Are financial experts on Wall Street forecasting that Consolidated Edison shares will rise or fall?

Overview of Consolidated Edison, Inc.

Consolidated Edison, Inc. (ED), based in New York, operates regulated businesses delivering electricity, natural gas, and steam. With a market capitalization of $41 billion, the company is dedicated to ensuring dependable and secure energy services for millions of customers within its service areas.

Stock Performance Highlights

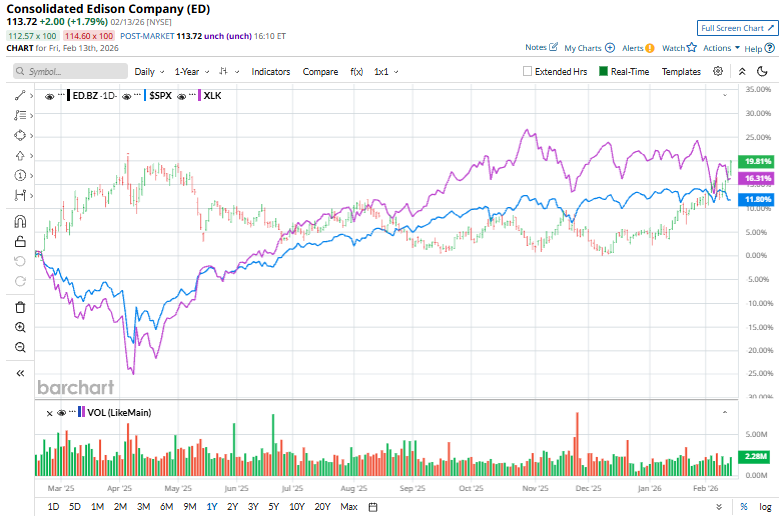

Over the past year, ED shares have outperformed the overall market. The stock has advanced 18.9% during this period, outpacing the S&P 500 Index ($SPX), which rose by nearly 11.8%. In 2026, ED’s share price climbed 14.5%, while the SPX experienced a slight year-to-date decline.

Comparison with Utilities Sector

ED has also outperformed the State Street Utilities Select Sector SPDR Fund (XLU), which posted a 17.1% gain over the last year and an 8.9% increase year-to-date.

Dividend Growth and Financial Outlook

On January 27, Consolidated Edison’s stock saw a slight uptick after the company announced a quarterly dividend of $0.8875 per share, payable on March 16, 2026. This adjustment brings the annual dividend to $3.55 per share, marking the 52nd consecutive year of dividend increases and maintaining a payout ratio target between 55% and 65% of adjusted earnings.

For the fiscal year ending in December, analysts project that ED’s diluted earnings per share will rise by 4.8% to $5.66. The company’s recent earnings history has been mixed, surpassing analyst expectations in three of the last four quarters but falling short once.

Analyst Ratings and Price Targets

Among 19 analysts tracking ED, the consensus rating is “Hold,” with three recommending a “Strong Buy,” ten suggesting “Hold,” one giving a “Moderate Sell,” and five assigning a “Strong Sell.”

On January 23, UBS analyst William Appicelli increased his price target for ED from $108 to $112, while keeping a “Neutral” stance on the stock.

Although ED’s current share price is above the average target of $105.70, the highest analyst target of $128 implies a potential upside of 12.6%.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Can Bitcoin Price Recover? Billionaire Dan Tapiero Says “Capitulation First,” Predicts What Comes Next

Crypto Institutional Investment: The Profound Shift from Speculation to Strategic Portfolio Management

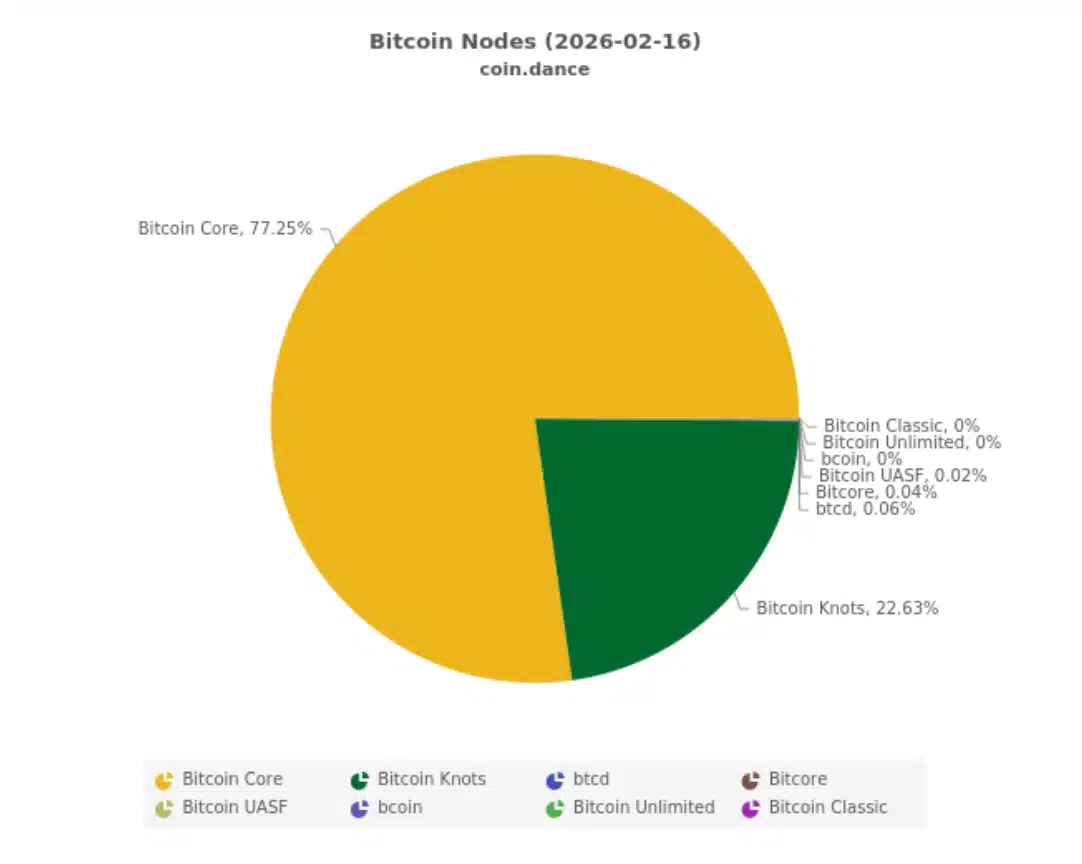

Adam Back warns of ‘lynch mob’ tactics – Is Bitcoin facing fork fight?

Meta's Platfroms' New Bull: Why Billionaire Bill Ackman Is Buying