Consumers invested more in mobile applications than in games in 2025, fueled by the rise of AI-powered apps

Global Mobile App Spending Surpasses Games for the First Time in 2025

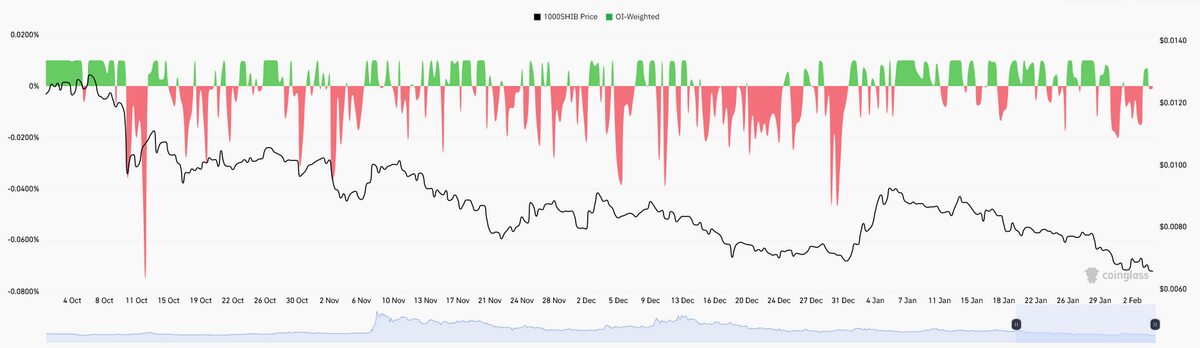

For the first time ever, worldwide consumer spending on non-gaming mobile applications overtook spending on games in 2025, according to Sensor Tower’s annual State of Mobile report. While this shift had previously occurred in select regions such as the United States or during certain quarters, 2025 marked the inaugural year this trend was seen on a global scale. Last year, users spent around $85 billion on mobile apps, a 21% increase from the previous year and nearly three times the amount recorded five years earlier.

