Is CVS Health Corporation (CVS) Larry Robbins' top pick?

Accounting for 13.76% share ($617.96 million) in the billionaire’s portfolio, CVS Health Corporation (NYSE:CVS) ranks as Larry Robbins’ top stock pick. We recently published a list of

Supported by strength in the Caremark pharmacy benefit unit and higher prescription volumes at retail pharmacies, adjusted EPS came in at $1.09, down from $1.19 a year earlier but ahead of the $0.99 consensus. With the help of assets purchased from Rite Aid, total revenue increased from $97.70 billion to $105.70 billion. Meanwhile, the number of prescriptions filled increased by 6.30% annually.

For 2026, CVS Health Corporation (NYSE:CVS) reaffirmed its revenue guidance of at least $400.00 billion and adjusted EPS guidance of $7.00–$7.20. With this, the company indicates that management is more focused on execution discipline than on aggressive outlook expansion. Despite pressure from Medicare Advantage cost trends associated with the Inflation Reduction Act changes, the Aetna insurance unit reported a medical loss ratio of 94.80%, which was marginally better than anticipated. Despite operational improvement, shares dropped premarket as investors processed the cautious tone.

CVS Health Corporation (NYSE:CVS), a diversified healthcare company, combines insurance, pharmacy benefit management, retail pharmacies, and clinical services to provide integrated healthcare solutions throughout the United States via its vertically integrated platform.

While we acknowledge the potential of CVS as an investment, we believe certain AI stocks offer greater upside potential and carry less downside risk. If you're looking for an extremely undervalued AI stock that also stands to benefit significantly from Trump-era tariffs and the onshoring trend, see our free report on the best short-term AI stock.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Cardano Whales are Trying to Rescue ADA Price

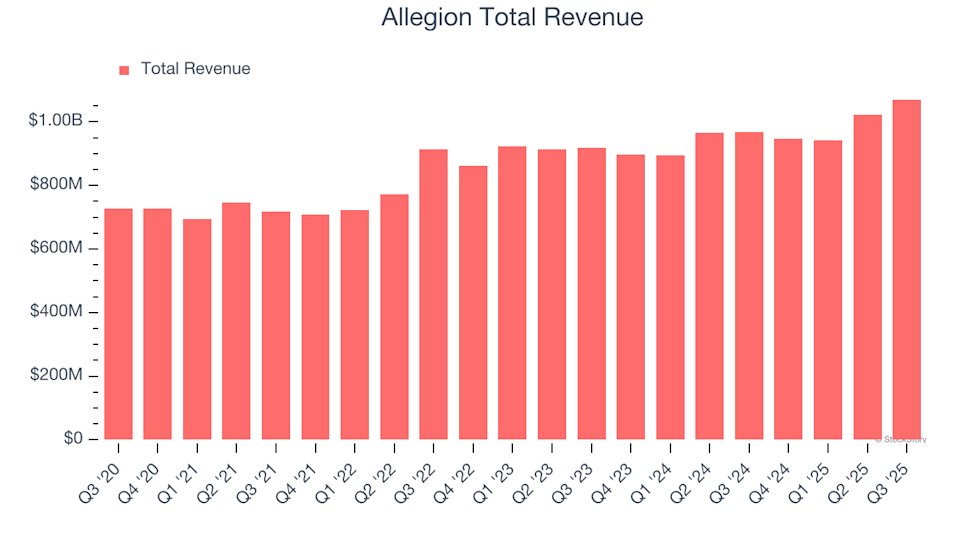

Allegion (ALLE) Q4 Results: What You Should Know

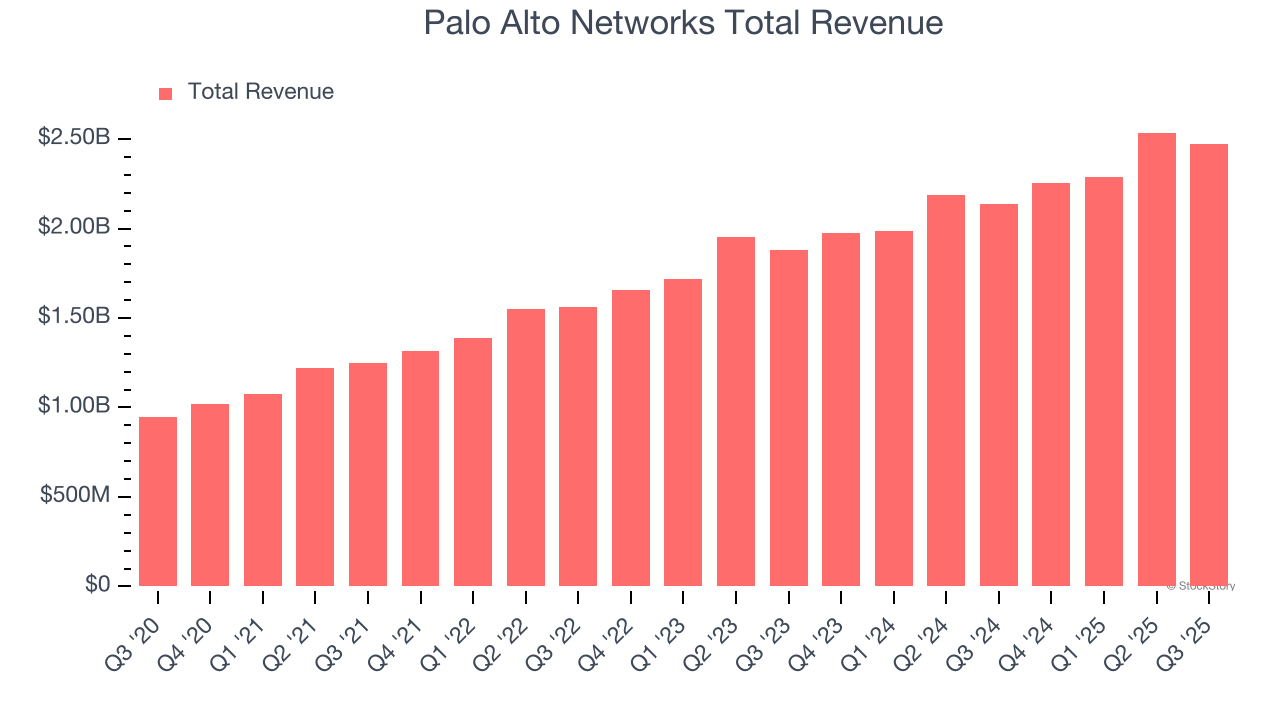

Palo Alto Networks (PANW) Reports Q4: Everything You Need To Know Ahead Of Earnings