B Volume

‘Onchain markets are responsible for virtually 100% of weekend price discovery’ – Theo’s Ioppe

Tidewater: Fourth Quarter Earnings Overview

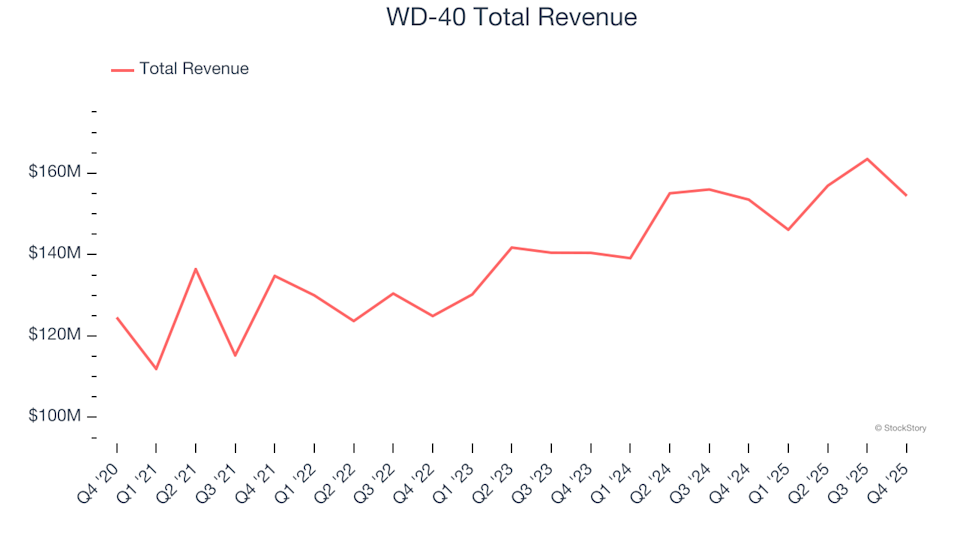

Spotting Top Performers: WD-40 (NASDAQ:WDFC) And Home Goods Stocks In The Fourth Quarter