Robinhood 2025 Q4 Earnings: Revenue Miss,Profit Falls 34% as Crypto Weakness Takes Center Stage

1. Core Views:

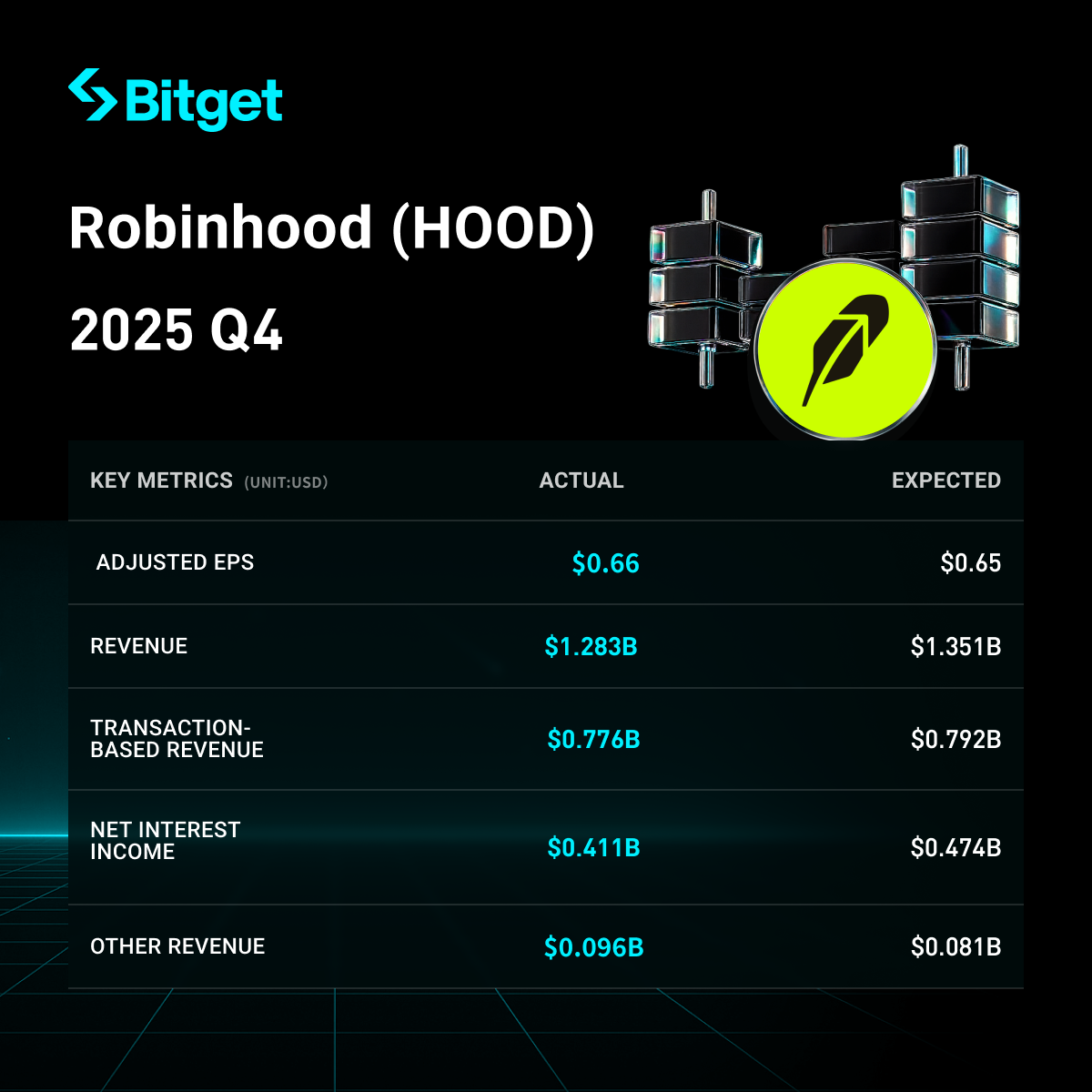

Robinhood's overall performance in Q4 2025 was steady but faced challenges. Total revenue reached $1.28 billion, up 27% year-over-year, but fell short of Wall Street expectations of $1.351 billion. Net profit was $605 million, down 34% year-over-year, with earnings per share at $0.66, slightly above the expected $0.65. Full-year revenue was $4.5 billion, up 52% year-over-year, with net profit at $1.9 billion. Assets under custody reached $324 billion, up 68% year-over-year. Gold subscription users reached 4.2 million, up 58% year-over-year. The stock price fell more than 7% after hours, mainly dragged down by revenue missing expectations and a decline in cryptocurrency revenue. The market is concerned about the impact of the cryptocurrency market downturn on the future.

