PENGU Token Value Soars: Blockchain Data and Institutional Interest Indicate Optimal Timing for Investment

- PENGU ranks #81 with $706.5M market cap, showing rising institutional interest and whale accumulation. - The pending Canary PENGU ETF, if approved, could unlock institutional capital by including NFTs in a U.S. ETF. - Mixed on-chain signals (RSI 38.7, OBV growth) and 2B tokens moved from team wallets highlight uncertainty. - Partnerships with Care Bears and Lufthansa, plus Bitso collaboration, expand utility but face regulatory risks. - Recent 8.55% price rebound and 2.6% gain post-BNB listing suggest ca

PENGU Token: Navigating On-Chain Trends and Institutional Momentum

The PENGU token, associated with Pudgy Penguins, has become a notable example of how blockchain activity and institutional involvement can shape a digital asset's trajectory. As of November 2025, PENGU holds the 81st spot by market capitalization, valued at $706.5 million, and sees a daily trading volume of $160.4 million across more than 50 trading platforms, as reported by Bitget. This robust liquidity, combined with growing interest from major investors, places PENGU at a pivotal juncture.

On-Chain Insights: Contradictory Signals and Whale Influence

Blockchain analytics paint a complex picture for PENGU. Technical indicators such as a Relative Strength Index (RSI) of 38.705 and a dozen sell signals from moving averages suggest a bearish trend. However, positive signs like increasing On-Balance Volume (OBV) and a favorable MACD point to mounting buying interest. Large holders, or "whales," have accumulated approximately $273,000 in PENGU, which may help support the token's price. Yet, the transfer of 2 billion tokens from team-controlled wallets to exchanges in the last quarter of 2025 has sparked debate among analysts—some see it as a move to provide liquidity, while others worry it signals potential sell-offs.

Exchange data from Q4 2025 shows $9.4 million moving out of exchanges and $1.8 million coming in, a trend often viewed as a sign of price stabilization. Nevertheless, trading activity dropped sharply from $6 billion in July to $315 million by early December, alongside a significant reduction in open interest and $50 million in liquidated long positions, according to MEXC. This volatility highlights PENGU's sensitivity to broader economic factors, though a recent 8.55% price rebound within 24 hours demonstrates the token's underlying resilience.

Institutional Engagement: Partnerships and ETF Developments

Institutional participation is increasingly shaping PENGU's story. The proposed Canary PENGU ETF, which would blend PENGU tokens on Solana with Ethereum-based Pudgy Penguins NFTs, stands out as a potential game-changer. Submitted to the SEC in June 2025, its approval was postponed until October 12, 2025, as regulators reviewed its compliance with commodity trust regulations. Should it gain approval, this ETF would be the first in the U.S. to directly feature NFTs, potentially attracting significant institutional investment.

Further bolstering confidence, whales accumulated $273,000 in PENGU during November 2025, and institutional investments surged by $430,000 in the fourth quarter, according to Bitget. Strategic alliances with brands like Care Bears and Lufthansa's Miles & More have expanded PENGU's real-world applications, enabling users to make in-game purchases and earn frequent flyer miles. Additionally, a partnership with Bitso, the leading crypto exchange in Latin America, is helping PENGU tap into new and rapidly growing markets.

Technical Perspective and Market Forecast: Optimism with Caveats

Technical forecasts for PENGU in the final quarter of 2025 are optimistic, with resistance points identified at $0.014678 and $0.027140, according to MEXC. Analysts believe the token could challenge the $0.03030 level, with speculation around the ETF potentially driving prices toward $0.046. However, regulatory uncertainty remains a significant risk. Delays in SEC decisions and new legislative measures like the GENIUS Act and MiCA have, at times, led to an 80% drop in PENGU's market cap, underscoring the asset's volatility.

Despite these headwinds, PENGU experienced a 2.6% price uptick following its listing on the BNB Smart Chain, as reported by StockTwits. The token's ecosystem continues to mature, with new projects such as penguSOL and Pudgy World enhancing its utility. With 76% of institutional investors planning to prioritize tokenized assets by 2026, according to Bitget, PENGU's integration into mainstream finance appears increasingly likely.

