Robinhood launches public testnet for blockchain built on Arbitrum

Robinhood, the popular U.S.-based trading platform leaning increasingly into crypto, has launched the public testnet for its own blockchain.

The blockchain is an Ethereum Layer 2 built on Arbitrum, Robinhood said Tuesday night.

"The testnet for Robinhood Chain lays the groundwork for an ecosystem that will define the future of tokenized real-world assets and enable builders to tap into DeFi liquidity within the Ethereum ecosystem," Robinhood SVP and GM of Crypto Johann Kerbrat said in a statement. "We look forward to building alongside our infrastructure partners as we work to bring financial services onchain."

Like most testnets, Robinhood's will support experimentation to identify issues and improve network stability ahead of a mainnet launch.

Since it began providing users with the ability to trade crypto, Robinhood has sought to expand its footprint in the digital assets arena. The platform's cryptocurrency transaction revenue, however, fell 38% year-over-year to $221 million during the fourth quarter of last year, the company reported Tuesday.

The result marked a significant slowdown from the third quarter, when crypto revenue surged to $268 million.

Robinhood said last month it plans to expand its tokenized stock offering to include round-the-clock trading, near-real-time settlement, and self-custody. The company launched tokenized stocks for European customers in June 2025, offering exposure to more than 2,000 U.S.-listed equities with 24/5 trading. The tokens are issued on Arbitrum One.

The company said that in the months ahead, developers using Robinhood Chain will be able to access "testnet-only assets, including Stock Tokens, to be used for integration testing," as well as "direct testing with Robinhood Wallet."

"Robinhood Chain is well-positioned to help the industry deliver the next chapter of tokenization and permissionless financial services," Offchain Labs co-founder and CEO Steven Goldfeder said.

Offchain Labs is the developer of Arbitrum.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

