El Salvador’s Bitcoin stash surpasses 7,500 BTC as reserve build-up continues

Key Takeaways

- El Salvador's Bitcoin holdings have exceeded 7,500 BTC as it continues to build reserves.

- In addition to expanding its Bitcoin reserves, El Salvador is incorporating Bitcoin and blockchain technology into its education and financial sectors.

El Salvador’s Bitcoin holdings have exceeded 7,500 coins worth over $670 million as the country continues to build its reserves, according to data from the National Bitcoin Office.

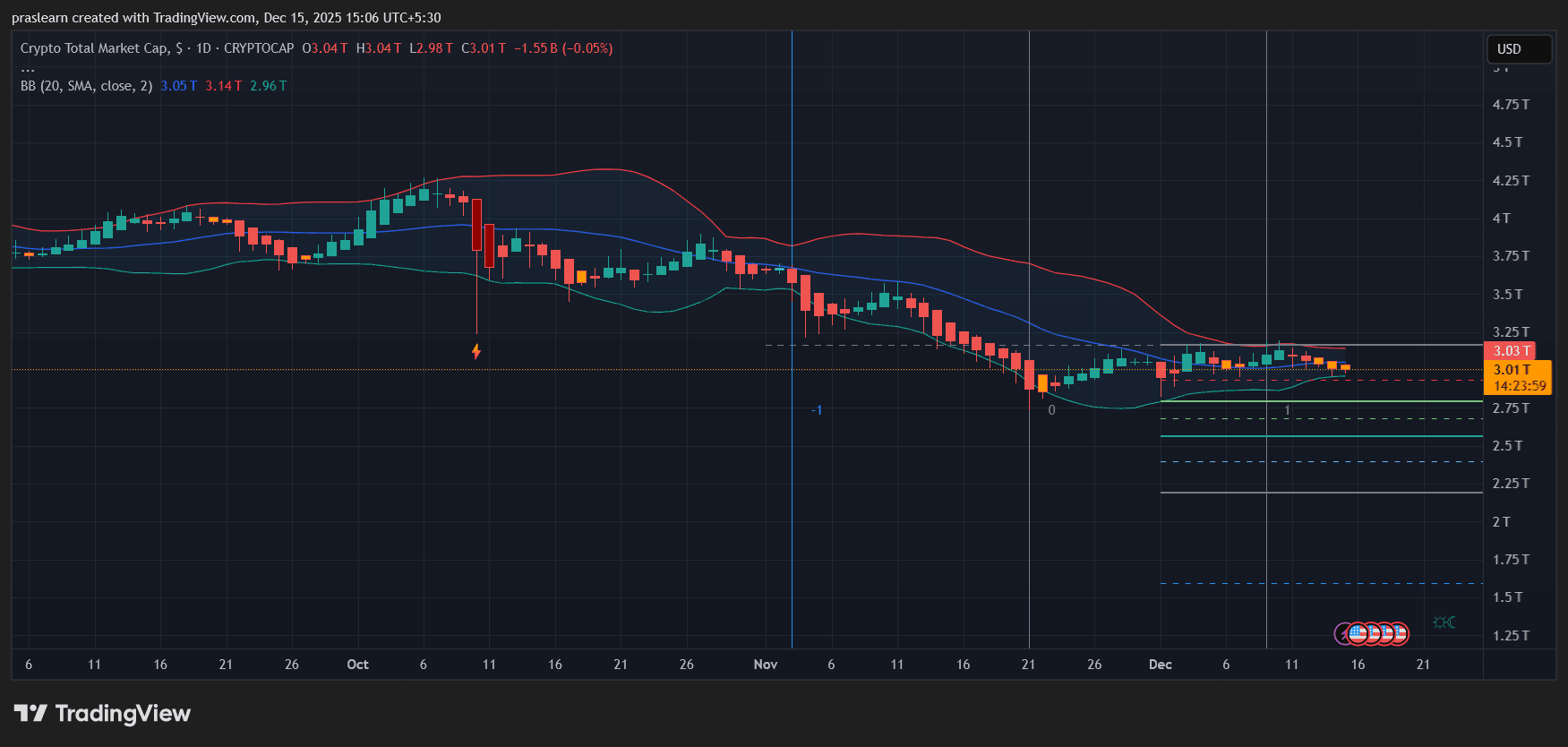

The country maintains its policy of adding one BTC to its reserves each day regardless of market conditions. Bitcoin has been volatile in recent months, driven by factors such as investor rotation and wider economic uncertainty.

The digital asset was trading at about $89,300 at press time, down 2% over the past week, according to CoinGecko data.

The expansion has raised questions over how El Salvador manages to increase its BTC holdings without making new purchases under its IMF agreement, especially as the IMF confirmed that in a recent report.

Apart from building its Bitcoin reserves, El Salvador has worked to integrate Bitcoin and blockchain technology into its education and financial systems. The government aims to use Bitcoin to promote financial inclusion, attract foreign investment, reduce remittance costs, and advance technological development.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Are Shiba Inu, PEPE, and Dogecoin Dead in 2025? The Numbers Tell a Brutal Story

What to Expect in Crypto Markets This Week: Macro Pressure Meets a Fragile Market Structure

Global Liquidity Set to Shrink in 2026. Here’s Why

Clean Energy Market Fluidity: Ushering in a New Age with CFTC-Sanctioned Platforms

- REsurety's CleanTrade, the first CFTC-approved SEF for clean energy , is transforming market liquidity and transparency by standardizing VPPAs, PPAs, and RECs. - The platform attracted $16B in notional value within two months, enabling institutional investors to hedge energy risks while aligning with ESG goals through verifiable decarbonization metrics. - Renewable developers benefit from streamlined financing and securitization tools, creating predictable revenue streams and expanding access to capital