Image Credits: Sensor Tower

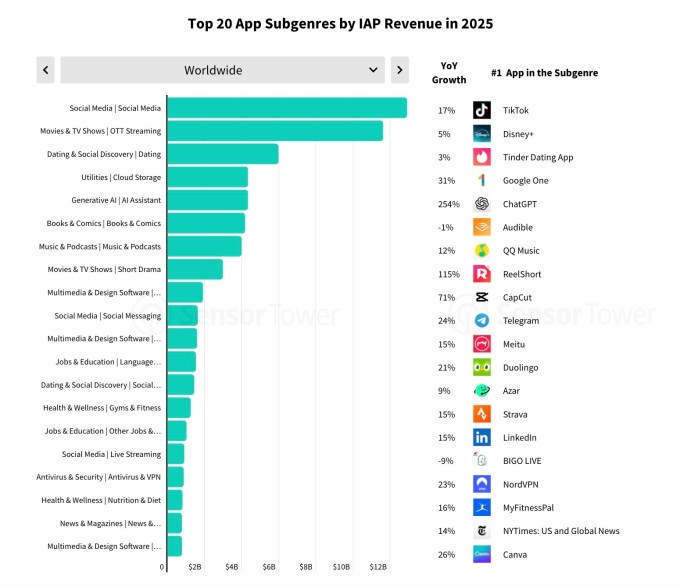

Generative AI Fuels Explosive Growth in App Revenue

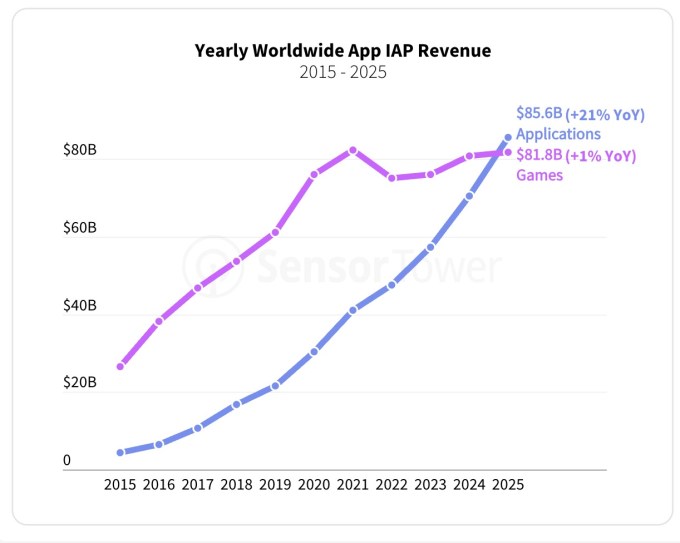

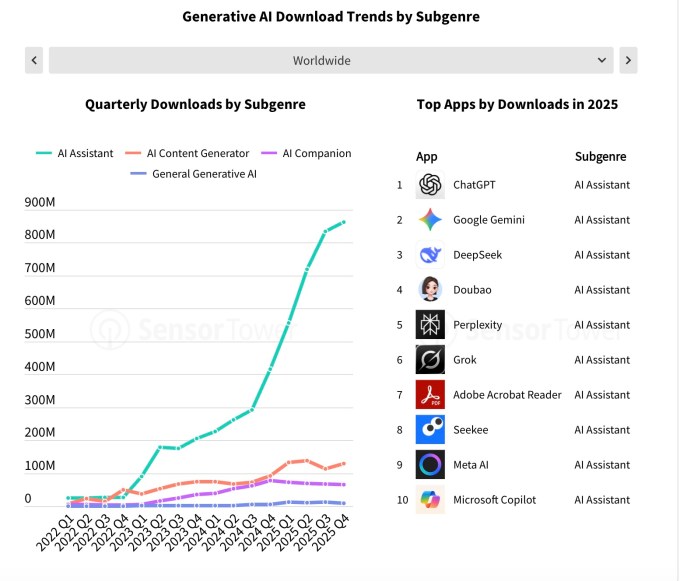

Generative AI emerged as a dominant force in the app market, driving significant revenue gains. In-app purchases within this category soared, more than tripling to exceed $5 billion in 2025. Downloads of AI-powered apps also doubled year-over-year, reaching 3.8 billion installs.

Image Credits: Sensor Tower

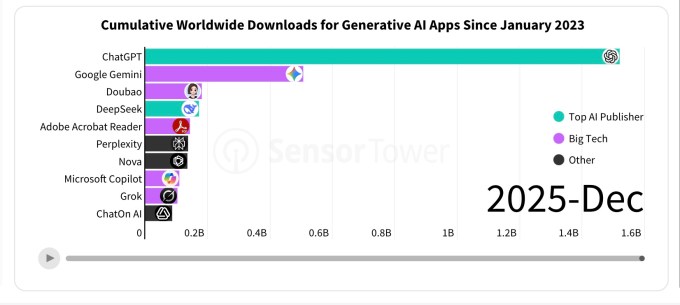

AI Assistants Dominate Downloads and Revenue

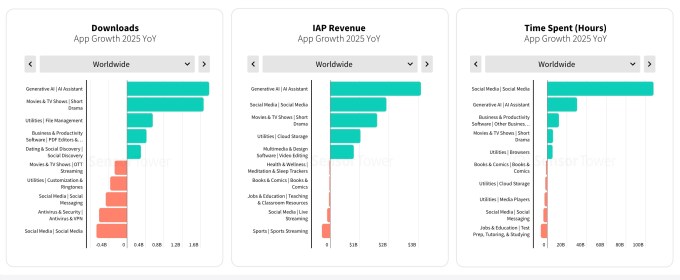

The surge in generative AI app usage can be traced to several factors, chief among them the widespread adoption of AI assistants. All of the top 10 most-downloaded AI apps in 2025 were assistants, led by OpenAI’s ChatGPT, Google Gemini, and DeepSeek. ChatGPT alone accounted for $3.4 billion in global in-app purchase revenue, a milestone previously reported in late 2025.

