Why Is Solar Company SUNation Shares Trading Higher On Friday?

SUNation Energy, Inc. (NASDAQ:SUNE) shares are trading higher on Friday.

This week, on Wednesday, the company disclosed a strategic financing agreement with Palmetto to support the residential solar projects in 2026.

This news comes as the broader market experienced declines, with major indices like the Dow Jones and S&P 500 both closing lower on the previous trading day.

SUNation and Palmetto’s Strategic Solar Financing

Under the agreement, Palmetto LightReach will provide lease and power purchase agreement options to improve project economics for SUNation.

The partnership is expected to facilitate a wider range of residential solar installations, allowing homeowners to adopt clean energy solutions through predictable monthly payments.

The CEO of SUNation, Scott Maskin, emphasized that this collaboration is a crucial step in strengthening their residential financing platform as they navigate the post-investment tax credit landscape in 2026. This strategic move aims to accelerate project execution and customer adoption in the coming years.

SUNE’s Strong Short-Term Technical Indicators

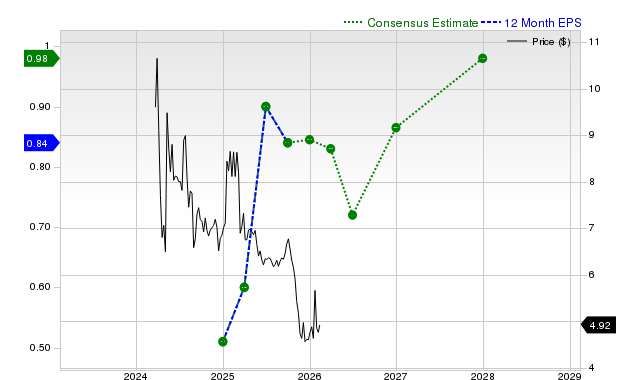

SUNation Energy (SUNE) is currently trading well above its short-term moving averages, indicating a potential bullish shift in momentum. With the stock positioned significantly above its 20-day, 50-day, and 100-day SMAs, traders may see this as a sign of strength, especially given the recent price action.

The RSI is currently at 68.15, which suggests that SUNation Energy, Inc. Common Stock is nearing overbought territory. This level indicates that while momentum is strong, traders should be cautious as a pullback could occur if the RSI crosses above 70.

MACD is above its signal line, indicating bullish momentum for SUNation Energy. This suggests that the current trend may have some strength, but traders should keep an eye on any potential reversals as the stock approaches overbought conditions.

Currently, there are no defined support or resistance levels for SUNation Energy, which makes it challenging to predict immediate price movements. If the stock were to test previous highs or lows, it could signal either a continuation of the current trend or a reversal, depending on the market’s reaction.

In terms of longer-term trends, SUNation Energy’s performance over the past 12 months has been quite troubling, with a decline of 99.21%. This steep drop highlights the volatility and risks associated with the stock, suggesting that traders should exercise caution and be prepared for further fluctuations.

SUNation’s Role in Residential Solar Market

SUNation Energy provides households with sustainable solar energy, backup power, and security, control, and predictability, along with cost savings. The company offers a full range of installation services, including design, engineering, procurement, permitting, construction, grid connection, warranty, monitoring, and maintenance of residential solar energy systems.

SUNation’s Benzinga Edge Scorecard Analysis

Below is the Benzinga Edge scorecard for SUNation Energy, highlighting its strengths and weaknesses compared to the broader market:

– Value Rank: N/A – Growth Rank: N/A – Quality Rank: N/A – Momentum Rank: N/A

The Verdict: SUNation Energy’s Benzinga Edge signal reveals a classic ‘High-Flyer’ setup. While the Momentum score indicates potential for growth, the lack of solid Value and Quality rankings suggests that investors should proceed with caution.

SUNE Price Action: SUNation Energy shares were up 23.89% at $2.29 at the time of publication on Friday. The stock is trading near its 52-week low of $0.67, according to Benzinga Pro data.

Photo via Shutterstock

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Earnings Estimates Moving Higher for Auna S.A. (AUNA): Time to Buy?

Nowhere to run (bonds are the only refuge)

Will American Eagle (AEO) Beat Estimates Again in Its Next Earnings Report?

Will Crescent Energy (CRGY) Beat Estimates Again in Its Next Earnings Report?