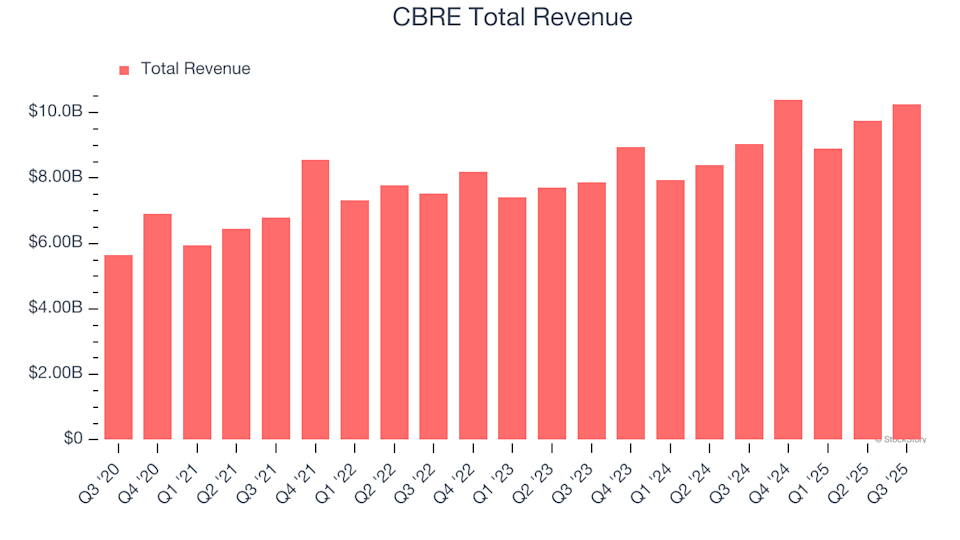

CBRE Earnings: Key Points to Watch in CBRE’s Report

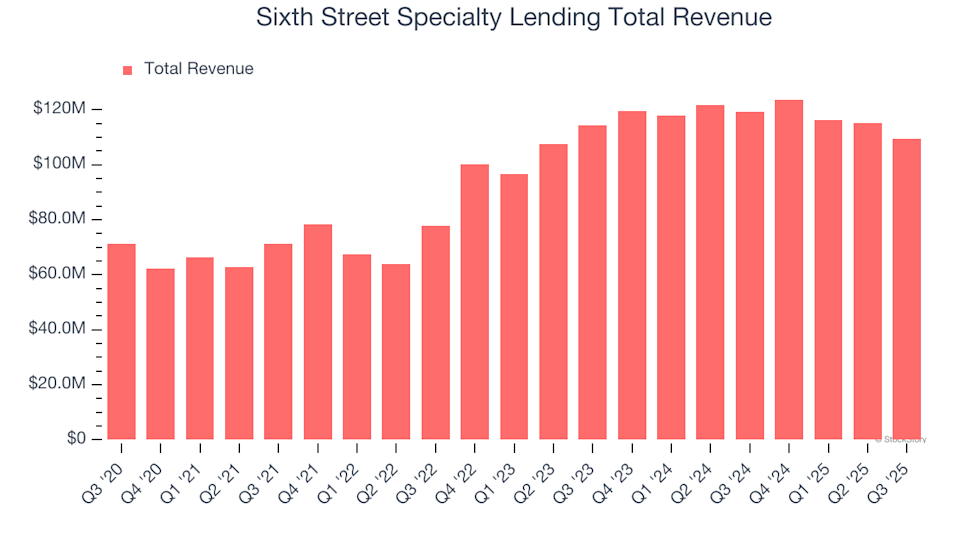

Sixth Street Specialty Lending Results: Key Points to Watch for TSLX

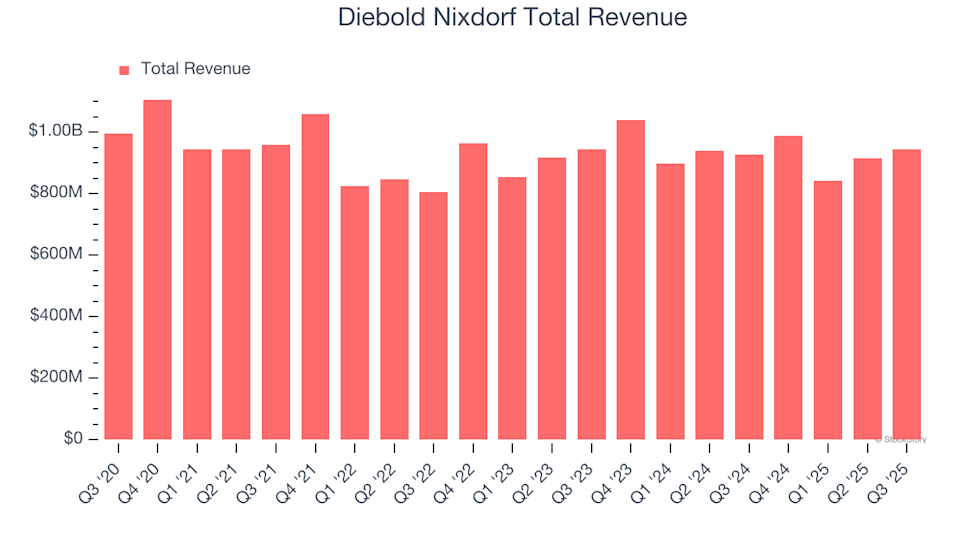

Diebold Nixdorf (DBD) Q4 Results: Anticipated Outcomes

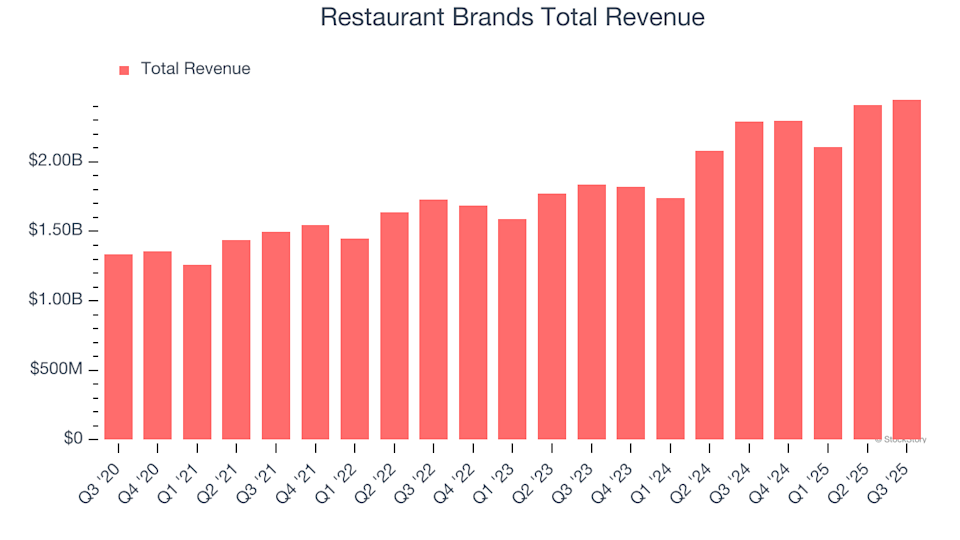

Earnings To Watch: Restaurant Brands (QSR) Will Announce Q4 Results Tomorrow