2. Detailed Breakdown:

-

Overall Revenue and Profit Performance:

Quarterly total net revenue: $1.28 billion, up 27% year-over-year, below analyst expectations of $1.351 billion. Earnings per share (diluted EPS): $0.66, down 35% year-over-year, above analyst expectations of $0.65. Net income: $605 million, down 34% year-over-year (Q4 2024 was $916 million, influenced by one-time tax and regulatory adjustment gains). Adjusted EBITDA (non-GAAP): $761 million, up 24% year-over-year. Total operating expenses: $633 million, up 38% year-over-year (mainly driven by marketing, growth investments, and acquisition-related expenses). Compared to expectations: Revenue missed expectations, mainly due to a decline in cryptocurrency trading revenue; EPS slightly exceeded expectations.

-

Trading Business Performance:

Total trading revenue: $776 million, up 15% year-over-year.

Key drivers: Increased activity in options and stock trading partially offset the cryptocurrency decline; strong growth in other trading revenue.

Specific data:

| Cryptocurrency Revenue | 2.21 | -38% | Dragged down by cryptocurrency market downturn |

| Options Revenue | 3.14 | +41% | Increased trading volume |

| Stock Revenue | 0.94 | +54% | Active retail trading |

| Other Trading Revenue | 1.47 | +300% | Contributions from emerging businesses like prediction markets |

-

Other Business Segment Performance

- Net interest revenue: $411 million, up 39% year-over-year, driven by growth in interest-bearing assets and securities lending activities, partially offset by declines in short-term interest rates;

- Other revenue: $96 million, up 109% year-over-year, mainly driven by Robinhood Gold subscription revenue of $50 million, up 56% year-over-year;

- User metrics: Gold subscription users at 4.20 million, up 58% year-over-year; Active customers at 2.70 million, up 7% year-over-year; Investment accounts at 2.84 million, up 8% year-over-year; Assets under custody (AUC) at $324 billion, up 68% year-over-year; Net deposits at $15.9 billion, with an annualized growth rate of 19%;

- Monthly active users (MAUs) declined, with Q4 MAUs at 13.0 million (13.0M), down 1.9 million (1.9M) year-over-year, below expectations of 14.2 million (14.2M);

-

Capital Expenditure Plan:

- Q4 2025 capital expenditure: Property, software, and equipment purchases at $20 million, down 50% year-over-year; Capitalized internal development software at $110 million (flat).

- Full-year 2025 capital expenditure: Property, software, and equipment purchases at $150 million, up 15% year-over-year; Capitalized internal development software at $390 million (up 5% year-over-year).

- Key investment areas: Acquisition activities, including the completion of TradePMR and Bitstamp acquisitions (full-year 2025 acquisition consideration of $399 million); Announced acquisition of an Indonesian brokerage and cryptocurrency company; Formed a joint venture company Rothera with Susquehanna International Group, with acquisition of MIAXdx in January 2026.

Project Q4 2025 Amount (in billions USD) Full-Year 2025 Amount (in billions USD) Compared to 2024

Property/Software/Equipment Purchases 0.02 0.15 +15% Internal Software Capitalization 0.11 0.39 +5% Acquisition Consideration Not broken down 3.99 +198%

-

Facing Uncertainties in 2026

- CEO Vlad Tenev stated the goal is to build a "financial super app" that meets all customer needs, but no specific quantitative guidance was provided.

-

Market Background and Investor Concerns:

- Core contradiction: Although overall trading revenue grew +15%, the cryptocurrency market downturn led to a 38% decline in revenue, becoming the biggest drag; Bitcoin fell over 50% from its peak.

- Market challenges: The ongoing cryptocurrency winter continues to impact trading volume; Potential Federal Reserve rate cuts erode interest revenue; Regulatory uncertainty in prediction markets.

- Investor reaction: Stock price fell over 7% after hours to $79.201; Closed down 1.11% on the day; Stock price has fallen 24% year-to-date in 2026 (after tripling the previous year).

- (Currently, Bitget supports Robinhood 20x leverage contract trading, allowing investors to capture post-earnings volatility opportunities.)

- Disclaimer: The content of this article is for reference only and does not constitute any investment advice.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

PancakeSwap (CAKE) Price Prediction 2026, 2027-2030: Long-Term Forecast and Market Analysis

Top Gainers for the Day—Prices of pippin, LayerZero & River Explode as Market Consolidates

EU Widens Sanctions Net to Ports and Banks Linked to Russian Trade

Bitcoin is no longer a safe haven according to Grayscale