Date: Mon, Dec 15, 2025 | 05:50 AM GMT

The cryptocurrency market is attempting to recover following heightened weekend volatility that dragged Bitcoin (BTC) down to $87,634 before rebounding above $89,700.

While broader market sentiment remains mixed, activity within the memecoin segment is beginning to show selective strength. Despite trading slightly in the red, Fartcoin (FARTCOIN) is displaying a technically constructive setup that suggests a larger bullish move could be forming beneath the surface.

Source: Coinmarketcap

Source: Coinmarketcap

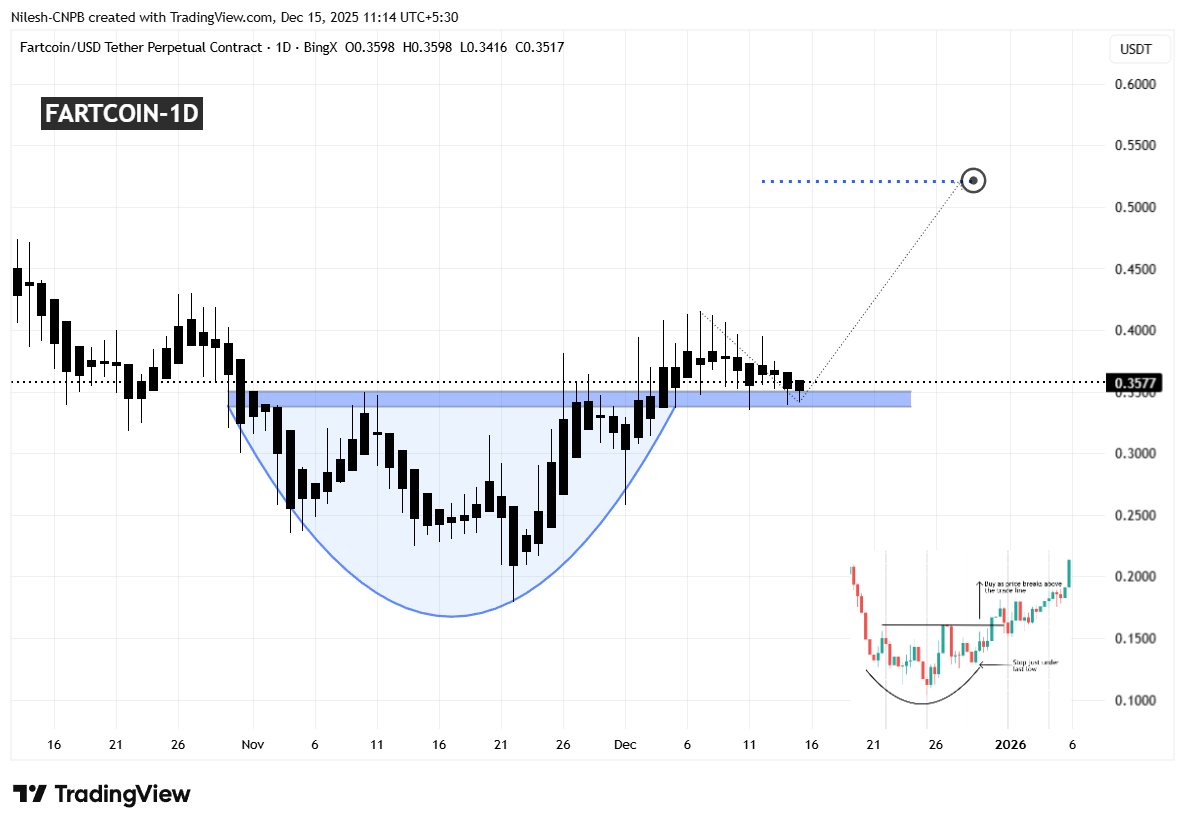

Retested Cup and Handle Breakout

On the daily chart, FARTCOIN is forming a textbook Cup and Handle pattern — a bullish continuation structure that often precedes strong upside expansions once confirmation is in place.

The cup formation began last month, starting with a sharp decline from the $0.35 region before finding a rounded bottom near $0.1788. From this low, price gradually recovered, forming a smooth rounded base that reflected weakening selling pressure and steady accumulation. As the recovery progressed, FARTCOIN transitioned into the handle phase, where price consolidated just below resistance.

This consolidation resolved with a breakout above the neckline near $0.35, pushing FARTCOIN to a local high of $0.4157. Following the breakout, price experienced a brief pullback — a common post-breakout behavior — allowing the market to retest the former resistance as support.

FARTCOIN Daily Chart/Coinsprobe (Source: Tradingview)

FARTCOIN Daily Chart/Coinsprobe (Source: Tradingview)

Breakout Retest Holding Structure

The recent dip brought FARTCOIN back toward the $0.3350–$0.35 zone, where buyers stepped in once again. Price has since rebounded to around $0.3580, indicating that the neckline retest is holding. This successful retest strengthens the bullish case, as former resistance is now acting as a support base.

From a structural perspective, this behavior confirms that the Cup and Handle breakout remains intact, with the market showing signs of acceptance above the key breakout zone.

What’s Next for FARTCOIN?

If buyers continue to defend the neckline area and manage to push price above the recent swing high at $0.4157, bullish momentum could accelerate quickly. Based on the height of the cup, the projected technical target sits near $0.5212, representing a potential upside move of nearly 45% from current levels.

A sustained move toward this target would signal renewed speculative interest and could place FARTCOIN back into an expansion phase. On the downside, failure to hold the $0.35 support zone could temporarily weaken momentum and delay the bullish scenario, though the broader structure would remain valid as long as price stays above the cup base.

For now, the chart suggests that FARTCOIN is in a critical confirmation phase, with the coming sessions likely to determine whether this setup evolves into a full-scale breakout.