Image Credits: Sensor Tower

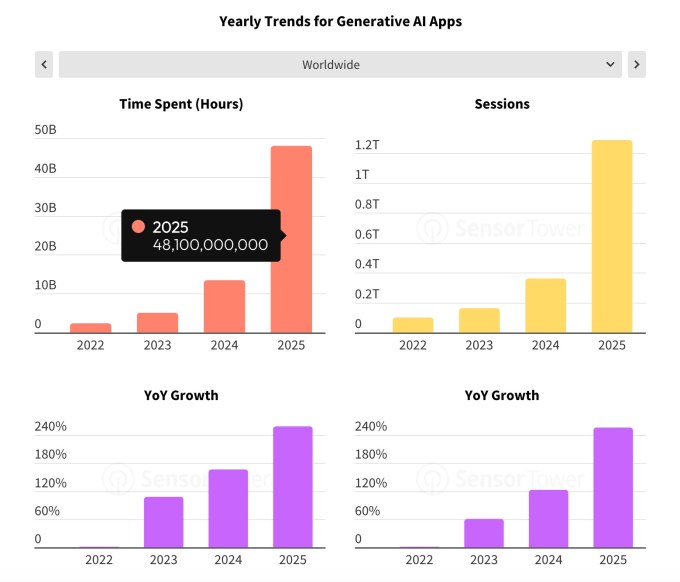

User Engagement with Generative AI Apps Skyrockets

Consumers spent a staggering 48 billion hours using generative AI apps in 2025—over three and a half times more than in 2024, and ten times the total from 2023. The number of app sessions surpassed one trillion, indicating that existing users were engaging more deeply with these apps, even as download growth continued.

Image Credits: Sensor Tower

Tech Giants Intensify Competition in AI

Major technology companies such as Google, Microsoft, and X have significantly ramped up investment in their AI assistants to compete with ChatGPT. Over the past year, these companies have rapidly introduced new features, enhancing capabilities in areas like code generation, content creation, reasoning, task automation, and accuracy. Notable advancements include ChatGPT’s GPT-4o image generation model and Google’s Nano Banana, both of which have pushed the boundaries of image and video generation.

Market Share Shifts Among AI Publishers

OpenAI and DeepSeek together captured nearly half of all global AI app downloads in 2025, up from just over one-fifth the previous year. Meanwhile, large tech publishers increased their market share from 14% to almost 30%, overtaking earlier competitors such as Nova, Codeway, and Chat Smith.

Image Credits: Sensor Tower

Mobile Devices Drive AI Assistant Adoption

The report also underscored the pivotal role of mobile devices in connecting users to generative AI services. By the end of 2025, Sensor Tower estimated that over 200 million people in the U.S. used AI assistants, with more than half (110 million) accessing them exclusively via mobile. This marks a dramatic rise from just 13 million mobile-only users in 2024.

Other Noteworthy AI Apps

Beyond AI assistants, several other AI-powered apps gained popularity, including Suno for AI-generated music, ByteDance’s Jimeng AI for text-to-video creation, and AI companion platforms like Character.ai and PolyBuzz.

Image Credits: Sensor Tower

Growth Extends Beyond AI

While AI apps were a major driver of revenue, other categories such as social media, video streaming, and productivity tools also contributed to the overall growth. The report noted that users spent an average of 90 minutes daily on social media apps, totaling nearly 2.5 trillion hours in 2025—a 5% increase from the previous year.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Best Cheap Crypto to Buy Now: Bitcoin Hyper Leads L2 Charge

Arthur Hayes Sells Altcoins He Previously Held as Major Bulls – Accumulating Another Altcoin

Best Crypto Presales to Invest In as Market Sentiment Shifts to Bitcoin L2s

Shiba Inu Hits Rock Bottom: Price Reversal Or Capitulation?