The Top 5 Analyst Questions That Stood Out During WesBanco’s Q4 Earnings Call

WesBanco Q4 Performance Overview

WesBanco experienced a drop of over 3.5% in its share price after releasing its fourth-quarter results. While the company matched analysts’ revenue forecasts, its adjusted earnings per share came in slightly below expectations. According to CEO Jeffrey Jackson, the quarter’s outcomes reflected the smooth integration of the Premier Financial acquisition, strong deposit inflows that supported loan growth, and ongoing efforts to control costs. Despite higher-than-usual payoffs in commercial real estate loans, WesBanco managed to grow its loan portfolio organically and kept credit quality steady. CFO Daniel Weiss highlighted improvements in operational efficiency and profit margins, noting that increased expenses were largely due to the expanded asset base and integration-related costs. The management also pointed to strategies such as lowering funding costs and expanding into new markets as important contributors to the quarter’s performance.

Should You Consider Buying WSBC?

Key Takeaways from WesBanco’s Q4 2025 Results

- Total Revenue: $265.8 million, matching analyst projections and marking a 62.7% increase year-over-year

- Adjusted Earnings Per Share: $0.84, just below the $0.85 expected by analysts (a 1.2% shortfall)

- Adjusted Operating Income: $118.3 million, surpassing the $116.2 million estimate with a 44.5% margin (1.9% above expectations)

- Market Value: $3.46 billion

While management’s prepared remarks are informative, the unscripted questions from analysts often reveal the most interesting details and challenges. Here are some of the most notable analyst questions from the earnings call:

Top 5 Analyst Questions from the Q4 Earnings Call

- Daniel Tamayo (Raymond James): Asked about the pace of commercial real estate loan payoffs and their effect on loan growth. CEO Jackson responded that payoffs are expected to slow after a busy fourth quarter, and that strong pipelines should help offset the impact.

- Russell Elliott Gunther (Stephens): Inquired about expense forecasts and the possibility of more branch closures. Jackson explained that while recent closures are included in current guidance, further reviews could lead to additional cost reductions later in the year.

- Manuel Navas (Piper Sandler): Sought clarification on factors driving net interest margin improvements. CFO Weiss pointed to deposit growth, reduced Federal Home Loan Bank borrowings, and upcoming certificate of deposit repricing as key influences.

- Catherine Mealor (KBW): Asked about capital allocation and profitability goals. Jackson emphasized that dividends and loan growth remain top priorities, with share repurchases and mergers and acquisitions as secondary options.

- Karl Shepard (RBC Capital Markets): Questioned the progress of the loan production office strategy. Jackson noted that these offices have fueled significant growth in targeted regions, especially in the Southeast, and will continue to be a focus for expansion.

Looking Ahead: What to Watch in Upcoming Quarters

In the next few quarters, key areas to monitor include:

- The balance between organic loan growth and runoff from the commercial real estate portfolio

- Realization of cost savings from recent and potential future branch closures

- Progress in entering new markets, particularly in healthcare lending and the Southeast region

- Continued momentum in deposit growth and diversification of revenue streams

WesBanco’s stock is currently trading at $36.15, up from $35.22 before the earnings announcement. Is the company at a pivotal moment for investors?

Top Picks for Quality-Focused Investors

Relying on just a handful of stocks can leave your portfolio vulnerable. Now is the time to secure high-quality investments before market dynamics shift and opportunities diminish.

Don’t wait for the next bout of market turbulence. Discover our Top 5 Strong Momentum Stocks for this week—a carefully selected group of high-quality stocks that have delivered a 244% return over the past five years (as of June 30, 2025).

Our list features well-known names like Nvidia, which soared 1,326% from June 2020 to June 2025, as well as lesser-known success stories such as Comfort Systems, which achieved a 782% five-year return. Start your search for the next standout stock with StockStory today.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Institutions fuel tokenized RWA boom as retail looks set to follow suit

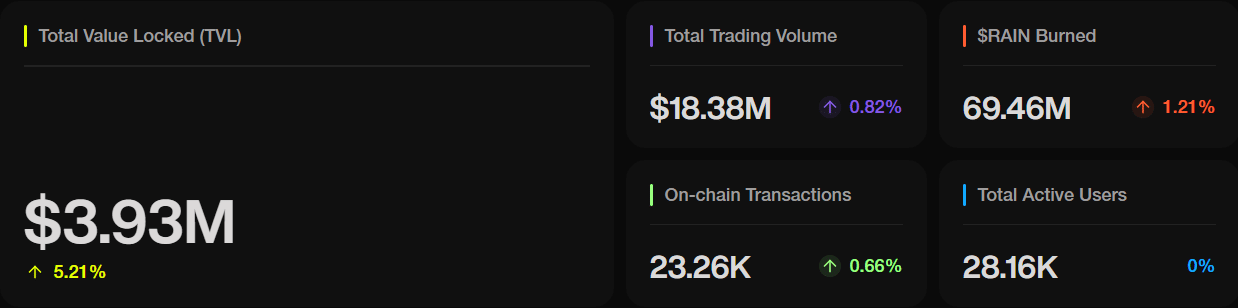

Can RAIN crypto continue its 18% rally after $338M token unlock?

Pepe coin price forms potential base after 73% collapse — will 23T whale accumulation spark reversal?

Tokenized Commodities Market Cap Soars 53% to $6.1B, Signaling a Stunning Digital Transformation