3 Key Reasons to Steer Clear of CLBK and One Alternative Stock Worth Buying

Columbia Financial: Recent Performance and Investor Considerations

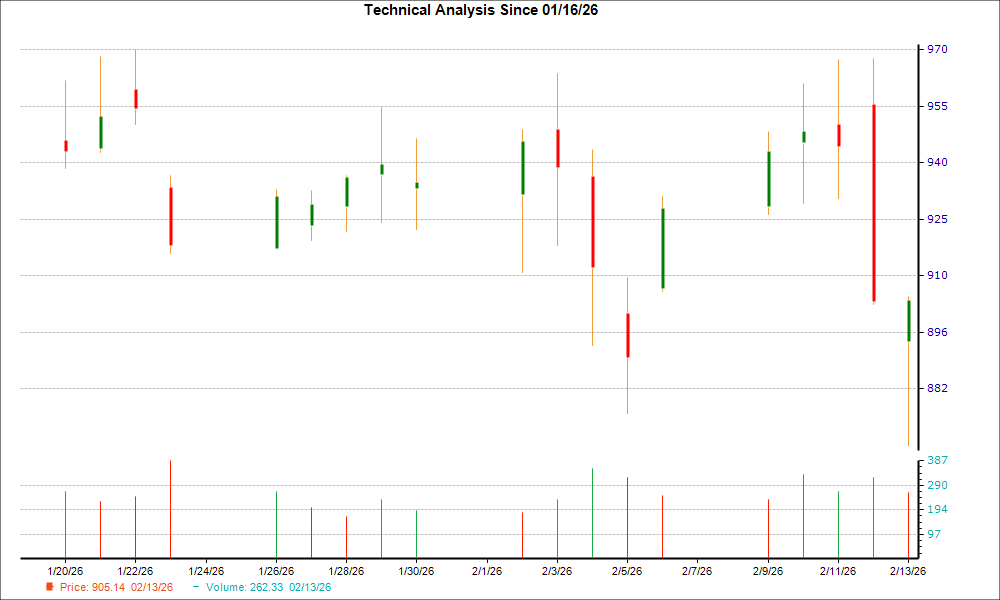

In the last half-year, Columbia Financial has delivered impressive returns, outperforming the S&P 500 by 19.5%. The stock has risen to $18.42, marking a robust 25.4% gain. This surge has been fueled in part by strong quarterly earnings, prompting investors to reassess their positions.

Is Columbia Financial a smart addition to your portfolio, or could it pose unnecessary risk? to get the full picture.

Why We Believe Columbia Financial May Lag Behind

While recent gains have benefited shareholders, our outlook on Columbia Financial remains cautious. Here are three key reasons we see more attractive alternatives than CLBK—and a stock we prefer instead.

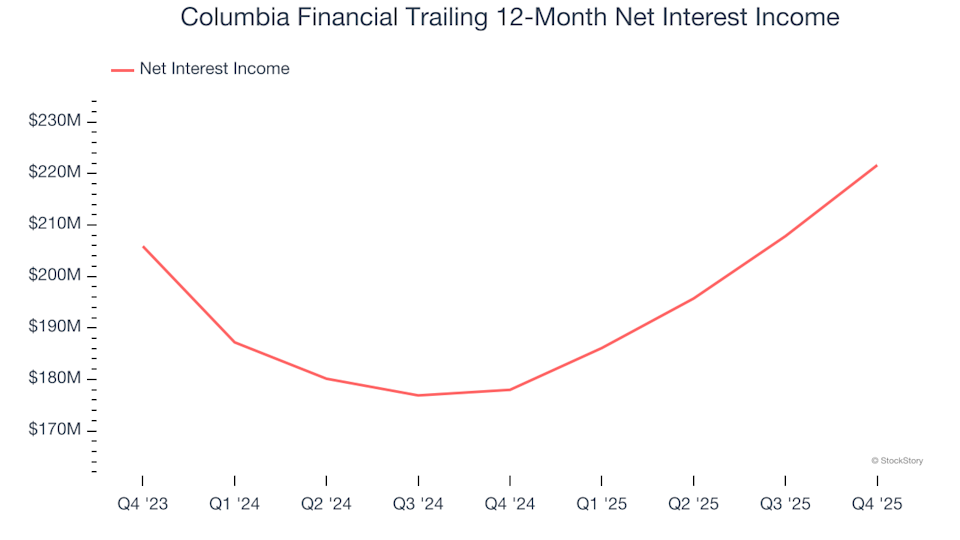

1. Stagnant Net Interest Income

Our research indicates that consistent growth in net interest income is crucial for banks, as it reflects the quality of their core earnings. In contrast, one-off fees are less reliable and not sustainable over time.

Columbia Financial’s net interest income has remained unchanged over the past five years, underperforming the broader banking sector. This suggests that its lending operations have not kept pace with other areas of the business.

2. Weak Net Interest Margin Signals Low Profitability

The net interest margin (NIM) is a vital metric that shows how effectively a bank earns from its loans compared to what it pays on deposits. It’s a direct measure of lending profitability.

Over the last two years, Columbia Financial’s average NIM was just 2.1%, highlighting weak profitability from its loan portfolio.

3. Declining Earnings Per Share

Tracking long-term changes in earnings per share (EPS) helps reveal whether a company’s growth is translating into real profits.

Unfortunately, Columbia Financial’s EPS has dropped by 1.9% annually over the past five years, even as revenue inched up by 1.2%. This indicates that the company’s expansion has not translated into greater per-share profitability.

Our Verdict

Columbia Financial does not meet our standards for quality investments. Despite its recent outperformance and a current price of $18.42 per share (1.5× forward price-to-book), much of the optimism is already reflected in the valuation. There are more compelling opportunities available. For example, consider a rapidly expanding restaurant chain known for its top-rated ranch dressing.

Alternative Stocks Worth Considering

This year’s market rally has been driven by just a handful of stocks, with four companies accounting for half of the S&P 500’s total gains. Such concentration can make investors uneasy. Savvy investors are seeking high-quality opportunities in less crowded corners of the market—often at much lower prices. Explore our curated selection in the Top 5 Growth Stocks for this month. These stocks have delivered a remarkable 244% return over the past five years (as of June 30, 2025).

Our list features both well-known names like Nvidia, which soared 1,326% from June 2020 to June 2025, and lesser-known companies such as Comfort Systems, which achieved a 782% five-year return. Discover your next potential winner with StockStory.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ServisFirst Bancshares (SFBS)'s Technical Outlook is Bright After Key Golden Cross

J&J's MedTech Shows Strong Growth in 2025: Will 2026 be Better?

What's in Store For These 5 Construction Stocks This Earnings Season?

Goldman (GS) May Find a Bottom Soon, Here's Why You Should Buy the Stock Now