Is Now the Right Time? Balancing Opportunity and Risk

PENGU's recent price movements reflect a blend of strong on-chain fundamentals and growing institutional support. While technical signals remain mixed, factors like whale accumulation, rising OBV, and strategic partnerships suggest the potential for a breakout. The anticipated Canary PENGU ETF could serve as a major catalyst, but investors should remain mindful of regulatory uncertainties. For those considering a medium-term investment, PENGU's current valuation—over 80% below its all-time high of $0.068—may offer a promising yet cautious opportunity.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

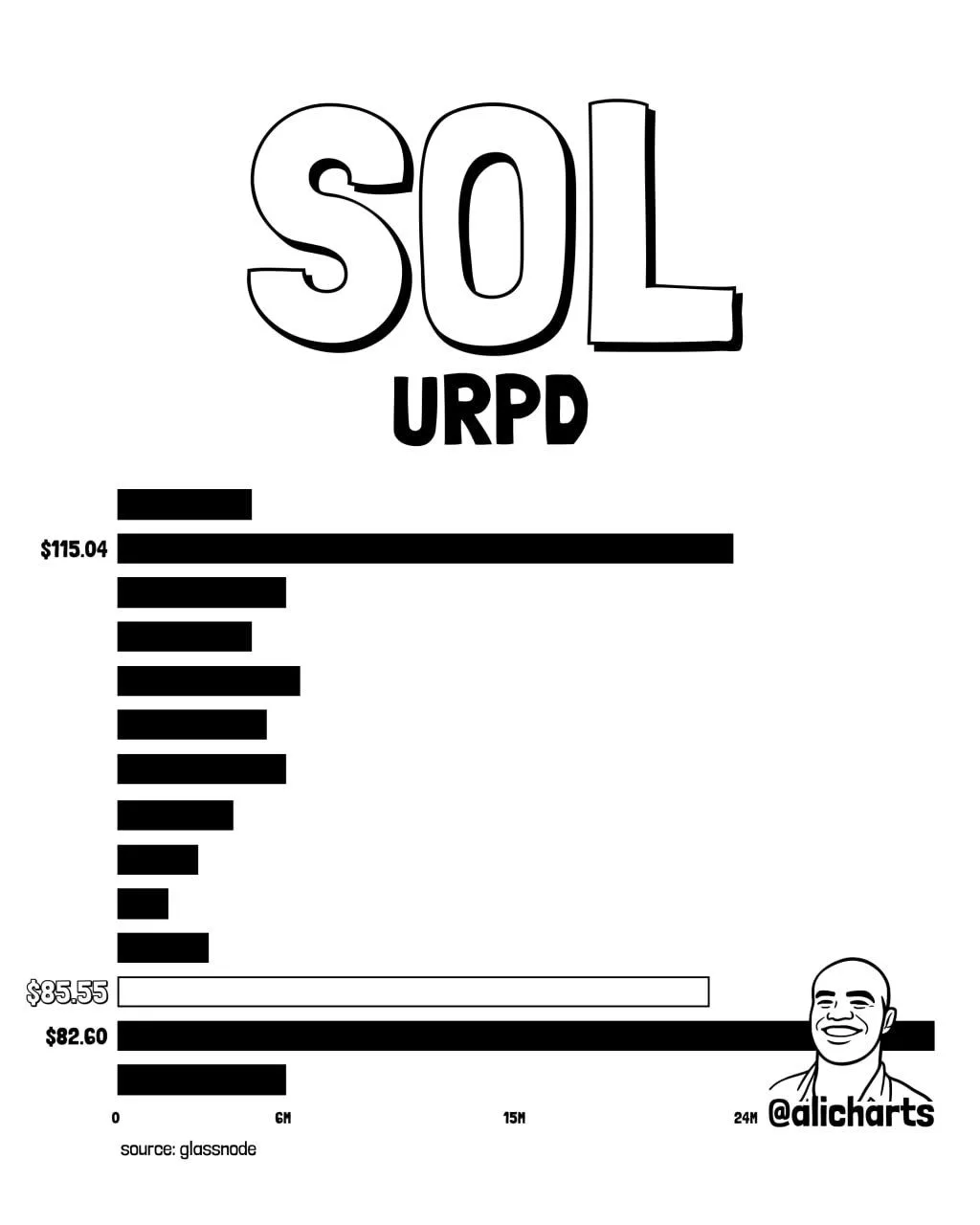

Solana Price Prediction: Breakout Eyes $103 and $115

Notcoin (NOT) at a Crossroads: Will the Price Rebound or Extend the Downside Risk?

ANKR Price Rockets 6.16%: Whales on the Move

Stocks Sink as Oil Logs Best Weekly Performance on Record