Date: Sun, Dec 14, 2025 | 04:15 AM GMT

The broader altcoin market has been experiencing choppy price action over the past several weeks, a phase that began after the sharp sell-off on October 10 . That correction dragged Ethereum (ETH) lower by nearly 25% over the last 60 days, creating strong downside pressure across the market. The bearish momentum has spilled into several major tokens, including Artificial Superintelligence Alliance (FET).

Over the same period, FET has declined by roughly 21%. However, beneath the surface weakness, its chart is beginning to reveal an emerging fractal setup that hints a potential recovery phase could be developing.

Source: Coinmarketcap

Source: Coinmarketcap

FET Mirrors Bitcoin’s Historical Footsteps

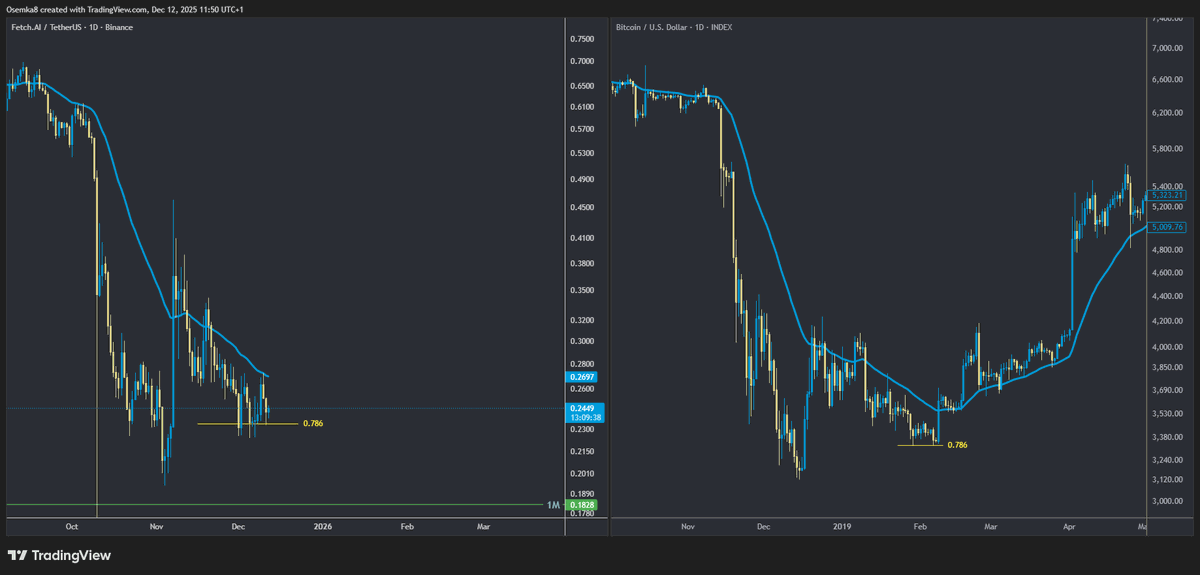

According to prominent crypto analyst Osemka , FET’s current price structure is showing striking similarities to Bitcoin’s price behavior during its early 2019 correction phase.

During that period, Bitcoin suffered a sharp correction of nearly 50% before stabilizing around the 0.786 Fibonacci retracement level. Once BTC established a base near that zone and successfully reclaimed its 50-day moving average, the market saw a powerful trend reversal that ultimately led to a sustained recovery rally.

FET and BTC Fractal Chart/Credits: @Osemka8 (X)

FET and BTC Fractal Chart/Credits: @Osemka8 (X)

At present, FET appears to be walking a similar path. The token has also undergone a correction close to 50% from its local highs and is now consolidating around the same 0.786 Fibonacci retracement area — a level that historically acted as a strong demand zone for Bitcoin. This stabilization phase suggests selling pressure may be weakening as buyers gradually step back in.

What’s Next for FET?

If this fractal continues to unfold in a similar manner, the next critical step for FET would be a decisive bounce from the current support zone followed by a reclaim of its 50-day moving average, which sits near $0.2697. A successful move above this level would mark a shift in momentum and could confirm the beginning of a recovery phase.

In such a scenario, the technical projection points toward a potential upside move into the $0.61 region. Reaching that level would represent a gain of nearly 150% from current prices, aligning with the type of recovery Bitcoin experienced after completing its own fractal setup.

That said, caution remains warranted. Fractal patterns do not guarantee identical outcomes, and until FET reclaims its 50-day moving average with strong confirmation, the broader structure remains vulnerable to seller control. The coming sessions will be crucial in determining whether history rhymes once again or the setup fails to fully materialize.